Distinguish between the return on investment and the return on Essay. Retrieved from https://studentshare.org/macro-microeconomics/1693474-distinguish-between-the-return-on-investment-and-the-return-on-capital-show-the-respective-relevance-of-each-to-investment-decisions

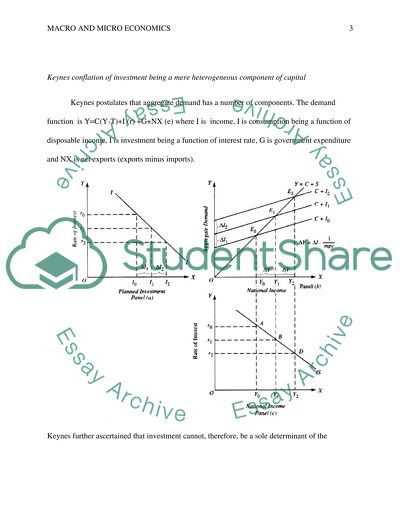

Distinguish Between the Return on Investment and the Return on Essay. https://studentshare.org/macro-microeconomics/1693474-distinguish-between-the-return-on-investment-and-the-return-on-capital-show-the-respective-relevance-of-each-to-investment-decisions.