StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Analysis of Questions in Financial Management

Free

Analysis of Questions in Financial Management - Assignment Example

Summary

This assignment "Analysis of Questions in Financial Management" describes the different ways in which capital can be transferred from suppliers of capital to those who are demanding capital. The assignment discusses a firm’s fundamental and intrinsic, value…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER96.6% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 1

- Author: luettgensabina

Extract of sample "Analysis of Questions in Financial Management"

1-3 What is a firm’s fundamental, or intrinsic, value? What might cause a firm’s intrinsic value to be different than its actual market value? A firm’s fundamental or intrinsic value is “the value that the company has paid for its assets, less a deduction for depreciation; the intrinsic value records all the money a company has raised from its shareholders plus all the earnings that have been plowed back on their behalf (Brealey 2004, 145, 147).”

The market value of the firm is the value of its shares and is affected by three factors: extra-earning power of the firm; intangible assets such as trademarks, brand equity, patents, etc.; and value of future investments. Depending on the view of the public according to these three factors will the market value of the firm be determined, and differ from its intrinsic value.

1-6 Describe the different ways in which capital can be transferred from suppliers of capital to those who are demanding capital?

There are different ways in which capital can be transferred from suppliers of capital to those demanding capital. When this capital is pooled from the suppliers in financial markets, these are transferred to those demanding the capital thru either thru financial intermediaries (mutual funds and pension funds) or financial institutions (banks or insurance companies).

One of the financial intermediaries, the mutual fund institution, raises money by issuing shares to investors, which it then invests in a portfolio of securities. The pension fund, another type of financial intermediary, raises money by a corporation or an organization through and on behalf of their employees, which the corporation then invests in securities.

Financial institutions include banks and insurance companies. Banks raise money through deposits from investors, which they then loan to entities that demand capital. Insurance companies on the other hand collects premium payments for policy plans they sell to investors, then lend money to debtors as investments.

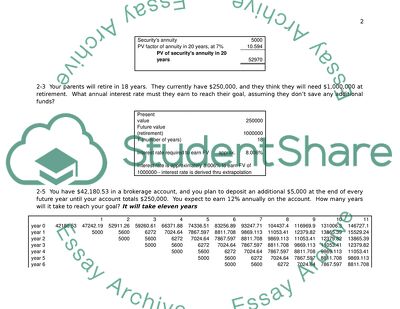

2-2 What is the present value of a security that will pay $5,000 in 20 years if securities of equal risk pay 7% annually?

Securitys annuity

5000

PV factor of annuity in 20 years, at 7%

10.594

PV of securitys annuity in 20 years

52970

2-3 Your parents will retire in 18 years. They currently have $250,000, and they think they will need $1,000,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don’t save any additional funds?

Present value

250000

Future value (retirement)

1000000

T (number of years)

18

Interest rate required to earn FV

approx.

8.006%

Interest rate is approximately 8.006% to earn FV of

1000000-- interest rate is derived thru extrapolation

2-5 You have $42,180.53 in a brokerage account, and you plan to deposit an additional $5,000 at the end of every future year until your account totals $250,000. You expect to earn 12% annually on the account. How many years will it take to reach your goal? It will take eleven years

1

2

3

4

5

6

7

8

9

10

11

year 0

42180.53

47242.19

52911.26

59260.61

66371.88

74336.51

83256.89

93247.71

104437.4

116969.9

131006.3

146727.1

year 1

5000

5600

6272

7024.64

7867.597

8811.708

9869.113

11053.41

12379.82

13865.39

15529.24

year 2

5000

5600

6272

7024.64

7867.597

8811.708

9869.113

11053.41

12379.82

13865.39

year 3

5000

5600

6272

7024.64

7867.597

8811.708

9869.113

11053.41

12379.82

year 4

5000

5600

6272

7024.64

7867.597

8811.708

9869.113

11053.41

year 5

5000

5600

6272

7024.64

7867.597

8811.708

9869.113

year 6

5000

5600

6272

7024.64

7867.597

8811.708

year 7

5000

5600

6272

7024.64

7867.597

year 8

5000

5600

6272

7024.64

year 9

5000

5600

6272

year 10

5000

5600

year 11

5000

TOTAL

42180.53

52242.19

63511.26

76132.61

90268.52

106100.7

123832.8

143692.8

165935.9

190848.2

218750

250000

2-7 An investment will pay $100 at the end of each of the next 3 years, $200 at the end of year 4, $300 at the end of year 5, and $500 at the end of year 6. If other investments of equal risk earn 8% annually, what is its present value? Its future value?

Year

Annual Cash flows

PV at 8%

1

100

92.59259

2

100

85.73388

3

100

79.38322

4

200

147.006

5

300

204.175

6

500

315.0848

Total

923.9754

FV

1466.233

The present value of the investment is worth 923.98. The

future value of the investment is derived by multiplying

the present value by the discount factor of 8% and

compounded for six years.

2-11 To the closest year, how long will it take $200 to double if it is deposited and earns the following rates?

a. 7% - slightly more than ten years

b. 10% - slightly more than seven years

c. 18% - slightly more than four years

d. 100% - one year

2-26 You need to accumulate $10,000. To do so, you plan to make a deposits of $1,250 per year, with the first payment being made a year from today, in a bank account that pays 12% annual interest. Your last deposit will be less than $1,250 if less is need to round out to $10,000. How many years, will it take you to reach your $10,000 goal, and how large will the last deposit be.

0

1

2

3

4

5

year 0

0

1

1250

1400

1756.16

2467.278

3882.31

2

1250

1400

1756.16

2467.278

3

1250

1400

1756.16

4

1250

1400

5

494.255

TOTAL

0

1250

2650

4406.16

6873.438

10000.00

It will take five years from now in order to accumulate the 10,000 goal; the last

addition to account should be approximately 494.255 in order to reach the goal.

2-34 You wish to accumulate $1m by your retirement date, which is 25 years from now. You will make 25 deposits in your bank, with the first occurring today. The bank pays 8% interest, compounded annually. You expect to get an annual raise of 3%, so you will let the amount you deposit each year also grow by 3% (i.e., your second deposit will be 3% greater than your first, the third will be 3% greater than the second, etc.). How much must your first deposit be to meet your goal?

Answer: 9542.422 should be the first deposit, growing annually at 3% in order to accumulate $1million in 25 years, at 8% interest rate.

year 0

year 1

year 2

year 3

year 4

year 5

year 6

year 7

year 8

year 9

year 10

year 11

year 12

year 0

9542.422

10305.82

11130.28

12020.7

12982.3598

14020.95

15142.624

16354.03

17662.36

19075.3457

20601.37

22249.48

24029.44

year 1

9828.695

10614.99

11464.19

12381.3246

13371.83

14441.577

15596.9

16844.66

18192.2279

19647.61

21219.41

22916.97

year 2

10123.56

10933.44

11808.1151

12752.76

13772.985

14874.82

16064.81

17349.9951

18737.99

20237.03

21856

year 3

10427.26

11261.4431

12162.36

13135.347

14186.18

15321.07

16546.7546

17870.49

19300.13

20844.15

year 4

10740.08

11599.29

12527.229

13529.41

14611.76

15780.7011

17043.16

18406.61

19879.14

year 5

11062.28

11947.265

12903.05

13935.29

15050.1131

16254.12

17554.45

18958.81

year 6

11394.151

12305.68

13290.14

14353.3486

15501.62

16741.75

18081.09

year 7

11735.98

12674.85

13688.8417

14783.95

15966.67

17244

year 8

12088.05

13055.0991

14099.51

15227.47

16445.66

year 9

12450.6963

13446.75

14522.49

15684.29

year 10

12824.22

13850.15

14958.17

year 11

13208.94

14265.66

year 12

13605.21

year 13

year 14

year 15

year 16

year 17

year 18

year 19

year 20

year 21

year 22

year 23

year 24

year 25

TOTAL

9542.422

20134.51

31868.83

44845.6

59173.3227

74969.47

92361.18

111486

132493

155543.123

180810.8

208484.6

238768.6

year 13

year 14

year 15

year 16

year 17

year 18

year 19

year 20

year 21

year 22

year 23

year 24

year 25

25951.8

28027.94

30270.18

32691.79

35307.13

38131.7

41182.24

44476.82

48034.97

51877.76

56027.98

60510.22

65351.04

24750.33

26730.35

28868.78

31178.28

33672.54

36366.35

39275.66

42417.71

45811.12

49476.01

53434.1

57708.82

62325.53

23604.48

25492.83

27532.26

29734.84

32113.63

34682.72

37457.34

40453.93

43690.24

47185.46

50960.29

55037.12

59440.09

22511.68

24312.61

26257.62

28358.23

30626.89

33077.04

35723.2

38581.06

41667.54

45000.95

48601.02

52489.1

56688.23

21469.47

23187.03

25041.99

27045.35

29208.98

31545.69

34069.35

36794.9

39738.49

42917.57

46350.97

50059.05

54063.78

20475.51

22113.55

23882.64

25793.25

27856.71

30085.25

32492.07

35091.43

37898.75

40930.64

44205.1

47741.5

51560.82

19527.57

21089.78

22776.96

24599.12

26567.05

28692.41

30987.8

33466.83

36144.17

39035.71

42158.56

45531.25

49173.75

18623.52

20113.4

21722.47

23460.27

25337.09

27364.06

29553.18

31917.44

34470.83

37228.5

40206.78

43423.32

46897.19

17761.32

19182.22

20716.8

22374.15

24164.08

26097.2

28184.98

30439.78

32874.96

35504.96

38345.35

41412.98

44726.02

16939.03

18294.16

19757.69

21338.31

23045.37

24889

26880.12

29030.53

31352.97

33861.21

36570.11

39495.71

42655.37

16154.82

17447.21

18842.98

20350.42

21978.45

23736.73

25635.67

27686.52

29901.44

32293.56

34877.05

37667.21

40680.59

15406.91

16639.46

17970.62

19408.27

20960.93

22637.81

24448.83

26404.74

28517.12

30798.49

33262.37

35923.36

38797.23

14693.63

15869.12

17138.65

18509.74

19990.52

21589.76

23316.94

25182.3

27196.88

29372.63

31722.44

34260.24

37001.06

14013.37

15134.44

16345.19

17652.81

19065.03

20590.24

22237.45

24016.45

25937.77

28012.79

30253.81

32674.12

35288.05

14433.77

15588.47

16835.55

18182.39

19636.98

21207.94

22904.58

24736.94

26715.9

28853.17

31161.43

33654.34

14866.78

16056.13

17340.62

18727.86

20226.09

21844.18

23591.72

25479.05

27517.38

29718.77

32096.27

15312.79

16537.81

17860.83

19289.7

20832.88

22499.51

24299.47

26243.42

28342.9

30610.33

15772.17

17033.94

18396.66

19868.39

21457.86

23174.49

25028.45

27030.73

29193.19

16245.33

17544.96

18948.56

20464.44

22101.6

23869.73

25779.3

27841.65

16732.69

18071.31

19517.02

21078.38

22764.65

24585.82

26552.68

17234.68

18613.45

20102.53

21710.73

23447.59

25323.39

17751.72

19171.85

20705.6

22362.05

24151.01

18284.27

19747.01

21326.77

23032.91

18832.8

20339.42

21966.57

19397.78

20949.6

19979.71

271883.4

308067.9

347580.1

390699.3

437727.4

488990.9

544842.9

605665

671869.9

743903.8

822248.9

907426.6

1000000

3-3 If a “typical” firm reports $20 million of retained earnings on its balance sheet, could its directors declare a $20 million cash dividend without any qualms whatsoever?

No. Some of the reasons include: 1) the firm’s future plans will need funding and a major source of funding by the firm, and retained earnings is one of those sources without incurring debt or additional capitalization by issuing stocks; 2) the firm’s capital structure will have a drastic change in terms of proportion, which can affect the firm’s credit risk rating as regards its capital structure; 3) while retained earnings reflect a good amount of $20million, the firm may not have sufficient cash to declare such huge amount of dividends, and in which case will require the firm to liquidate some of its assets in order to pursue the declaration of the dividends—cash is different from retained earnings and doing so will drain up the firm’s assets.

3-5 What is operational capital, and why is it important?

Operational capital is the net working capital—which is the difference between the firm’s current assets and current liabilities. Operational capital is important because no matter how profitable is a firm, when it cannot meet its obligations that are due in the short-term with the assets that it has, it will put the firm into so much trouble. Without proper handling of this, the firm may face liquidity problems which can cause halts into operations that could seriously hurt the company in terms of its financial standing.

3-8 If you were starting a business, what tax considerations might cause you to prefer to set up as a proprietorship or a partnership rather than as a corporation?

Corporations are subject to double taxation, but only if dividends are declared. If a person is starting a business and thinks of the business as the sole way for him/her to earn an income, then the objective of increasing the value in the long-term may be compromised by getting the earnings in the short-term. When the business owner gets the earning as a sole proprietor or partner, he/she will only be taxed once for the income. In the form of a corporation, the earning will first be subject to corporate tax, then upon declaration of dividends, subject to personal tax to the business owner when the earning is claimed.

3-10 The Moore Corporation has operating income (EBIT) of $750,000. The company’s depreciation expense is $200,000. Moore is 100% equity financed, and it faces a 40% tax rate. What is the company’s net income? What is its net cash flow?

EBIT

750000

Less: Depreciation expense

-200000

Taxable income

550000

Less: 40% tax

-220000

Net income

330000

Net cash flow

530000

*net cash flow is computed by adding the depreciation

expense to net income

3-11 The Berndt Corporation expects to have sales of $12 million. Costs other depreciation are expected to be 75% of sales, and depreciation is expected to be $1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndt’s federal-plus-state tax is 40%. Berndt has no debt.

a. Set up an income statement. What is Berndt’s expected net cash flow?

Sales

12000000

Less: costs (75% of sales)

9000000

EBIT

3000000

Less: depreciation expense

1500000

Taxable income

1500000

Less: 40% tax

600000

Net income

900000

Net cash flow

2400000

b. Suppose Congress changed the tax laws so that Berndt’s depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow?

Sales

12000000

Less: costs (75% of sales)

9000000

EBIT

3000000

Less: depreciation expense

3000000

Taxable income

0

Less: 40% tax

0

Net income

0

Net cash flow

3000000

Net income falls to zero, but net cash flow becomes 3,000,000—with the changes in tax laws, net cash flow is 600,000 more.

c. Now suppose that Congress, instead of doubling Berndt’s depreciation, reduced it by 50%. How would profit and net cash flow be affected/

Sales

12000000

Less: costs (75% of sales)

9000000

EBIT

3000000

Less: depreciation expense

750000

Taxable income

2250000

Less: 40% tax

900000

Net income

1350000

Net cash flow

2100000

Net income increases up to 1,350,000, but with the changes in tax laws and depreciation expenses, net cash flow is down to 2,100,000.

d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why?

I would rather choose the depreciation expense to be doubled. In finance, cash is king and not net income. By doubling the depreciation expenses (this is not a cash expense, and tax deductible as well), the taxable income is drastically reduced without real reduction in cash flows, or cash outflow as we may say. This is better, so more cash will flow back into the balance sheet as a result of the changes in laws.

4-1 Greene Sister’s has a DSO of 20 days. The company’s average daily sales are $20,000. What is the level of its accounts receivable? Assume there are 365 days in a year.

Days sales outstanding (average collection period) = accounts receivable / daily credit sales

20 days = accounts receivable / 20, 000

Accounts receivable = 20 days * 20,000; Therefore, accounts receivable = 400,000

4-2 Vigo Vacations has an equity multiplier of 2.5. The company’s assets are financed with some combination of long-term debt and common equity. What is the company’s debt ratio?

Equity multiplier = total assets / total shareholders’ equity; 2.5 = 2.5 / 1

Total assets = total debt + total shareholders’ equity; 2.5 = total debt + 1; therefore, total debt = 1.5

Debt ratio = total debt / total assets; debt ratio = 1.5 / 2.5; therefore debt ratio is 0.6

4-4 A company has an EPS of $1.50, a cash flow per share of $3.00, and a price/cash flow ratio of 8.0 times. What is its P/E ratio?

If price/cash flow ratio = 8.0 times, and a cash flow per share is 3.00; then price/3.00 = 8.0 or price = 8.0*3.00, or 24.00

If the EPS is 1.50, and price is 24.00, then the price/earning ratio is 24.00/1.50 or 16.

4-7 Ace Industries has current assets equal to $3 million. The company’s current ratio is 1.5, and its quick ratio is 1.0. What is the firm’s level of current liabilities? What is the firm’s level of inventories?

Current ratio = current assets / current liabilities; 1.5 = 3 million / current liabilities

Current liabilities = current assets / current ratio; current liabilities = 3 million / 1.5; Thus, current liabilities = 2 million

Quick ratio = current assets - inventories / current liabilities; 1.0 = 3 million – inventories / 2 million

Inventories = current assets – current liabilities * quick ratio; inventories = 3 million – 2 million * 1.0;

Therefore, inventories = 1 million

4-13 Data for Morton Chip Company and its industry averages follow:

a. Calculate the indicated ratios for Morton.

Morton Chip Company: Balance Sheet as of December 31, 2007 (In Thousands)

Cash

77500

Accounts payable

129000

Receivables

336000

Notes payable

84000

Inventories

241500

Other current liabilities

117000

Total current assets

655000

Total current liabilities

330000

Net fixed assets

292500

Long-term debt

256500

Common equity

361000

TOTAL ASSETS

947500

TOTAL LIABILITIES AND EQUITY

947500

Morton Chip Company: Income Statement for year Ended December 31, 2007 (In Thousands)

Sales

1607500

Cost of goods sold

1392500

Selling, general and administrative expenses

145000

Earnings before interest and taxes (EBIT)

70000

Interest expense

24500

Earnings before taxes (EBT)

45500

Federal and State income taxes (40%)

18200

Net income

27300

Ratio Morton Industry Average

Current ratio 1.984848 2.0x

current assets

655000

current liabilities

330000

Current ratio

1.984848

Days sales outstanding 76.29238 days 35.0 days

accounts receivable

336000

daily credit sales

4404.11

days sales outstanding

76.29238

Sales/inventory 6.656315 6.7x

sales

1607500

inventory

241500

inventory turnover

6.656315

Sales/fixed assets 5.495726 12.1x

sales

1607500

fixed assets

292500

fixed-assets turnover

5.495726

Sales/total assets 1.69657 3.0x

sales

1607500

total assets

947500

total asset turnover

1.69657

Net income/sales 1.6983% 1.2%

net income

27300

sales

1607500

net profit margin

0.016983

Net income/total assets 2.8813% 3.6%

net income

27300

total assets

947500

net income ROI

0.028813

Net income/common equity 7.5623% 9.0%

net income

27300

common equity

361000

return on equity

0.075623

Total debt/total assets 61.8997% 60.0%

total debt

586500

total assets

947500

debt ratio

0.618997

***Calculation is based on a 365-day year.

b. Construct the extended Du Pond equation for both Morton and the industry,

ROE = [(net income / sales) * (sales / total assets)] / [1 – (total debt / total assets)]

ROE = [(27300 / 1607500) * (1607500 / 947500)] / [1 – (586500 / 947500)]

[0.016983 * 1.69657] / [1 – 0.618997]

0.028813 / 0.381003

ROE = 0.075623 or 7.5623%

c. Outline Morton’s strengths and weaknesses as revealed by your analysis.

Net income/sales: Morton fares better than the industry, with 1.6983% vs. 1.2%; thus, profitability is good for the company

Sales/total assets: Morton fares less than the industry, with 1.69657 vs 3; thus, Morton is less efficient in utilizing its assets in providing the company with sales; this is the main driver in terms of the relative inefficiency in the use of assets is apparent in the huge discrepancy of Morton’s fixed asset turnover compared to that of the industry’s. Also, inefficiency is evident in the lower inventory turnover of the company in contrast with the industry. This could warrant further investigations, in order to spot problems of inefficiency in utilization of assets in contrast to the company’s sales.

1 – total debt/total assets : Morton’s debt ratio is higher than the industry, which means it is utilizing the leverage well. This results in a smaller denominator for the ROE ratio, which gives a higher figure for the company

d. Suppose Morton had doubled its sales as well as its inventories, accounts receivable, and common equity during 2007. How would that information affect the validity of your ratio analysis? (Hint: Think about averages and the effects of rapid growth on ratios if averages are not used. No calculations are needed.)

If averages are not used, the ratios would reflect higher/lower figures which are not the true reflection of the duration of the whole duration of the operation. Especially in the case of accounts in the balance sheet which is a picture of the firm’s financial standing at a time—if the changes are not evened out by the use of the averages, ratio analysis will not reveal the true health of the firm given a whole duration/fiscal year.

5-1 Jackson Corporation’s bonds have 12 years remaining to maturity. Interest is paid annually, the bonds have a $1000 par value, and the coupon interest rate is 8%. The bonds have a yield to maturity of 9%. What is the current market price of these bonds?

Bond value = coupon*(present value interest annuity factor of 9% in 12 years)

+ par value*(present value interest factor of 9% in 12 years);

Bond value = (1000*8%)*7.1607 + 1000* 0.3555; bond value = 80*7.1607 + 1000*0.3555; bond value = 927.856

5-3 Heath Food’s bonds have a seven years remaining to maturity. The bonds have a face value of $1,000 and yield to maturity of 8%. They pay interest annually and have a 9% coupon rate. What is their current yield?

To calculate current yield, we must first get the bond’s market value:

Bond value = coupon*(present value interest annuity factor of 8% in 7 years)

+ par value*(present value interest factor of 8% in 7 years);

Bond value = (1000*9%)*5.2064 + 1000* 0.5835; bond value = 90*5.2064 + 1000*0.5835; bond value = 1052.076

Then we get the current yield = coupon / bond value; current yield = 90 / 1052.076; current yield = 0.0855 or 8.55%.

5-12 A 10 year, 12% semiannual coupon bond with a par value of $1,000 may be called in 4 years at a call price of $1,060. The bond sells for $1,100. (Assume that the bond has just been issued.)

a. What is the bond’s yield to maturity?

=YIELD(DATE(2008,8,3),DATE(2018,8,3),12%,110,100,2). Yield-to-maturity is = 10.3699%

b. What is the bond’s current yield?

Current yield = coupon / bond value; current yield = 120 / 1100; current yield = 10.9090%.

c. What is the bond’s capital gain or loss yield?

In order to get capital gain/loss yield, we get first the price change:

Price change = PV price year 4 – PV price year 0; price change = 1037.64-1100; price change = -62.36

Capital gain/loss yield = (coupon income*PV annuity interest factor for 4 periods at 12% + price change) / investment;

Capital gain/loss yield = [(120*3.0373) + (-62.36)] / 1100; capital gain yield = 27.4651%

d. What is the bond’s yield to call?

=YIELD(DATE(2008,8,3),DATE(2012,8,3),12%,110,106,2). Yield-to-call is = 10.1495%

5-18 The real risk-free market is 2%. Inflation is expected to be 3% this year, 4% next year, and then 3.5% thereafter. The maturity risk premium is estimated to be 0.0005 x (t – 1), where t = number of years to maturity. What is the nominal interest rate on a 7-year Treasury security?

Let R = current yield on a 2 year bond

Let r1 = current yield on a 1 year bond

Let rne = expected yield on a n-1 year bond a year from now

If R = term premium + (r1 + r2e+ r3e+ r4e+ r5e+ r6e+ r7e) / 7

5-21 Suppose Hilliard Manufacturing sold an issue of bonds with a 10-year maturity, a $1,000 par value, a 10% coupon rate, and semiannual interest payments.

a. Two years after the bonds were issued, the going rate of interest on bonds such as these fell to 6%. At what price would the bonds sell?

Required rate of return

Rate

0.03

Periods left to maturity

Nper

16

Semiannual interest payment

Pmt

50

Future value

FV

1000

Present value (2 years after issue date)

PV

($1,251.22)

b. Suppose that, 2 years after the initial offering, the going interest rate had risen to 12%. At what price would the bonds sell?

Required rate of return

Rate

0.06

Periods left to maturity

Nper

16

Semiannual interest payment

Pmt

50

Future value

FV

1000

Present value (2 years after issue date)

PV

($898.94)

c. Suppose that the conditions in part a existed—that is, interest rates fell to 6% 2 years after the issue date. Suppose further that the interest rate remained at 6% for the next 8 years. What would happen to the price of the bonds over time?

The bond will eventually reach its future value of 1,000 over time, where the market value equals the future value of the bond, in 10 years-time.

6-1 An individual has $35,000 invested in a stock which has a beta of 0.8 and $40,000 invested in a stock with a beta of 1.4. If these are the only two investments in her portfolio, what is her portfolio’s beta?

Beta of portfolio = (fraction of portfolio in first stock * beta of first stock) + (fraction of portfolio in second stock * beta of second stock)

Beta of portfolio = [{35,000/(35,000+40,000)} * 0.8] + [{40,000/(35,000+40,000)} * 1.4]

Beta of portfolio = 1.12

6-2 Assume that the risk-free rate is 6% and the expected return on the market is 13%. What is the required rate of return on a stock that has a beta of 0.7?

Required rate of return = risk-free rate + beta (risk premium)

Required rate of return = risk-free rate + beta (market risk – risk free rate)

Required rate of return = 6% + 0.7 (13% - 6%)

Required rate of return = 10.9%

6-3 Assume that the risk-free rate is 5% and the market risk premium is 6%. What is the expected return for the overall stock market? What is the required rate of return on a stock that has a beta of 1.2?

Risk premium = market return – risk-free rate

Thus, market return = risk premium + risk-free rate

Market return = 6% + 5%; thus, market return = 11%

Required rate of return = risk-free rate + beta (risk premium)

Required rate of return = 5% + 1.2 (6%)

Required rate of return = 12.2%

6-4 A stock’s return has the following distribution:

Demand for the Probability of This Rate of Return if This

Company’s Products Demand Occurring Demand Occurs

Weak 0.1 (50%)

Below average 0.2 (5)

Average 0.4 16

Above average 0.2 25

Strong 0.1 60

1.0

Calculate the stock’s expected return, standard deviation, coefficient of variation.

Stock’s expected return = 11.4%

Standard deviation = +/-26.69%

value of ith possible rate of return (ki)

expected rate of return (k)

probability that ith outcome will occur p(ki)

k-ki

(k-ki) squared

(k-ki) squared * p(ki)

-50%

0.114

0.1

-0.6140

0.3770

0.0376996

-5%

0.114

0.2

-0.1640

0.0269

0.0053792

16%

0.114

0.4

0.0460

0.0021

0.0008464

25%

0.114

0.2

0.1360

0.0185

0.0036992

60%

0.114

0.1

0.4860

0.2362

0.0236196

0.071244

Standard deviation

0.266915717

Coefficient of variation = standard deviation / expected return

Coefficient of variation = 26.69% / 11.4%; coefficient of variation = 2.341228

6-7 Suppose r RF = 9%, rM = 14%, and bi = 1.3.

a. What is ri, the required rate of return on stock i?

ri = rf + bi (rm-rf); where ri = 9% + 1.3*(14%-9%); ri =15.5%

b. Now suppose rRF (1) increases to 10% or decrease to 8%. The slope of the SML remains constant. How would this affect rM and ri?

An increase to 10% in rf will leave the rm unchanged, but the ri lower, because market premium is lower due to higher rf. At 10% rf, ri=15.2%.

A decrease to 8% in rf will leave the rm still unchanged, but the ri higher, because market premium is higher due to lower rf. At 8% rf, ri=15.8%.

c. Now suppose rRF remains at 9% but rM (1) increases to 16% or (2) falls to 13%. The slope of the SML does not remain constant. How would these changes affect ri?

With rf remaining at 9%, and rm increases to 16%, ri increases due to higher market premium. With rm at 16%, ri=18.1%.

With rf remaining at 9%, and rm decreases to 13%, ri decreases due to lower market premium. With rm at 13%, ri=14.2%.

7-6 Suppose you are given the following information. The beta of company I, b, is 1.1, the risk-free rate, rRF, is 7%, and the expected market market premium, rM – rRF, is 6.5%. (Assume that ai = 0.0)

a. Use the security market line (SML) of CAPM to find the required return for this company.

ri = rf + bi (rm-rf); where ri = 7% + 1.1*(6.5%); ri =14.15%

b. Because your company is smaller than average and more successful than average (that is, it has a low book-to-market ratio), you think the Fama-French three-factor model might be more appropriate than the CAPM. You estimate the additional coefficients from the Fama-French three-factor model: The coefficient for the size effect, Ci, is 0.7, and the coefficient for the book-to-market effect, di, is -0.3. If the expected value of the size factor is 5% and the expected value of the book-to-market factor is 4%, what is the required return using the Fama-French three factor model?

Fama-French model:

r - Rf = beta3 x ( Km - Rf ) + bs x SMB + bv x HML + alpha;

r – 7% = 1.1*(6.5%) + 0.7*5% + -0.3*4% + 0.0

r – 0.07 = 0.0945; using Fama-French three-factor model, r = 0.1645 or 16.45%.

8-4 Basil Pet Products has preferred stock outstanding which pays a dividend of $5 at the end of the year. The preferred stock sells for $50 a share. What is the preferred stock’s required rate of return?

Preferred stock’s required rate of return = annual dividend / intrinsic value; however, intrinsic value of stock is not given.

Thus we find the preferred stock’s expected rate of return:

Expected rate of return (preferred stock) = annual dividend / market price

Expected rate of return (preferred stock) = 5 / 50; Expected rate of return (preferred stock) = 10%.

8.9 Brushy Mountain Mining Company’s ore reserves are being depleted, so its sales are falling. Also, its pit is getting deeper each year, so its costs are rising. As a result, the company’s earnings and dividends are declining at the constant rate of 4% per year. If D0 = $5 and rs = 15%, what is the value of Brushy Mountain’s stock?

Common stock value = dividend in year 1 / required rate of return – growth rate

If dividend in year 0 = 5, at a growth rate of -4% (declining rate); we get dividend in year 1 by = dividend year 0*(1 + g where g is growth rate);

Thus, dividend in year 1 = 5*(1 + (-.04)); dividend in year 1 = 4.8

Therefore, Common stock value = dividend in year 1 / required rate of return – growth rate

Common stock value = 4.8 / 15% – (-4%); common stock value = $25.26316.

Bibliography

Brealey, R., Myers, S., Marcus, A. (2004). Fundamentals of Corporate Finance, (International Edition). Philippines: Mc-Graw Hill Education (Asia).

Jensen, M., Murphy, K. J. and E. Wruck (2004). Remuneration: Where we’ve Been, How We Got to Here, What are the Problems, and How to Fix Them. Available from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=561305#PaperDownload. [Accessed 12 May, 2008]

Keown, A. J., Martin, J. D., Petty, J. W., Scott, Jr., D. F. (2005) Financial Management: Principles and Applications. New Jersey: Pearson Education, Inc.

Read

More

CHECK THESE SAMPLES OF Analysis of Questions in Financial Management

Financial Sector in Saudi Arabia Differentiating between Conventional Loans and Murabaha Financing

Further, in the next section, an analysis of the information gathered in the previous section will be presented.... Simply, finance stands for the allocation as well as management of available resources.... The paper "financial Sector in Saudi Arabia Differentiating between Conventional Loans and Murabaha Financing" is aimed at revealing the present scenario of Saudi Arabia.... We will discuss the current financial practices of the country....

56 Pages

(14000 words)

Essay

Reflective statement for previous case study Nestle

The analysis of the competitive forces pertaining to Nestle was done by using the Porter's five forces model.... The analysis of Ansoff's matrix helped in predicting the possible strategies with regards to the business strategy adopted by an organization.... During the course of analysis of the case study tools like PESTEL and SWOT were also used.... The use of the balanced scorecard model helped in understanding how to evaluate a firm's strategy based on financial as well as non financial aspects (Balanced Scorecard Institute, 2011)....

4 Pages

(1000 words)

Essay

Financial Management and Control: Solvent PLC, Mega PLC, and Brothers Ltd

The "financial management and Control: Solvent PLC, Mega PLC, and Brothers Ltd" paper argues that the operating profit of the company halved either due to an increase in operating expenses or a reduction in operating income.... Since the sale has increased operating income is expected to increase....

11 Pages

(2750 words)

Essay

Strategic Management - Brief Financial Analysis of Ryanair

The paper "Strategic Management - Brief Financial analysis of Ryanair" explores Ryanair as an airline based in Ireland.... It was quite difficult to make Ryanair profitable until its management was taken over by Michael O'Leary.... The briefs of the financial & operational performance of the company from 1998 to 2002 retrieved from the ATI database show a great change in the financial status of the company.... (financial performance table is attached as Appendix II retrieved from ATI Database)

...

12 Pages

(3000 words)

Case Study

The Role of Financial Analyst in Banking

This study analyzes the role of the financial analyst in Banking.... Though there is formal route such as for analysts to earn a professional qualification such as Chartered financial Analyst designation (CFA) in the United States of America, or an international qualification Certified International Investment Analyst designation (CIIA), to advance beyond a certain level within a firm Many recent financial reporting scandals (e.... the Enron Scandal) have been attributed to poor corporate governance oversight, understatement of the role of with analyst and poor financial reporting process (Weintrop, Li & Byard 2006)....

16 Pages

(4000 words)

Research Proposal

Accounting Earnings Management

Despite this, the practice has been a part of financial reporting for ages, however, now is the need to segregate little manipulation of figures in financial statements from the criminal acts of deceiving users of financial statements.... The paper "Accounting Earnings management" presents detailed information, that today is the world of severe competition which makes all the players in both global and domestic market, makes it insecure and fight for the market share....

6 Pages

(1500 words)

Term Paper

Analysis of the Impact of Stress Management on the Nurses

The research involved both the quantitative and qualitative analysis of the data collected through the process of the research.... The research conducted to analyze the importance of stress management on the employee's revealed significant result in the process.... A literature review of the journal has been conducted which discusses the impact of stress management on nurse productivity and retention by Milliken.... In view of the research undertaken to analyze the impact of stress management, the study of the literature seems helpful as it thoroughly addresses the need for stress management In the articles the researchers discuss about the increased stress which nurses have to handle because of various constraints which includes shortage in personnel, unavailability of funds and the role they have to carry out....

22 Pages

(5500 words)

Research Paper

The Global Financial Crisis and its Impact on the Financial Sector in Jordan

The paper 'The Global financial Crisis and its Impact on the financial Sector in Jordan ' is an affecting example of a finance & accounting literature review.... The global financial began from the mortgage crisis which took place in the U.... The paper 'The Global financial Crisis and its Impact on the financial Sector in Jordan ' is an affecting example of a finance & accounting literature review.... The global financial began from the mortgage crisis which took place in the U....

6 Pages

(1500 words)

Literature review

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Analysis of Questions in Financial Management"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY