StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Macro & Microeconomics

- Russia Impact on the Shape of the Global Energy Market

Free

Russia Impact on the Shape of the Global Energy Market - Essay Example

Summary

This essay "Russia Impact on the Shape of the Global Energy Market" focuses on Russia who is expected to be a key player in the global energy markets of the future. The Russian government needs to set the existing domestic chaos if it is to fulfill its ambitions of global energy dominance…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER96.2% of users find it useful

- Subject: Macro & Microeconomics

- Type: Essay

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

- Author: flohuel

Extract of sample "Russia Impact on the Shape of the Global Energy Market"

Russia impact on the shape of the global energy market from 2006 onwards: Outline The rise of Russia along with China and India as a economic power.

2. Exploring renewable energy sources have opened up new opportunities for Russia

3. The political uncertainty in the Persian Gulf region favors emerging energy producers like Russia.

4. The increasing investments into the energy sector in Russia augur well for the industry’s future.

5. The declining clout of the United States as an economic superpower provides ideal conditions for the rise of Russian influence in the global energy markets.

Essay:

Russia is expected to be a key player in the global energy markets of the future. In fact, Russia alongside China and India is touted to replace the traditional energy superpowers in the Middle East and Latin America. All the three countries have expanded their industry bases and are in ever more need of energy supplies to feed those industries. Consequently, oil and gas producers have reaped rich returns due to the greater demands. While Russia is able to make good profits out of foreign trade, the situation at home is quite different. In fact, “Russian citizens have faced serious social and infrastructure decline on the home front, from the notorious May 2005 power cut in Moscow to the near collapse of cities district central heating systems right across the region” (ONeill, 2006). In this context, the Russian government needs to set right the existing domestic chaos if it is to fulfill its ambitions of global energy dominance (ONeill, 2006).

Another interesting political development to have had a bearing on Russian energy industry is the stand-off between Russia and Ukraine that posed a serious threat to gas supplies to Western Europe. On top of that it also raised doubts regarding the future security of these supplies. This conflict between the two neighbors is a crucial challenge to the Russian administration. So much so that its most lucrative market, in the form of Western Europe, could be made inaccessible, if no amicable resolution is to be found between the neighbors. Hence, Russia’s prospects of dominating global energy markets cold impinge upon its successful partnership with Ukraine (Middle East Economic Digest, 2006).

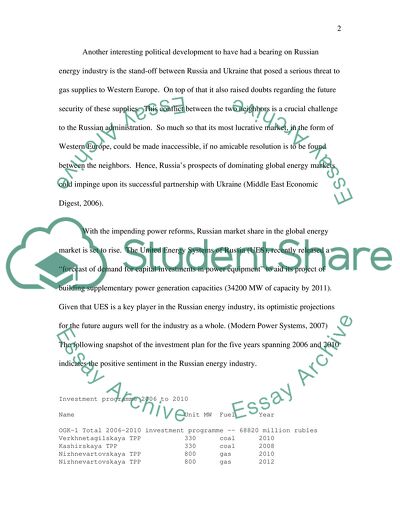

With the impending power reforms, Russian market share in the global energy market is set to rise. The United Energy Systems of Russia (UES), recently released a “forecast of demand for capital investments in power equipment” to aid its project of building supplementary power generation capacities (34200 MW of capacity by 2011). Given that UES is a key player in the Russian energy industry, its optimistic projections for the future augurs well for the industry as a whole. (Modern Power Systems, 2007) The following snapshot of the investment plan for the five years spanning 2006 and 2010 indicates the positive sentiment in the Russian energy industry.

Investment programme 2006 to 2010

Name Unit MW Fuel Year

OGK-1 Total 2006-2010 investment programme -- 68820 million rubles

Verkhnetagilskaya TPP 330 coal 2010

Kashirskaya TPP 330 coal 2008

Nizhnevartovskaya TPP 800 gas 2010

Nizhnevartovskaya TPP 800 gas 2012

Permskaya TPP 800 gas 2010

TGK-1 Total 2006-2010 investment programme -- 104220 million rubles

Pervomaiskaya CHPP 180 gas 2009

Pervomaiskaya CHPP 180 gas 2010

CHPP-15 30 gas/oil 2007

CHPP-5*** 400 gas 2010

CHPP-7 50 gas/oil 2007

CHPP-7*** 200 gas 2010

Tsentralnaya CHPP 18 gas/oil 2008

Tsentralnaya CHPP 50 gas/oil 2009

Tsentralnaya CHPP 50 gas/oil 2010

Tsentralnaya CHPP 60 gas/oil 2009

Tsentralnaya CHPP 60 gas/oil 2010

Tsentralnaya CHPP 60 gas/oil 2010

Tsentralnaya CHPP 5 gas/oil 2009

Tsentralnaya CHPP 5 gas/oil 2010

CHPP-21*** 400 gas 2011

CHPP-22 450 gas 2009

Volkhovskaya HPP-6 12 2007

Volkhovskaya HPP-6 12 2007

Volkhovskaya HPP-6 12 2008

Volkhovskaya HPP-6 12 2009

Volkhovskaya HPP-6 12 2010

Lesogorskaya HPP-10 30 2008

Lesogorskaya HPP-10 30 2009

Lesogorskaya HPP-10 30 2010

Lesogorskaya HPP-10 30 2011

Niva HPP-3 40 2007

Nizhne-Svirskaya HPP-9 28 2008

Nizhne-Svirskaya 28 2010

Svetogorskaya HPP-11 30 2009

Svetogorskaya HPP-11 30 2007

Svetogorskaya HPP-11 30 2010

Svetogorskaya HPP-11 30 2011

Hyamekoski HPP 2 2006

Hyamekoski HPP 2 2008

(Modern Power Systems, 2007)

The Russian government’s recent initiatives to develop renewable energy supplies should come as a further boost for the industry. A report from the International Energy Agency (IEA) suggests that the country has great prospects in the years that lay ahead. For example,

“It is estimated that Russias renewable energy potential could provide as much as 30 per cent of total potential energy supply (TPES). In terms of biomass fuel, forests cover 40 per cent of the entire landmass, and account for nearly a quarter of the worlds forests. Although the forestry industry is important to the Russian economy, and it is a large potential supplier and consumer of biomass, these resources are, so far, only being minimally exploited.” (Power Economics, 2003)

Similarly, with Russia having plenty of rivers, Hydro power provides enormous opportunities for the energy industry in the country. As with the biomass fuel, hydro power is yet to be tapped into. In many ways this is still a nascent industry in Russia with tremendous growth potential. The IEA report further points out that this energy source could provide nearly 10 percent of the total energy needs for the country. On top of that, plans have been charted out to explore Wind energy. This again offers huge opportunities for the country, especially since the “Pacific and Arctic coasts, as well as those of the Caspian, Baltic, Azov and Black Seas, and the high plains and mountain regions” are ideally suited for wind-mills. Nearly 37 per cent of the country’s wind resources are found in European Russia, and nearly sixty percent in the upper reaches of the country (especially Siberia). The Far East is the other region being considered for wind mill projects. With population being very low in these regions, conditions must be perfect for the setting up of Wind energy plants. The following table illustrates the future potential of these renewable energy sources, which could strengthen Russia’s position in the global energy market (Power Economics, 2003).

Table 1: Potential of Renewable Energy Sources in Russia *

Resource Gross Technical Economic

potential potential potential

Small Hydropower 360.4 124.6 65.2

Geothermal Energy * * *

Biomass Energy 10x10 53 35

Wind Energy 26x10 2000 10.0

Solar Energy 2.3x10 2300 12.5

Low Potential Heat 525 115 36

Total Renewable 2.34x10 4593.0 273.5

Energy Source

* (million tonnes of coal equivalent) (Power Economics, 2003)

It is accepted that there are potential dangers associated with the rising dominance of Russia in the energy market, but there are other positive aspects as well. For one thing, Russian ascendancy will neutralize the clout held so far by Saudi Arabia and Venezuela in setting global oil prices. But, with the introduction of Russia and China into leadership positions in the energy market, tougher competition will persist, which will ultimately benefit the consumers across the world (The Economist (US), 2006). In other words,

“The oil market is tight, but price is a wondrous mechanism, and rising prices have spurred investment. Though high prices may persist for several more years, the danger of disruption will recede. With oil, as Mr. Chavez well knows for all his huffing and puffing, aiming this "weapon" is especially difficult, since oil, unlike gas, can be loaded on tankers and sold into a single world market. As ever, the Middle East is volatile. Chinas growth is sucking in energy. In 2003 it overtook Japan to become the worlds second-biggest consumer of oil after America. Energy security therefore plays a growing part in Chinas foreign policy.” (The Economist (US), 2006)

China has already started making alliances with oil manufacturers irrespective of their democratic or human-rights records. This is already a source of friction with America, the prevailing superpower. With nearly 65 percent of the Middle Eastern oil exports already garnered by Asia, the United States is confronted with unprecedented challenges. While this delicate balance of power is something that will worry America, Russia can see this as an opportunity to stamp their authority in the energy market. This uncertain international political situation can only benefit Russia. Hence, in the final analysis, Russia, along with China is set to play a bigger role in the global energy markets of the future (The Economist (US), 2006).

Works Cited:

ONeill, Peter. "Will hydro win the great game? Competition between Russia and China is driving tens of billions of dollars of investment into the hydro sector across the former Soviet republics. Peter ONeill reviews the potential benefits and risks as the two giants compete to set up alliances for raw materials and the power to mine and process them." International Water Power & Dam Construction 58.11 (Nov 2006): 14(3)

"Moscow raises energy security fears." MEED Middle East Economic Digest 50.1 (Jan 6, 2006): 10(1).

"Russias route to power reform: Russia has plans to invest 119 billion dollars in 34 GW of new power generation by 2010. Heres how its to be done.(UPDATE: RUSSIA)." Modern Power Systems 27.6 (June 2007): 12(4).

"Russian renewables: a hidden treasure trove." Power Economics 7.8 (Sept 2003): 10(1).

"A Gusher For Big Oil Is Drying Up; Western giants used to have easy pickings in Russia., Now Moscow is taking a harder line." Business Week Online (Sept 22, 2006): NA.

Matthews, Owen. "Russias Big Energy Secret.(Nations to Watch)(Gazproms lacks supply of natural gas)." Newsweek International 151.01 (Jan 7, 2008): 0.

Freedman, Michael. "It Beats Iraq.(economic conditions of Russia)." Forbes 179.4 (Feb 26, 2007): 48.

"Power games; Energy security.", The Economist (US) 378.8459 (Jan 7, 2006): 13US.

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the essay on your topic

"Russia Impact on the Shape of the Global Energy Market"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY