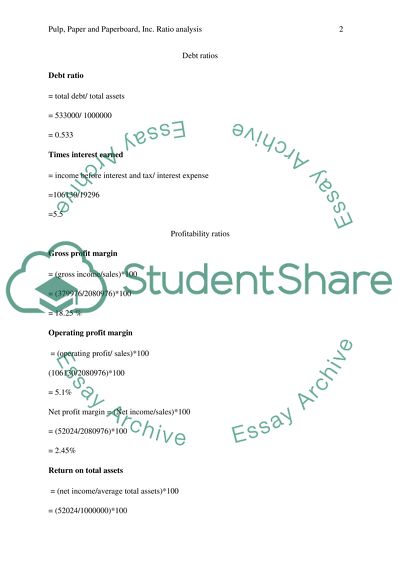

Pulp, Paper and Paperboard, Inc. ratio analysis Essay. Retrieved from https://studentshare.org/miscellaneous/1596704-pulp-paper-and-paperboard-inc-ratio-analysis

Pulp, Paper and Paperboard, Inc. Ratio Analysis Essay. https://studentshare.org/miscellaneous/1596704-pulp-paper-and-paperboard-inc-ratio-analysis.