Basis of Emelio and Charitas Assets Essay Example | Topics and Well Written Essays - 750 words. Retrieved from https://studentshare.org/miscellaneous/1532432-basis-of-emelio-and-charitas-assets

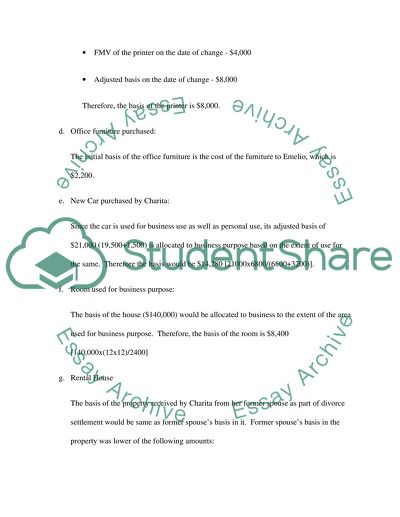

Basis of Emelio and Charitas Assets Essay Example | Topics and Well Written Essays - 750 Words. https://studentshare.org/miscellaneous/1532432-basis-of-emelio-and-charitas-assets.