Credit Risk Analysis - Application of Logistic Regression Essay. Retrieved from https://studentshare.org/statistics/1440906-credit-scoring

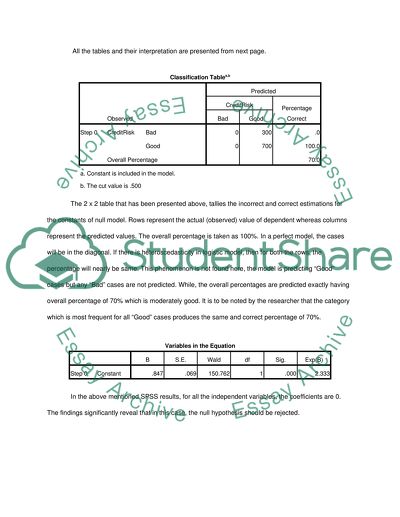

Credit Risk Analysis - Application of Logistic Regression Essay. https://studentshare.org/statistics/1440906-credit-scoring.