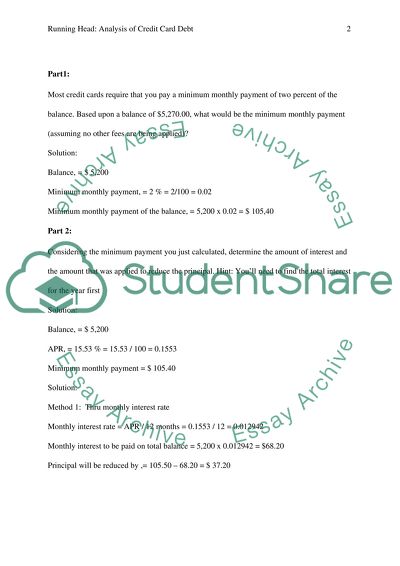

Analysis of Credit Card Debt Essay Example | Topics and Well Written Essays - 250 words. Retrieved from https://studentshare.org/mathematics/1599852-analysis-of-credit-card-debt

Analysis of Credit Card Debt Essay Example | Topics and Well Written Essays - 250 Words. https://studentshare.org/mathematics/1599852-analysis-of-credit-card-debt.