StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Macro & Microeconomics

- The Regression Model of a Medium-Term Strategy for Raising the Gross Domestic Product

Free

The Regression Model of a Medium-Term Strategy for Raising the Gross Domestic Product - Assignment Example

Summary

The intention of this paper "The Regression Model of a Medium-Term Strategy for Raising the Gross Domestic Product" is to provide an analysis of all the possibilities available before the forthcoming meeting of the government committee charged with formulating a medium-term strategy. …

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER92.4% of users find it useful

- Subject: Macro & Microeconomics

- Type: Assignment

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

- Author: sincere08

Extract of sample "The Regression Model of a Medium-Term Strategy for Raising the Gross Domestic Product"

The intention of this paper is to provide an analysis of all the possibilities available before the forthcoming meeting of the government committee charged with formulating a medium-term strategy for raising the country’s per capita Gross Domestic Product (GDP) over the next 15 years. The present meeting is considered to be of crucial significance since new priorities are to be decided upon with the current economic crisis changing the whole situation demanding a reappraisal of the same. At its previous meeting the committee had decided to devote the government allocated US$ 2 billion fund to policy measures that will increase the country’s enrolment rate in secondary education. Nevertheless this decision would now be seriously required to be revisited since this recession has inflicted serious damage especially upon the financial and banking sector. With banks making loud claims for an emergency intervention on the part of the government the committee needs to prioritise sectors on the basis of the likely chances to promote and raise the country’s per capita Gross Domestic Product (GDP). This paper provides with an econometric model in order to facilitate the committee to look at all the possibilities and arrive at a decision in this regard.

The Regression Model

For constructing the model, six independent variables are considered viz, normalized value of per capita GDP in 1990, percentage of secondary school enrollment rate, government share of real GDP per capita in 1990, variable related to the openness of the market of the country, rate of inflation and credit.

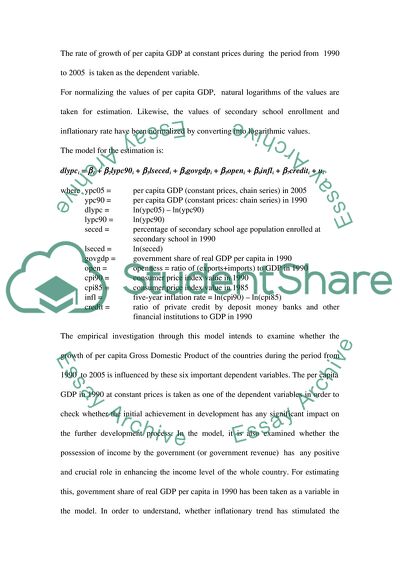

The rate of growth of per capita GDP at constant prices during the period from 1990 to 2005 is taken as the dependent variable.

For normalizing the values of per capita GDP, natural logarithms of the values are taken for estimation. Likewise, the values of secondary school enrollment and inflationary rate have been normalized by converting into logarithmic values.

The model for the estimation is:

dlypci = 1 + 2lypc90i + 3lsecedi + 4govgdpi + 5openi + 6infli + 7crediti + ui

where ypc05 = per capita GDP (constant prices, chain series) in 2005

ypc90 = per capita GDP (constant prices: chain series) in 1990

dlypc = ln(ypc05) – ln(ypc90)

lypc90 = ln(ypc90)

seced = percentage of secondary school age population enrolled at

secondary school in 1990

lseced = ln(seced)

govgdp = government share of real GDP per capita in 1990

open = openness = ratio of (exports+imports) to GDP in 1990

cpi90 = consumer price index value in 1990

cpi85 = consumer price index value in 1985

infl = five-year inflation rate = ln(cpi90) – ln(cpi85)

credit = ratio of private credit by deposit money banks and other financial institutions to GDP in 1990

The empirical investigation through this model intends to examine whether the growth of per capita Gross Domestic Product of the countries during the period from 1990 to 2005 is influenced by these six important dependent variables. The per capita

GDP in 1990 at constant prices is taken as one of the dependent variables in order to check whether the initial achievement in development has any significant impact on the further development process. In the model, it is also examined whether the possession of income by the government (or government revenue) has any positive and crucial role in enhancing the income level of the whole country. For estimating this, government share of real GDP per capita in 1990 has been taken as a variable in the model. In order to understand, whether inflationary trend has stimulated the growth rate of per capita GDP, the difference in the values of consumer price indices in 1990 and 1985, has been estimated. For making the crucial policy decision of whether boosting secondary school enrolment or bailing out the banks, secondary school enrolment ratio and ratio of private credit by deposit money banks and other financial institutions have been taken as variables in the model.

Model Estimation

The model estimated with data from 50 countries is as follows:

dlypci =0.757 + -0.199 lypc90i + 0.25 lsecedi + 0.01 govgdpi + 0.0110 openi +0.114 infli + 0.212 crediti

{ Number of obs = 50, F( 6, 43) = 1.77, Prob > F = 0.1291,

R-squared = 0.1977, Adj R-squared = 0.0857, Root MSE = .27658}

The estimated values of ratio of secondary school enrolment and ratio of private credit by deposit money banks and other financial institutions are 0.25 and 0.21 respectively which implies that these two variables influence more on the per capita GDP than other four variables under our consideration.

The coefficient value of the variable, ratio secondary school enrolment seems to be higher than the other five coefficients in the model. That is, there exists 25 percent influence of secondary school enrollment ratio on the per capita GDP of the country while the influence of credit is 21 percent. The coefficient value of per capita GDP in 1990 seems to be negative which points out that the average value of per capita GDP during the15 years and the value of per capita GDP in 1990 has an inverse relationship. This negative relationship between these variables may be because higher the value of per capita GDP in 1990, lesser will be the difference between the values of two years. The coefficient values of the variables, openness and government share in the per capita GDP seem to be very low.

The overall strength of the regression model, which is shown by R-Squared and Adjusted R-Squared Tests does not seem very powerful as the value of R-Square is not high.

The detailed regression results are shown in the following table.

Tests of Hypothesis:

(i) H0:2=3=4=5=6=7=0 against H1:j0 for at least one j(2...7), using a significance level of 0.05.

(ii) H0:2=0 against H0:20 using a significance level of 0.05.

(iii) H0:3=0 against H0:3>0 using a significance level of 0.05.

(iv) H0:7=0 against H0:7>0 using a significance level of 0.1.

Table 1. Regression Results

Source | SS df MS

-------------+------------------------------

Model | .810476713 6 .135079452

Residual | 3.28926078 43 .076494437

-------------+------------------------------

Total | 4.0997375 49 .083668112

dlypc

Coef.

Std. Err. T

P>t

[95% Conf.

Interval]

lypc90

-.1997314

.0748916 -2.67

0.011

-.3507648

-.048698

lseced

.250282

.0966267 2.59

0.013

.0554157

.4451483

govgdp

.0100052

.0062559 1.60

0.117

-.002611

.0226215

Open90

.0001565

.0015954 0.10

0.922

-.0030609

.003374

Infl

.1142594

.1060633 1.08

0.287

-.0996376

.3281564

credit

.2124701

.139727 1.52

0.136

-.0693162

.4942563

_cons

.7566435

.404901 1.87

0.068

-.0599171

1.573204

While looking at P values and t values of the coefficients, only three variables (i.e, the per capita GDP in 1990, secondary school enrollment, and government share in the per capita GDP in 1990) seem to be significant at 0.05 level of significance. Thus, the empirical evidence shows that the co-efficient of the variable, ratio of secondary school education seems to significant and the rejects the null hypothesis at 0.05 confidence level.

The coefficient of credit variable does not seem to be significant at 0.05 confidence level and hence it is not possible to reject the null hypothesis.

Hence strong recommendation is made for spending the sum of US$ 2 billion more effectively on boosting secondary school education than bailing out the banking sector.

Test for Homoscedasticity

White’s Test

White test is used to test whether the regression estimation satisfies the assumption of homoscedasticity or there is the presence of Heteroscedasticity (Hamilton 1994; Wooldridge 2002).

Whites test for Ho: homoskedasticity

Test statistic: TR^2 = 15.90219,

with p-value = P(Chi-square(2) > 3.256389) = 0.9548

Whites general test statistic : 15.90219 Chi-sq(27) P-value = .9548

The result shows that the residuals do not have the Heteroskedasticity as the probability value accept the null hypothesis that there is no heteroskedasticity (Table).

NormalityTest

Shapiro-Wilk W test is used to check whether the model satisfies the assumption of linearity. The results are given in the following table.

Shapiro-Wilk W test

Variable Obs W V z Prob>z

dlypc 50 0.91706 3.900 2.903 0.00185

lypc90 50 0.93390 3.109 2.419 0.00779

lseced 50 0.91626 3.938 2.923 0.00173

govgdp 50 0.93038 3.274 2.530 0.00571

infl 50 0.97639 1.110 0.223 0.41180

infl 50 0.97639 1.110 0.223 0.41180

credit 50 0.83159 7.920 4.413 0.00001

The results shows that the normality assumption of the OLS method exists in this regression estimation also.

Conclusion

The empirical evidence based on the observations from 50 countries throws light on the need of investing the sum of US $ 2 billion for enhancing secondary school enrollment than for boosting up of banking sector.

References

Hamilton, J. D. (1994). Time Series Analysis. Princeton, NJ: Princeton University Press.

Gujarati, Damodar (2004). Basic Econometrics, Fourth Edition, New York, The McGraw-Hill Companies.

Wooldridge, J.(2002). Introductory Econometrics: A Modern Approach, USA, Thomsun Business Information.

Appendix – The data used for the estimation of Regression Model

dlypc

lypc90

lseced

govgdp

open 90

infl

credit

0.168679

8.578219

4.110874

10.85

73.97

0.135922

0.401753

0.391244

10.05234

4.406719

13.46

28.85

0.278506

0.946479

0.292834

7.387808

2.944439

8.18

17.81

-0.11736

0.212692

0.256822

10.10883

4.634729

14.84

124.59

0.489905

0.348254

0.141694

8.963319

3.637586

21.34

13.39

0.377779

0.240326

0.332023

6.830971

1.94591

38.37

59.15

0.242289

0.175308

-0.04945

7.904781

3.332205

10.67

30.56

0.324603

0.275423

0.303555

10.14778

4.615121

15.21

49.94

0.175224

0.766266

0.674793

9.064156

4.290459

16.17

47.41

0.056461

0.468582

1.212102

7.564835

3.89182

20.27

23.82

-0.26788

0.86382

-0.22166

7.969244

3.091042

12.74

63.45

0.372058

0.402152

0.164475

8.493511

4.007333

21.28

41.55

-0.60756

0.121859

0.374862

8.187316

4.330733

7.41

62.33

-0.11368

0.278849

0.113376

6.756874

2.639057

18.38

27.95

-0.18109

0.231029

0.195971

10.07144

4.59512

16.86

32.71

0.466514

0.915517

0.18329

10.11047

4.584967

12.02

40.66

0.486977

0.93393

0.195406

7.137676

3.583519

18.12

58.88

-0.39903

0.046946

0.402867

9.742274

4.532599

14.13

36.71

0.488817

0.345739

0.348799

9.345009

4.369448

27.65

36.52

0.233354

0.448724

0.519587

7.601697

3.78419

28.29

17.05

-0.13171

0.255768

0.417537

8.076177

3.78419

18.32

46.59

-0.23778

0.367796

0.5122

8.646666

4.007333

13.88

75.76

1.136515

0.28709

0.182053

10.05055

4.418841

13.32

42.58

0.573789

0.480762

0.121066

10.18054

4.574711

10.71

16.86

0.383969

1.915641

-0.0215

7.631063

3.178054

8.41

43.02

-0.19427

0.298436

0.616012

9.384983

4.49981

10.16

32.56

0.290338

0.904025

-0.21659

6.976759

2.890372

12.09

57.23

-0.15877

0.147346

0.231642

6.841306

2.079442

6.72

55.7

0.143391

0.12597

0.671753

9.03824

4.025352

13.87

139.83

-0.14057

0.670275

0.353629

6.780513

1.94591

19.82

45.73

0.444871

0.123941

0.124496

8.411804

3.555348

10.7

44.93

0.293485

0.133424

0.260194

7.281909

3.496508

16.32

31.53

-0.08693

0.117449

0.281977

10.11126

4.787492

17.61

78.34

0.455658

1.398607

0.301187

7.200022

3.218876

7.02

56.44

-0.93321

0.118722

0.298385

7.79397

3.135494

18.53

32.09

-0.09135

0.237437

0.354024

8.300141

4.204693

12.71

24.54

0.696544

0.041801

0.182378

8.127319

4.290459

13.53

74.32

-0.08518

0.195622

0.565592

8.881093

4.394449

20.19

27.72

-0.42264

0.016446

-0.08262

10.02202

3.78419

17.74

79.73

-0.23838

0.637771

0.194014

8.976521

4.304065

22.27

38.4

0.444144

0.836308

0.422161

9.858065

4.644391

11.87

27.62

0.645984

0.751116

0.525316

8.055535

4.304065

23.42

54.8

-0.03674

0.177204

0.71807

6.862538

3.178054

6.41

29.33

1.13796

0.059481

0.356955

7.504722

3.951244

23.84

71.3

-0.07881

0.070054

0.472006

8.595204

3.401197

11.93

90.5

0.07221

0.72401

0.284566

8.587898

3.850148

15.27

24.63

0.411392

0.13066

0.455629

6.606785

2.564949

32.61

27.08

-0.4526

0.024429

0.33108

9.987024

4.442651

16.48

36.97

0.404541

1.130044

0.078276

9.224906

3.555348

21.96

46.47

-0.45851

0.231344

-0.79122

8.462777

3.912023

13.32

56.76

-0.03619

0.197089

Read

More

CHECK THESE SAMPLES OF The Regression Model of a Medium-Term Strategy for Raising the Gross Domestic Product

The impact of firm resources and host country specific factors on international entry mode strategy

The problem with such a strategy is that there is no one fixed approach to entering another market.... This dissertation aims to determine the impact of firm-specific factors on the choice of entry mode into a foreign market and to demonstrate the impact of host country factors on the choice of entry mode into a foreign market....

55 Pages

(13750 words)

Dissertation

Ford Develops a Strategy for Competitive Advantage

: Ford Develops a strategy for Competitive Advantage Case Summary The case discusses the trajectory of Ford Corporation right after the global recession of 2008.... The Ford Figa was an incredible product that increased the sales volume of Ford in India by more than three times.... Customer retention rate: The organization seeks to expand into other international markets and obtain similar customer loyalty as in its domestic market.... Personal Case Analysis It is my opinion that The Way Forward strategy was a success because the company eliminated waste that was draining the resources of the company....

7 Pages

(1750 words)

Case Study

China and the Real Estate Market

Financial organizations have diversified their product portfolios to accommodate the changing needs of the growing economy.... This essay "China and the Real Estate Market" is an analysis of the findings and research on China's property market and its viability.... The essay primarily focuses on secondary research as it is difficult to obtain information directly from Chinese realtors....

52 Pages

(13000 words)

Essay

Factors Affecting Global Economy

The company under consideration provides over thirty models of the customized product (motorbikes) through a worldwide network of over 1000 dealers.... H-D is a very famous global brand and loved by people all over the world due to the cult figure of the product.... It is understandable that compared to domestic marketing global marketing there is much more complex, and risks are associated as the company has to deal with various political, social, economic and cultural issues....

8 Pages

(2000 words)

Case Study

Strategic Marketing Management

sustained a gross domestic product of $16.... Companies that operate in very saturated, competitive markets must identify new innovation opportunities to extend the product and service life cycle and avoid consumer market stagnation.... This represents a market that provides ample economic benefits to businesses that cater to domestic and foreign travellers.... This section provides a macro and micro-level analysis of the market, review of the amusement park industry, consumer and competitor analyses, and a brief internal analysis of the competencies currently sustained by Walt Disney Parks and Resorts' organisational model....

12 Pages

(3000 words)

Essay

A Medium-Term Strategy for Raising Gross Domestic Product

In the paper 'A Medium-Term Strategy for Raising Gross Domestic Product' the author makes recommendations to a government committee with a medium-term strategy for raising the country's per capita Gross Domestic Product (GDP) over the next 15 years.... The author states that funding of US$ 2 billion has been earmarked by the government for policy measures to support this strategy.... You can recall an empirical model that addresses exactly this type of question, which was presented in a series of tutorials/workshops in which you participated during your time as a masters student at Bangor University in the UK....

6 Pages

(1500 words)

Assignment

Costa Coffee: Business Analysis

Research had indicated that the five most imperative issues facing the company are threat of new entrants in the market, the brand power of Starbucks, lack of diversification, the rising cost of commodities along the supply chain, and a growth in negative publicity regarding business strategy....

12 Pages

(3000 words)

Essay

Management of Information Technology - Dott Mann Group

With regard to the supplier powers, the suppliers play a minor role, if any, in raising the prices of DMG products (Oz, 2009, p.... DMG is taking measures to turn the tables in the industry and extend the domestic market share.... A higher cost of the packaging materials would result in DMG transferring the additional cost to consumers by raising prices.... he model will focus on five attributes that make up the competitive environment namely supplier power, buyer power, competitive rivalry, the risk of substitution and lastly the risk of new entrants....

9 Pages

(2250 words)

Assignment

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"The Regression Model of a Medium-Term Strategy for Raising the Gross Domestic Product"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY