- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

- Studentshare

- Subjects

- Miscellaneous

- Module title: STRATEGIC ACCOUNTING

Module title: STRATEGIC ACCOUNTING - Essay Example

- Subject: Miscellaneous

- Type: Essay

- Level: Undergraduate

- Pages: 4 (1000 words)

- Downloads: 0

- Author: lonschaefer

Extract of sample "Module title: STRATEGIC ACCOUNTING"

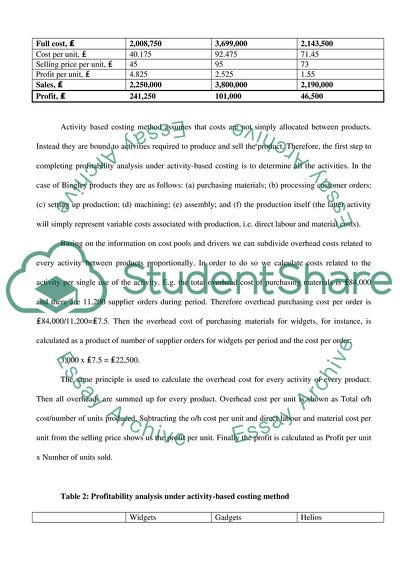

Note that cost per unit is calculated as the full cost divided by a number of units. Profit per unit, clearly shows the profitability of a product although not considering its sales levels, and is evaluated simply subtracting cost per unit from its selling price. The final line, profit takes into account amount of sales and provides the profit of a product as sales – full cost of the product (or by multiplying profit per unit by number of units sold). Activity based costing method assumes that costs are not simply allocated between products.

Instead they are bound to activities required to produce and sell the product. Therefore, the first step to completing profitability analysis under activity-based costing is to determine all the activities. In the case of Bingley products they are as follows: (a) purchasing materials; (b) processing customer orders; (c) setting up production; (d) machining; (e) assembly; and (f) the production itself (the latter activity will simply represent variable costs associated with production, i.e. direct labour and material costs).

Basing on the information on cost pools and drivers we can subdivide overhead costs related to every activity between products proportionally. In order to do so we calculate costs related to the activity per single use of the activity. E.g. the total overhead cost of purchasing materials is ₤84,000 and there are 11,200 supplier orders during period. Therefore overhead purchasing cost per order is ₤84,000/11,200=₤7.5. Then the overhead cost of purchasing materials for widgets, for instance, is calculated as a product of number of supplier orders for widgets per period and the cost per order: The same principle is used to calculate the overhead cost for every activity of every product.

Then all overheads are summed up for every product. Overhead cost per unit is shown as Total o/h cost/number of units produced. Subtracting the o/h cost per

...Download file to see next pages Read MoreCHECK THESE SAMPLES OF Module title: STRATEGIC ACCOUNTING

Strategic Management Accounting and the Realistic Practices of Nestle

A Little Labor Knowledge Could Go a Long Way for HR as Unions Push Into Private Sector

Forward-Thinking, Outcome-Oriented Producer

Vodafone's Foundation, Vision, and Mission

Analysis: Accsys Technologies PLC

The Views of Different Writers on What Constitutes Strategic Management Accounting

The Current System Utilized by Tracksuits-N-Sportswear Company Limited

Analysis of CPA and ICAA Accounting Bodies and Their Membership Benefits to a Student

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY