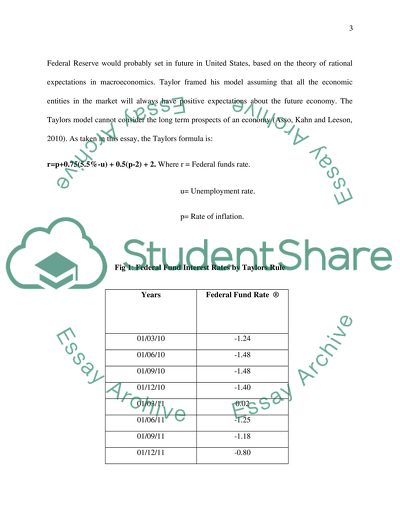

Economics of Money and Banking Essay Example | Topics and Well Written Essays - 1250 words. Retrieved from https://studentshare.org/macro-microeconomics/1485142-economics-of-money-and-banking

Economics of Money and Banking Essay Example | Topics and Well Written Essays - 1250 Words. https://studentshare.org/macro-microeconomics/1485142-economics-of-money-and-banking.