StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Financial Ratios for British Airways

Free

Financial Ratios for British Airways - Essay Example

Summary

In the paper “Financial Ratios for British Airways” the author discusses the Liquidity Position of Easy Jet, which is better than that of British Airways. Its current, as well as quick ratios, are both better than that of BA. Easy Jet has the advantage over the BA…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER97.6% of users find it useful

- Subject: Finance & Accounting

- Type: Essay

- Level: Undergraduate

- Pages: 4 (1000 words)

- Downloads: 0

- Author: iondricka

Extract of sample "Financial Ratios for British Airways"

Financial Ratios British Airways (Financial Ratios for the year 2005 & 2006)

Current Ratio

1.0 times

1.1 times

Quick Ratio

0.9 times

1.0 times

Debt to Total Assets

76.3%

84.7%

Times Interest Earned

4.3 times

8.3 times

Inventory Turnover *

82.79 times

209.9 times

Ave. Collection Period *

51.5 days

14.4 days

Fixed Assets Turnover *

0.9 times

2.0 times

Total Assets Turnover *

0.7 times

1.4 times

Profit Margin on Sales

3.4%

5.5%

Return on Total Assets *

2.3%

7.8%

Return on Net Worth *

9.7%

51.3%

Easy Jets ( Financial Ratios for the year 2005 & 2006)

Current Ratio

2.1 times

2.1 times

Quick Ratio

2.1 times

2.1 times

Debt to Total Assets

47.0%

53.7%

Times Interest Earned

8.5 times

6.4 times

Inventory Turnover *

0

0

Ave. Collection Period *

57.3 days

24.0 days

Fixed Assets Turnover *

1.8 times

3.1 times

Total Assets Turnover *

0.8 times

1.5 times

Profit Margin on Sales

4.4%

5.8%

Return on Total Assets *

3.6%

8.9%

Return on Net Worth *

6.8%

19.1%

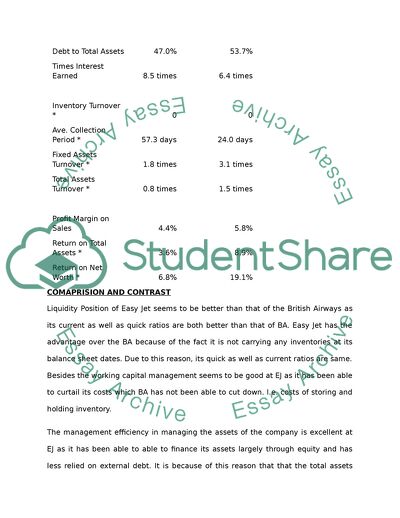

COMAPRISION AND CONTRAST

Liquidity Position of Easy Jet seems to be better than that of the British Airways as its current as well as quick ratios are both better than that of BA. Easy Jet has the advantage over the BA because of the fact it is not carrying any inventories at its balance sheet dates. Due to this reason, its quick as well as current ratios are same. Besides the working capital management seems to be good at EJ as it has been able to curtail its costs which BA has not been able to cut down. I.e. costs of storing and holding inventory.

The management efficiency in managing the assets of the company is excellent at EJ as it has been able to able to finance its assets largely through equity and has less relied on external debt. It is because of this reason that that the total assets financed through debt is just 47% and 53% in 2005 & 2006 as compared to BA whose ratio of debt to assets have shown an increase i.e. from 76% to 83%. This not only impairs the management’s ability to effectively manage the assets but also significantly reduce the profits since higher proportion of returns goes to debt servicing. In 2006, BA has been able to greatly able to lessen its cost of goods sold. This also seems to be the reason behind recording higher interest covered ratio in 2006 as compared to EJ- a move showing BA’s management attitude to concentrate on cost cutting. In 2006 BA somewhat seems to be in driving seat as for as controlling and efficient management of the assets. Inventory turnover has greatly increased showing efficient management of inventories. EJ due to enjoying no inventory, do not have any inventory turnover ratio. Collection efforts of both the companies seem to be inline with each other.

As for as the profit margins are concerned, BA still is enjoying higher margins despite the claims made by EJ that it enjoys low cost.

Overall, Shareholders of BA are better off than the shareholders of EJ since they enjoyed higher returns on their investments during the period.

APPENDIX

British Airways

BA-5

BA-6

CASH

147

1,591

MARKETABLE SECURITIES

0

0

INVENTORY

159

146

ACCOUNTS RECEIVABLE

2,034

1,202

OTHER, MISCELLANEOUS

3,026

3,493

CURRENT ASSETS

5,366

6,432

FIXED ASSETS (NET)

16,023

14,926

TOTAL ASSETS

21,389

21,358

CURRENT LIABILITIES

5,623

6,021

LONG-TERM LIAB.

10,702

12,072

TOTAL LIABILITIES

16,325

18,093

SHs EQUITY (NET WORTH)

5,064

3,265

TOTAL EQUITIES

21,389

21,358

Statement, no. of months:

12

6

NET SALES

14,411

15,283

COST OF GOODS SOLD

13,163

2,929

GROSS PROFIT

1,249

12,354

OPERATING EXPENSES

252

11,089

GROSS OPERATING INCOME

997

1,265

DEPRECIATION

0

0

NET OPERATING INCOME

997

1,265

OTHER INCOME

0

0

GROSS INCOME

997

1,265

OTHER EXPENSES

0

0

INTEREST EXPENSES

232

153

NET INCOME BEFORE TAXES

765

1,113

INCOME TAX

275

275

NET INC. BEFORE DIVIDENDS

490

838

Current Ratio

1.0 times

1.1 times

Quick Ratio

0.9 times

1.0 times

Debt to Total Assets

76.3%

84.7%

Times Interest Earned

4.3 times

8.3 times

Inventory Turnover *

90.9 times

209.9 times

Ave. Collection Period *

51.5 days

14.4 days

Fixed Assets Turnover *

0.9 times

2.0 times

Total Assets Turnover *

0.7 times

1.4 times

Profit Margin on Sales

3.4%

5.5%

Return on Total Assets *

2.3%

7.8%

Return on Net Worth *

9.7%

51.3%

EJ-5

EJ-6

CASH

667

861

MARKETABLE SECURITIES

6

13

INVENTORY

0

0

ACCOUNTS RECEIVABLE

211

213

OTHER, MISCELLANEOUS

7

0

CURRENT ASSETS

891

1,087

FIXED ASSETS (NET)

739

1,036

TOTAL ASSETS

1,630

2,124

CURRENT LIABILITIES

415

509

LONG-TERM LIAB.

352

632

TOTAL LIABILITIES

766

1,141

SHs EQUITY (NET WORTH)

863

983

TOTAL EQUITIES

1,630

2,124

2005

2006

NET SALES

1,341

1,620

COST OF GOODS SOLD

1,135

1,341

GROSS PROFIT

206

279

OPERATING EXPENSES

0

0

GROSS OPERATING INCOME

206

279

DEPRECIATION

140

161

NET OPERATING INCOME

66

118

OTHER INCOME

27

35

GROSS INCOME

93

153

OTHER EXPENSES

0

0

INTEREST EXPENSES

11

24

NET INCOME BEFORE TAXES

82

129

INCOME TAX

24

35

NET INC. BEFORE DIVIDENDS

58

94

Current Ratio

2.1 times

2.1 times

Quick Ratio

2.1 times

2.1 times

Debt to Total Assets

47.0%

53.7%

Times Interest Earned

8.5 times

6.4 times

Inventory Turnover *

#DIV/0!

#DIV/0!

Ave. Collection Period *

57.3 days

24.0 days

Fixed Assets Turnover *

1.8 times

3.1 times

Total Assets Turnover *

0.8 times

1.5 times

Profit Margin on Sales

4.4%

5.8%

Return on Total Assets *

3.6%

8.9%

Return on Net Worth *

6.8%

19.1%

British Airways

Ratios for 2005

In Million

Ratio

Formulae

Amount

Amount

Ratio

Current ratio

Current Asset/Current Liabilities

5366

5623

0.95

Quick Ratio

(Current Assets-Inventory)/Current Liabilities

5207

5623

0.93

Debt to total assets

Total Debt/Total Assets

16325

21389

76.32%

Times Interest Earned

Operating Profit/Interest

997

232

4.30

Inventory Turnover

COGS/Inventory

13163

159

82.79

Av.Collection Period

(Recievables/sales/365)

2034

14411

51.52

Fixed Asset Turnover

Sales/Fixed Assets

14411

16023

0.90

Total Asset Turnover

Sales/Total Assets

14411

21389

0.67

Profit Margin on sales

Net Income/Sales

490

14411

3.40%

Return on total assets

Net Income/Total Assets

490

21389

2.29%

Return on Networth

Net Income/Equity

490

5064

9.68%

Ratios for 2006

In Million

Ratio

Formulae

Amount

Amount

Ratio

Current ratio

Current Asset/Current Liabilities

6432

6021

1.07

Quick Ratio

(Current Assets-Inventory)/Current Liabilities

6286

6021

1.04

Debt to total assets

Total Debt/Total Assets

18093

21358

84.71%

Times Interest Earned

Operating Profit/Interest

1265

153

8.27

Inventory Turnover

COGS/Inventory

2929

146

20.06

Av.Collection Period

(Recievables/sales/365)

1202

15283

28.71

Fixed Asset Turnover

Sales/Fixed Assets

15283

14926

1.02

Total Asset Turnover

Sales/Total Assets

15283

21358

0.72

Profit Margin on sales

Net Income/Sales

838

15283

5.48%

Return on total assets

Net Income/Total Assets

838

21358

3.92%

Return on Networth

Net Income/Equity

838

5064

16.55%

EASY JET

Ratios for 2005

In Million

Ratio

Formulae

Amount

Amount

Ratio

Current ratio

Current Asset/Current Liabilities

891

415

2.15

Quick Ratio

(Current Assets-Inventory)/Current Liabilities

891

415

2.15

Debt to total assets

Total Debt/Total Assets

766

1630

46.99%

Times Interest Earned

Operating Profit/Interest

66

11

6.00

Inventory Turnover

COGS/Inventory

1135

0

0.00

Av.Collection Period

(Recievables/sales/365)

211

1341

57.43

Fixed Asset Turnover

Sales/Fixed Assets

1341

739

1.81

Total Asset Turnover

Sales/Total Assets

1341

1630

0.82

Profit Margin on sales

Net Income/Sales

58

1341

4.33%

Return on total assets

Net Income/Total Assets

58

1630

3.56%

Return on Networth

Net Income/Equity

58

863

6.72%

Ratios for 2006

In Million

Ratio

Formulae

Amount

Amount

Ratio

Current ratio

Current Asset/Current Liabilities

1087

509

2.14

Quick Ratio

(Current Assets-Inventory)/Current Liabilities

1087

509

2.14

Debt to total assets

Total Debt/Total Assets

1141

2124

53.72%

Times Interest Earned

Operating Profit/Interest

118

24

4.92

Inventory Turnover

COGS/Inventory

1341

0

0.00

Av.Collection Period

(Recievables/sales/365)

213

1620

47.99

Fixed Asset Turnover

Sales/Fixed Assets

1620

1036

1.56

Total Asset Turnover

Sales/Total Assets

1620

2124

0.76

Profit Margin on sales

Net Income/Sales

94

1620

5.80%

Return on total assets

Net Income/Total Assets

94

2124

4.43%

Return on Networth

Net Income/Equity

94

983

9.56%

Read

More

CHECK THESE SAMPLES OF Financial Ratios for British Airways

Understanding company accounts and reports: Mothercare

Mothercare is a british Company which specializes in products for expectant mothers and for children up to 8 years old and is a specialist retailer of products for mothers-to-be, babies and children up to the age of eight.... Financial Analysis Liquidity ratios Liquidity ratios illustrate the company's ability to pay off obligations in the short term (Jae K.... Accounting Policies and Audit: Mothercare's financial statements (individual and consolidated) are prepared in accordance with International financial Reporting Standards (IFRS) adopted for use in the European Union, International financial Reporting Interpretations Committee (IFRIC) and with those parts of the Companies Act 2006 applicable to companies reporting under IFRS....

9 Pages

(2250 words)

Essay

International Developments of Accounting

21 Pages

(5250 words)

Essay

Analysis of AMRs Financial Statements

American Airlines has entered into various arrangements with other carriers and transportation providers including Jet Blue and other airlines operating out of other countries such as british airways.... AMR through its airlines faces competition on its domestic route from Air Tran airways, Alaska airlines, Continental Airlines, Delta Airlines, Frontier Airlines, Jet Blue, Hawaiian Airlines, Southwest Airlines, Spirit Airlines, United Airlines, US airways, Virgin American Airlines and their affiliated regional carriers (PHX Corporate 2011)....

8 Pages

(2000 words)

Research Paper

EDF Group and EON SE from an Investor's Perspective

Investors can use a wide variety of tools to measure performance, but mainly focus on financial analysis, including ratio analysis, as well as other finance tools such as the Capital Asset Pricing Model (CAPM).... The analysis includes a discussion on CAPM (along with its assumptions, mainly efficient market hypothesis theory) and a financial ratio analysis....

20 Pages

(5000 words)

Assignment

Finance and Accounting: Analysis of BP

british Petroleum - BP is a UK based oil exploration and mining firm with operations across the world.... BP Adjusted ratios'.... Details of the changes (Share Issue/Repayment; Debt Issued/Repaid): ratios and calculations for various terms are given as follows (Annual Reports, 2013).... … This paper provides an analysis of BP financial structure, its cash flows and the dividend policies.... financial structure also called as the capital structure refers to the mixture of long-term debt of a firm and its equity that it uses to provide funding for its operations (Elliott and Elliott, 2013)....

10 Pages

(2500 words)

Essay

British Airways Stock Price Analysis

The return on assets ratio for british airways reveals that the company has been generating a declining return on its various assets over the last four years.... The ROCE for british airways has declined by about 30% in the year 2005 as compared to 2002.... british airways plc is one of the top companies in the British airlines industry.... This report provides insightful analysis of the financial position and performance of british airways plc over the four years 2002-2005 and compares it against the benchmark of the performance of its major industrial competitor Air France-KLM plc which is also from the airlines industry....

10 Pages

(2500 words)

Essay

Financial Statement

Current Ratio is one of the best known and most widely used ratios to ascertain company's solvency/liquidity.... The group's annual sales revenue has been almost stagnant for the last ten years.... If it had maintained a sustained growth of even 5% every year, it would have reached at least m 15,000 by 2005-06....

12 Pages

(3000 words)

Essay

Usefulness and Limitations of Financial Ratios

Despite the fact that most of the financial statements provide historical data, management and other users of financial information can use the ratios to identify… Investors use these ratios to make comparisons between companies in the same industry.... Most of these ratios are not generally meaningful when evaluated alone but they tend to bring 300).... n the financial year 2013, easy jet plc had the following liquidity ratios namely, current ratio of 0....

6 Pages

(1500 words)

Essay

sponsored ads

Save Your Time for More Important Things

Let us write or edit the essay on your topic

"Financial Ratios for British Airways"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY