StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Macro & Microeconomics

- Developing Econometrics

Free

Developing Econometrics - Assignment Example

Summary

The study “Developing Econometrics” hypothesized that consumption is directly related to income but inversely related to unemployment and real interest rates. As such, we used mathematical reasoning, statistical inference, and economic theories to quantify the above hypothesis…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER93% of users find it useful

- Subject: Macro & Microeconomics

- Type: Assignment

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

Extract of sample "Developing Econometrics"

Developing Econometrics

Our study hypothesized that consumption is directly related to income but inversely related to unemployment and real interest rates. As such, we used mathematical reasoning, statistical inference, and economic theories to quantify the above hypothesis. In simple terms, we turned four theoretical economic models (starting with model 1) into meaningful and useful tools that can be adopted for economic policymaking. Our objective was to convert the qualitative statement (hypothesis) using data from Japan into quantitative statements. Model 1 was formulated as:

∆LCJAPt = β1 + β2∆LGJAPt + β3∆RIJAPt + β4∆UJAPt + Ut

Where; the β,s were coefficients of estimation and were stochastic error terms;

Subscript t represented the time period;

∆ was the change in parameters;

LCJAPt represented in consumption in time t (dependent variable);

LGJAPt represented income in time t;

RIJAPt represented real interest rate in time t;

∆UJAPt represented the change in unemployment in time t; and

Ut represented the error term in time t.

Results and Discussion

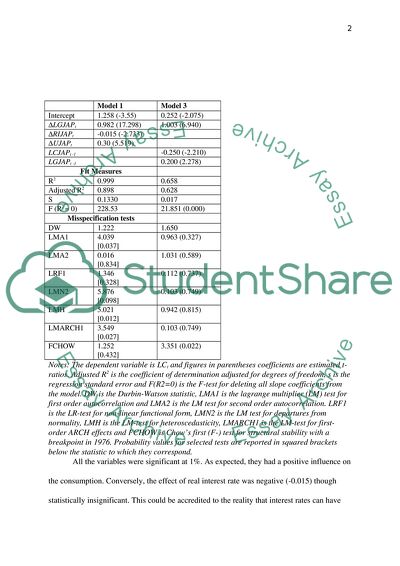

So as to explore the determinants of consumption in Japan, we estimated the nature of the relationship between consumption, interest rate, unemployment and disposable income. After subjecting the data set from 1957 to 1994 (using the Japan economy) to various statistical analyses, the results were displayed in Table 1 below:

Model 1

Model 3

Intercept

1.258 (-3.55)

0.252 (-2.075)

∆LGJAPt

0.982 (17.298)

1.003 (6.940)

∆RIJAPt

-0.015 (-2.733)

∆UJAPt

0.30 (5.519)

LCJAPt -1

-0.250 (-2.210)

LGJAPt -1

0.200 (2.278)

Fit Measures

R2

0.999

0.658

Adjusted R2

0.898

0.628

S

0.1330

0.017

F (R2 = 0)

228.53

21.851 (0.000)

Misspecification tests

DW

1.222

1.650

LMA1

4.039

[0.037]

0.963 (0.327)

LMA2

0.016

[0.834]

1.031 (0.589)

LRF1

1.346

[0.328]

0.112 (0.737)

LMN2

5.876

[0.098]

0.103 (0.749)

LMH

5.021

[0.012]

0.942 (0.815)

LMARCH1

3.549

[0.027]

0.103 (0.749)

FCHOW

1.252

[0.432]

3.351 (0.022)

Notes: The dependent variable is LCt and figures in parentheses coefficients are estimated t-ratios. Adjusted R2 is the coefficient of determination adjusted for degrees of freedom, s is the regression standard error and F(R2=0) is the F-test for deleting all slope coefficients from the model. DW is the Durbin-Watson statistic, LMA1 is the lagrange multiplier (LM) test for first order autocorrelation and LMA2 is the LM test for second order autocorrelation. LRF1 is the LR-test for non-linear functional form, LMN2 is the LM test for departures from normality, LMH is the LM-test for heteroscedasticity, LMARCH1 is the LM-test for first-order ARCH effects and FCHOW is Chow’s first (F-) test for structural stability with a breakpoint in 1976. Probability values for selected tests are reported in squared brackets below the statistic to which they correspond.

All the variables were significant at 1%. As expected, they had a positive influence on the consumption. Conversely, the effect of real interest rate was negative (-0.015) though statistically insignificant. This could be accredited to the reality that interest rates can have two sets of influences on consumption, a positive income effect and negative income effect, which may approximately cancel.

The major determinant of consumption in the model was disposable income. A unit change in disposable income can cause a 0.982 increase in consumption. The resulting coefficient of determination R2, that reflected the quality of our estimation, was 0.999 in model 1. The model explained nearly 94 per cent of the variation in consumption. Furthermore, the autocorrelation test of the errors statistically showed the absence of such autocorrelation in the models.

The economic implications of the results from model 1 were that consumption was influenced by current income, unemployment rate and real interest rate. The error term was applied to take care of any political and/or social uncertainty in Japan for the period of study. This variable was statistically significant for model 1 and thus, it was included in our reported results. The results specified that real interest rate had a negative coefficient, which was just significant at less than 10% in model 1. In model 1, the speed of adjustment was about 14% per year. The findings showed also that there is a short-run impact of disposable income, unemployment, and real interest rate on private consumption. Moreover, the alterations in both the first and second lag had a significant but negative impact of real interest rate on consumption. According to Baltagi (2011), such outcomes could replicate the losses concerning real liquid assets, may be, due to inflation. Nonetheless, the disposable income displayed a positive influence on consumption for similar lags in model 1.

Group Report: Model 5

Word Count: 701

In parsimonious model 5, we had three regressors together with the intercept. The incorporated variables were LGJAPt , LCJAPt -1 and LGJAPt-. Not even the term of interest rate or unemployment rate was in our preferred model. The two were not significant. Therefore, in our investigation there were evidences proving that fluctuations in real consumption in Japan do not rely on the unemployment rate and interest rate. Such an outcome was not surprising especially in a welfare nation like Japan where uncertainty of income is low and the government has vast schemes for the future generations. Each of the regressors, counting the intercept, in our preferred model was significant. Moreover, the F-statistic put forward that the regressors jointly have significant impact on ∆LCJAP. The R2 showed that the projected model explained 65.8 per cent of the variations as far as the ∆LCJAP are concerned. This was a moderate degree of explanatory power. Adjusted R2 can be utilized for comparison purpose. The preferred model 5 had the uppermost explanatory capacity compared with the four fitted models as shown by the adjusted R2. Standard error of the regression was also the smallest in model 5. The parsimonious model was not influenced by any misspecification because p-values regarding the test statistics of different misspecification tests stated in the table were higher than 0.01.

Results and Discussion

Our parsimonious model was represented in an equation as shown below:

∆LCJAPt = - 0.252(-2.075) + 1.003 (6.94)∆LGJAPt – 0.250 (-2.210)LCJAPt -1+ 0.200 (2.278)LGJAPt -1

Adjusted R2 = 0.628, R2 = 0.658 s = 0.017 F(R2 = 0) = 21.850 P(F) = 0.000

∆LGJAPt had a coefficient with positive sign, implying that short run variations in real consumption are positively related with changes in real income. However, the negative coefficient on the LCJAPt -1, which was the adjustment coefficient, designated a valid error rectification mechanism in the estimated preferred model. A coefficient of -0.250 represented a 25 per cent error correction in every year than the preceding year irrespective of the current value of the LCJAPt ; whether below or above the long run equilibrium mark.

We carried out a valid error correction test using F-test for our model since the model was not formulated at level terms as one variable. The alternate and the null hypotheses were:

Ho: αLCJAP = βLGJAP = 0 (There is no valid error correction)

H1: αLCJAP ≠ βLGJAP ≠ 0 (Valid error correction)

A redundant variable test found the F-statistic to be 2.66 with 0.084 as the p-value. The critical F-value was F5%,38 ≅ F5%,50 = 6.08. Since the calculated F< critical F, we could not reject our null hypothesis and so our model did not meet one condition for valid error correction technique. With no valid error correction, any equilibrium association between real consumption and real income was nullified. This was not in line with economic theory.

Derivation of long run static solution

Since in equilibrium variables do not change, C = Ct = Ct -1 = Ct -2 and G = Gt = Gt-1 = Gt -2 and ∆Ct = ∆Gt. We applied these concepts in our parsimonious model and obtained that:

0 = (1.003 - 252 * 0) – 0.250LCJAPt + 0.200LGJAPt

Implying 0.250LCJAP = -252 + 0.200LGJAP

Thus, LCJAP = (-0252/0.250) + (0.200/0.250) LGJAP

= -1.008 + 0.80LGJAP

Since the coefficient of LGJAP (marginal propensity for consumption in long run) was less than one and positive (0.80), we affirmed that our results matched the economic theory.

By finding that real interest rate did not show much impact on consumption level of Japanese in model 1 and 5, we affirmed previous studies like Baltagi (2011) who discovered, by investigating Argentine, statistically insignificant relationship between interest rate and consumption based on yearly data. Just as inflation rate is related inversely to consumption in the short run and directly in the long run, disposable income tends to behave the same. Tong, Kumar & Huang (2011) explain this paradox by showing that if prices upsurge faster than income, an individual increases the level of consumption. Similarly, if prices decrease faster than income, individuals increase their savings so as to preserve their own wealth to the preferred levels and hence, they lessen their consumption level.

Reference List

Tong, H., Kumar, T. K., & Huang, Y. X. 2011. Developing econometrics. Chichester, West

Sussex: Wiley.

Baltagi, B. H. 2011. Econometrics. Berlin: Springer.

Read

More

CHECK THESE SAMPLES OF Developing Econometrics

Non-Strategic Games

The paper "Non-Strategic Games" appreciates that most of the computerized marketing games today involve complex environments and are time-consuming in preparing inputs and executing the game, and demand sophisticated computer facilities and a great deal of time.... ... ... ... Whether or not non-strategic games actually reflect the psychology of the decision maker's rather objectively derived outcomes remains an issue to be discussed....

14 Pages

(3500 words)

Case Study

Determinants of Effective Tax Rate in Thailand

This research study is therefore being taken up to understand the intricacies regarding the determinants of effective tax rates in a developing country like Thailand.... are some of the important types of public services which a government arranges for the general public.... The cost incurred in such public services is to be borne by the....

5 Pages

(1250 words)

Research Proposal

Econometric Regression Analysis

Nevertheless, a majority of the scientific work did not succeed in considering this crucial aspect of econometrics.... An overview of the official technical issues is provided and associated with the literature in three-dimensional econometrics.... Conclusion Raising the reserves for health systems is vital to developing health in underprivileged states, but significant benefits could be created in a majority of states by making use of the present reserves more productively (324)....

2 Pages

(500 words)

Assignment

Solow Growth Model and Beyond

The paper "Solow Growth Model and Beyond" discusses that there are discussions conducted to come up with efforts to enable the correlation to make sense.... Additionally, they aid in the identification of several noted pitfalls involved in giving it a casual interpretation.... ... ... ... Solow (1956) recognizes it is an economic framework that focuses on long-run economic growth that is in the neoclassical economics framework....

8 Pages

(2000 words)

Essay

Economic and Social Determinants of Infant Mortality in Developing Countries

The paper "Economic and Social Determinants of Infant Mortality in developing Countries" is a great example of an assignment on macro and microeconomics.... PART This part must have a total of four pages (excluding the bibliography), and it must have two sections: _ Select / describe/justify a research topic (two pages) The paper "Economic and Social Determinants of Infant Mortality in developing Countries" is a great example of an assignment on macro and microeconomics....

7 Pages

(1750 words)

Assignment

Difference in Usage Patten of Instagram Among Males and Females

The main focus of the paper "Difference in Usage Patten of Instagram among Males and Females" is on examining the difference between male and female Instagram users, the demographic data on Instagram subscribers, factors that result in the huge gender difference between....

... .... ... ... According to the Pew Research centre, 73 per cent of all online adults are currently using different kinds of social networks....

5 Pages

(1250 words)

Report

The Problem of Infant Mortality

It has been observed that the level of infant mortality is higher among developing countries.... It has been observed that the level of infant mortality is higher among developing countries compared to developed countries.... Statement of the ProblemThe problem of infant mortality is considerably high in developing countries compared to the developed countries.... It has often been found that; the infant mortality rate of developing countries is much higher compared to that of developed countries....

8 Pages

(2000 words)

Research Proposal

How Different Has Microfinance Been from Traditional Banking

To do so, the researcher sought to analyze the developments within the microfinance sector prior to as well as after the Lehman Brothers in 2008 (United States) by comparing them with developments within the traditional banking sector for rising market economies as well as developing countries.... The study was designed to come up with evidence from earlier crises within the developing market as well as the ways in which microfinance emerged to become profitable within the international credit cycle....

16 Pages

(4000 words)

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Developing Econometrics"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY