StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Macro & Microeconomics

- A Pigouvian Tax Issues

Free

A Pigouvian Tax Issues - Report Example

Summary

The report "A Pigouvian Tax Issues" focuses on the critical analysis and elaborations upon Pigouvian taxes. The focal point is to be the advantages of this type of tax as compared to the alternative of regulation. The disadvantages of Pigouvian taxes shall also be discussed…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER97.4% of users find it useful

- Subject: Macro & Microeconomics

- Type: Report

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 1

- Author: ysatterfield

Extract of sample "A Pigouvian Tax Issues"

The objective of this essay is to elaborate upon Pigouvian taxes. The focal point is to be the advantages this type of tax has compared to the alternative of regulation. The disadvantages of Pigouvian taxes shall also be discussed. However, since to understand the notion of a Pigouvian tax it is imperative to perceive the notion of economic externalities, the essay shall start off by introducing the concept of an economic externality and what problems it leads to. It shall thereon move on to discuss what exactly is meant by a Pigouvian tax and how that can solve the problems associated with the presence of externalities. Following this lead, the advantages of such a tax over the alternative mechanism of regulation shall be analysed and finally, the problems of a Pigouvian tax scheme will be discussed.

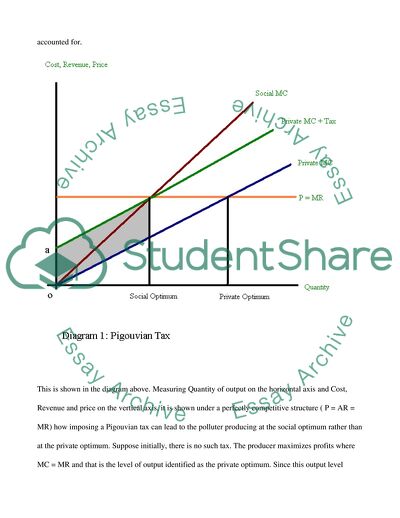

An externality in essence refers to the phenomenon of one individual or firms production or consumption decision affecting the production or consumption of another individual without the latter. being directly involved. Pollution is a negative externality implying that the polluters production activities cause disutility or increase in costs of others. Consider for instance the situation of two producers A and B with A producing something that includes using water from the river (for instance, for disposal of waste) and this usage reduces the fish productivity of the river and B being a fisherman. The more A increases his production, the greater will be the cost of production for B since he will be able to catch lesser fish per unit of time, labor or capital. The idea of the Pigouvian tax is to make the polluters production costs become inclusive of the damage that he does. Since the changes in the fish productivity of the river does not affect producer A, he has no incentive on his own to produce below his private optimum. However, if A had to pay a tax per unit of output, his cost of production rises and thus, the private optimum now moves towards the social optimum. The amount of this tax, according to Pigou (1920) should precisely be equal to the marginal social cost of pollution per unit of output. Essentially the mechanism is that the externalities created due to the pollution are internalized and thus accounted for.

This is shown in the diagram above. Measuring Quantity of output on the horizontal axis and Cost, Revenue and price on the vertical axis, it is shown under a perfectly competitive structure ( P = AR = MR) how imposing a Pigouvian tax can lead to the polluter producing at the social optimum rather than at the private optimum. Suppose initially, there is no such tax. The producer maximizes profits where MC = MR and that is the level of output identified as the private optimum. Since this output level causes some given damage to the environment, it also has a social cost associated with it. However, that damage is not internalized by the producer himself. The marginal social cost curve reflects this damage to society. The level of output corresponding to the intersection of the social marginal cost curve and the marginal revenue curve is the optimum for society. Thus, initially, the amount produced exceeds societies optimum by the distance (private optimum – social optimum). Now, if a tax is imposed on the per unit output of the polluter, his marginal cost curve shifts upwards as for every additional unit of output a higher cost has to be borne. There exists a particular per unit tax which shall move the polluters marginal cost curve exactly so that it intersects the marginal revenue curve precisely at the level of output corresponding to the social optimum. This shall be the point where the social marginal cost curve intersects the marginal revenue curve. The per unit tax that is able to achieve precisely this allocation is called the Pigouvian tax. It is precisely equal to the marginal externality for any given output level. Now, with the costs restructured, the private optimum coincides with the social optimum. In the diagram the distance o-a represents the Pigouvian tax. The shaded area represents the governments revenue from the tax.

The advantages that a Pigouvian tax has over the alternative of establishing state dictated regulatory control on the amount of pollution permissible for any producer is essentially twofold. First, the Pigouvian tax actually provides the producer with an incentive to reduce pollution. Since due to the presence of this tax, every unit of pollution costs more, the profit maximization problem for the producer will incorporate the requirement of reducing these costs and thus reduce the amount of pollution. Secondly, Pigouvian taxes generate a revenue for the Government. So, there are twin dividends to be reaped. Not only is the pollution level reduced in aggregate, there is also a positive revenue generated. This revenue allows the government to cut down on other distortionary taxes that it may have imposed on other productive activities.

The Pigouvian tax although conceptually very simple and appealing, does fall short on grounds of practical applicability and the main disadvantages are essentially manifestations of such practical problems. First and foremost, computing the Pigouvian tax depends upon information assuming which to be readily available may be unrealistic. The exact per unit cost structure of any producer may not be available to the government. Further, in the presence of market imperfections, the optimum amount of a Pigouvian tax is not equal to the marginal externality itself. It has been shown by Buchanon (1969) and subsequently by Barnett (1980) that under an imperfectly competitive industry that produces pollution as a byproduct, the optimum Pigouvian tax should lie below the social marginal cost of pollution. Thus, setting it equal to the marginal damage caused by pollution would be sub-optimal.

Also, as argued by Ronald Coase (1960), the social optimum can be reached without intervention simply through the introduction of enforceable property rights, as often the incentives of the polluters and the individuals affected lead to private arrangements between them with either the producer paying the sufferer an amount for the right to pollute or the sufferer paying the polluter for the right to clean air. As a result the problem of externalities are internalized through such private resource transfers. However, for such an arrangement to attain social optimum, bargaining and transfer costs have to be insignificant. But even in the presence of positive transfer costs, such private transfers may take place which partially mitigate the effects of the externality. But if a Pigouvian tax has to be imposed in the presence of such transfers, or market imperfections for that matter, it has to take these into account and the computations become complicated and contingent upon a large base of perfect and complete information.

Finally, the Pigouvian tax is associated with a deadweight loss which can be avoided if instead a regulatory framework is adopted. In the diagram below, this deadweight loss is shown.

To conclude, what emerges is that a Pigouvian tax, in principle, is very appealing and a solution with a number of advantages to the problem of discrepancy between private and social optima in the presence of externalities. It is however, based upon information that is not readily available and its applicability is limited since to attain perfection all present taxes subsidies and transfers would have to be accounted for and replaced in the net by a Pigouvian tax. The easy solution of setting the tax precisely equal to the externality per unit of output is plausible and meaningful only in the absence of regulations and market imperfections.

References:

Barnett, A. H., (1980) “The Pigouvian tax rule under monopoly”, American Economic Review 70, 1037-1041.

Baumol, W. J., (1972) "On Taxation and the Control of Externalities", American Economic Review 62 : 307–322

Buchanan, J. M., (1969) “External diseconomies, corrective taxes, and market structure”, American Economic Review 59: 174-177

Pigou, A. C., (1920) “The Economics of Welfare” Macmillan, London

Read

More

CHECK THESE SAMPLES OF A Pigouvian Tax Issues

How We Are Destroying the Planet

This research paper "How We Are Destroying the Planet" perfectly shows that Mankind is systematically destroying the sensitive ecosystems which support life on earth.... To date, very little effort is being made to stop and correct the damage being done'.... ... ... ... It is an accepted fact that we are destroying our earth in many ways even though we are advancing rapidly socially, culturally, scientifically, and economically....

9 Pages

(2250 words)

Research Paper

Imposition of the Pigouvin Taxes

In the US, the support for such taxes is spreading and the Congress are considering to tax sugary drinks in order to help pay for expansion of health-care coverage.... In the United States, the support for a tax on junk food is now spreading and as a result, the Congress are considering to tax sugary drinks in order to help pay for planned expansion of health-care coverage1.... It is not clear whether a tax on junk food will make sense because most people have junk food as part of a well-balanced diet as well as active lifestyle....

2 Pages

(500 words)

Assignment

Environmental Economics

It includes the environmental issues like global warming, air pollution, water quality, toxic substances, nuclear waste, solid waste, etc.... igovian Taxes is a kind of special tax that is often levied on companies that pollute the environment or create excess social costs, called negative externalities, through business practices.... In a true market economy, a Pigovian tax is the most efficient and effective way to correct negative externalities (Pigovian tax) The main objective of this tax is to incorporate the social cost of the environment problems caused by the polluter....

4 Pages

(1000 words)

Essay

Micro economy: Analyze and Discuss the trade policiy of any country of your choice

The paper accounts the government policies, the taxes imposed such as Pigovian taxes, tariffs, import quota etc.... It also gives details about the subsidies, ceiling price, floor price of the market and the.... ... ... During the last twenty-five years, the international US trade has changed dramatically....

4 Pages

(1000 words)

Essay

Analysis of Cap and Trade Issues

elationship between the Coase Theorem, pigouvian tax, and the cap and trade issues

... This essay "Analysis of Cap and Trade issues" discusses cap and trade that essentially refers to a market strategy that attempts to cut down the environmental effect of large-scale pollution emitters without necessarily crashing the economic activities going on within an economic system.... ith regards to Cap and tax, a regulatory system is set that provides incentives for polluter companies to find cost-effective mechanisms for controlling their emissions....

2 Pages

(500 words)

Essay

Carbon Tax

In the paper 'Carbon Tax' the author analyzes if carbon tax is a potential problem or a solution to the different environmental issues related to greenhouse gas emissions caused by the combustion of different types of fuels and energy resources.... There are many aspects that should be considered to understand the potential issues and solutions.... According to the author, the levying of carbon tax is considered to be necessary, because it would help to price the fuels equitably and would solve the problem of the excessive combustion of fuels that produce carbon emissions....

8 Pages

(2000 words)

Research Paper

The Concepts of Moral Hazard and Adverse Selection

firm producing a negative externality mainly pays its underlying marginal private cost and pigouvian tax that is equivalent to the corresponding externality thus reducing its production regarding the socially optimal level of the output.... When the completion date for the contract is two years then adverse selection issues are the builder might be high cost and the cost-plus contract protect it.... Example of Pogouvian tax in everyday lifePogouvian tax mainly caters to taxes and compensation regarding the external negative impacts....

2 Pages

(500 words)

Essay

Regulatory Measures for Carbon Dioxide Emission Reduction

The paper 'Regulatory Measures for Carbon Dioxide Emission Reduction' is a cogent variant of the essay on environmental studies.... Carbon dioxide (CO2) emissions into the atmosphere are a negative externality.... By using appropriate theories and researching in the current Australian policy debates, the author compares regulatory measures for emission reduction....

8 Pages

(2000 words)

Essay

sponsored ads

Save Your Time for More Important Things

Let us write or edit the report on your topic

"A Pigouvian Tax Issues"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY