Models for Forecasting Exchange Rates Essay Example | Topics and Well Written Essays - 2000 words. Retrieved from https://studentshare.org/miscellaneous/1504513-models-for-forecasting-exchange-rates

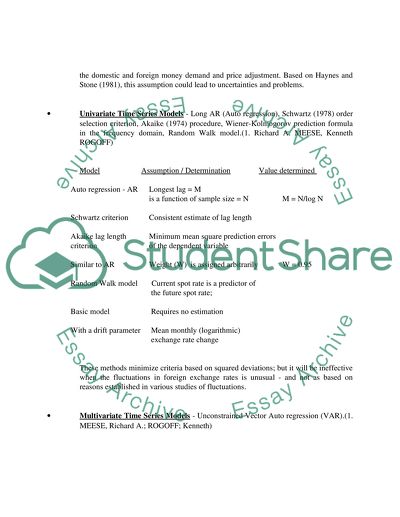

Models for Forecasting Exchange Rates Essay Example | Topics and Well Written Essays - 2000 Words. https://studentshare.org/miscellaneous/1504513-models-for-forecasting-exchange-rates.