Retrieved from https://studentshare.org/miscellaneous/1559929-disscuss-the-relevance-of-the-capital-asset-pricing-model-capm-to-a-company-seeking-to-evaluate-its-cost-of-capital

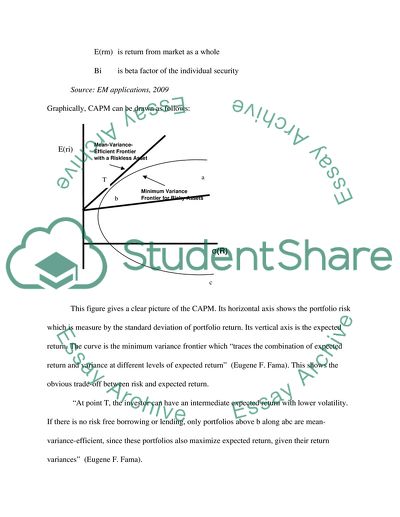

https://studentshare.org/miscellaneous/1559929-disscuss-the-relevance-of-the-capital-asset-pricing-model-capm-to-a-company-seeking-to-evaluate-its-cost-of-capital.