StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Macro & Microeconomics

- The Relationship of Perfect Competition to the Structure of the Market

Free

The Relationship of Perfect Competition to the Structure of the Market - Essay Example

Summary

The paper "The Relationship of Perfect Competition to the Structure of the Market" argues that there are a very large number of firms, each selling the same product to a large number of buyers so that no individual firm has any influence over the market price and acts merely as a price taker…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER97.6% of users find it useful

- Subject: Macro & Microeconomics

- Type: Essay

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

- Author: rbrekke

Extract of sample "The Relationship of Perfect Competition to the Structure of the Market"

Perfect competition refers to the market structure where there are a very large number of firms, each selling the same product to a large number of buyers so that no individual firm has any influence over the market price and acts merely as a price taker. Entry is free and all buyers are perfectly informed. Consequently, any firm can sell any amount at the prevailing market price. This implies that the demand curve each individual firm faces is parallel to the horizontal axis and since the firm does not have to lower per unit price of the product to ensure higher sales, the marginal revenue curve and the average revenue or the demand curve are the same (Varian, 1999).

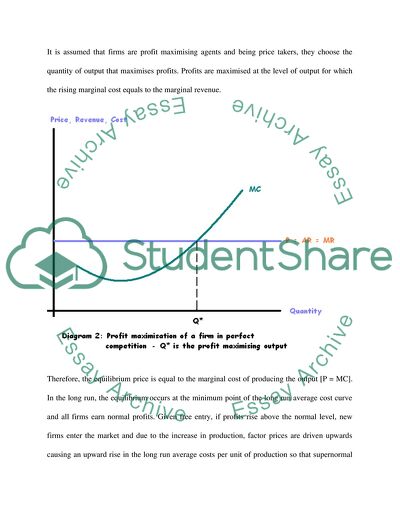

It is assumed that firms are profit maximising agents and being price takers, they choose the quantity of output that maximises profits. Profits are maximised at the level of output for which the rising marginal cost equals to the marginal revenue.

Therefore, the equilibrium price is equal to the marginal cost of producing the output [P = MC]. In the long run, the equilibrium occurs at the minimum point of the long run average cost curve and all firms earn normal profits. Given free entry, if profits rise above the normal level, new firms enter the market and due to the increase in production, factor prices are driven upwards causing an upward rise in the long run average costs per unit of production so that supernormal profits are driven down to zero and firms earn only normal profits. So, in the long run the consumer avails the product at the minimum price possible. This maximises consumers’ surplus. Attaining this point is possible due to the horizontal demand curve and thus essentially due to the price taking behaviour that characterises firms under perfect competition. It is the equality between equilibrium price and marginal cost alternatively known as ‘marginal cost pricing’ (Ison & Wall, 2006) that makes perfect competition apparently the most advantageous form of market for the consumers in the sense that welfare is maximised through ensuring the greatest possible consumers surplus in the long run, given the cost structure and normal profits for the firms.

In case of imperfectly competitive markets the number of sellers is lesser so that each individual seller has some influence on the market price. Each firm to sell higher amounts has to lower prices so that the demand curve now becomes downward sloping. The marginal revenue line lies below the demand curve and firms choose both output and prices to maximise profits. Though the profits are still maximised for the level of output that equates marginal costs to marginal revenue, since the marginal revenue curve lies below the Average revenue curve, the equilibrium price becomes necessarily higher than the marginal cost. The most extreme form of imperfect competition is monopoly, with only a single seller operating in a market. The firm itself constitutes the industry and acts as a price maker. The firm is able to influence prices through its output decisions and thus chooses to produce lower so that prices rise. The equilibrium output is lower and the price higher compared to a perfectly competitive market (Varian, 1999). Actually, the monopolist prefers to produce a lower level of output as that bids that price of the product upwards (Ison & Wall, 2006).

However, it is important to note that it is solely not the price of a product that satisfies a consumer. Product qualities and the availability of different varieties also influence degree of satisfaction of a customer. Further, since there are different income-classes which participate as buyers in any market, while the poorer section are more likely to be advantaged by cheap prices, the wealthier consumers may be dissatisfied if due to lower prices quality is sacrificed. Therefore the availability of various qualities for different prices may be the consumers’ welfare maximising outcome if such differences in preferences are accounted for. However, this can happen only if markets are imperfectly competitive so that the firms differentiate products to lure consumers into buying their products. For instance in the market for monopolistic competition, each firm tries to differentiate its product from those of its rivals. Most retail products like soaps and shampoos are sold in monopolistically competitive markets. Though the number of sellers in such markets is still large, it is not large enough to make individual market shares insignificant. In these markets, the as the number of firms are quite large, individual output and pricing decisions are independent. Each firm thus has a small share of the market in this form and given the extents of differentiation, such a market offers greater satisfaction to any customer with a love for variety.

It may actually be argued it is this necessity of firms to differentiate its products to remain competitive under imperfectly competitive markets that motivates innovations. The growths in features and attributes of products such as cellular phones and computers and other technology intensive products is the result of research and development activities that are undertaken only under imperfectly competitive market structures to stimulate demand. Without the profit motives such activities would be rarely stimulated. As the elasticity of demand under perfect competition is infinitely elastic, firms have to undertake no additional effort to secure higher sales which therefore also points out the stagnating potential of such a market. Consider the desirability of a world where markets went on selling the same products and there were no new developments. One should not that a company like Dell computers offer customized computers and competes on terms of after sales services as well and this is an instance of the significant differentiation that computer companies have to strive to attain given the oligopolistic nature of the market with prices and output choices of each firm affecting the decisions of others in the industry (Shy, 1995).

Thus, what emerges is that though the price can be set to the minimum possible average cost over the long run and thus the lowest possible non-negative profit generating price can be achieved only under perfect competition, this is not the only aspect that one should consider in exploring the desirability of competition. Availability of variety in quality rises under imperfect markets and these do have positive effects on consumers’ welfare. Most importantly, it is only through positive profit making opportunities on offer under imperfect competition through technological advancements that arguably motivate the bulk of the innovations that in turn contribute to technological progress in the presence of spill over effects that contribute to the growth and development of the society overall. Thus to argue for perfect competition solely due to the price advantage for consumers would on its own be myopic.

.

References:

Ison, S., & Wall, S., (2006) Economics, Prentice Hall

Shy, O., (1995) Industrial Organization: Theory and Applications, MIT press

Varian, H.R., (1999) Intermediate Microeconomics: A modern Approach, 5th ed. W. W. Norton & Company

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the essay on your topic

"The Relationship of Perfect Competition to the Structure of the Market"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY