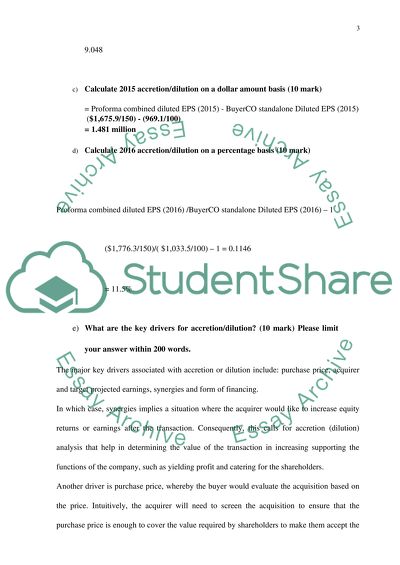

Investment Banking ( calculation and short answer) Essay - 1. Retrieved from https://studentshare.org/miscellaneous/1692023-investment-banking-calculation-and-short-answer

Investment Banking ( Calculation and Short Answer) Essay - 1. https://studentshare.org/miscellaneous/1692023-investment-banking-calculation-and-short-answer.