StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Free Cash Flow Ratio

Free

Free Cash Flow Ratio - Report Example

Summary

The report "Free Cash Flow Ratio " is analysing the free cash flow and liquidity of the company providing the example of a particular individual based on the strengths and weaknesses what the company has initiated. …

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER91.1% of users find it useful

- Subject: Finance & Accounting

- Type: Report

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

- Author: lebsackhaley

Extract of sample "Free Cash Flow Ratio"

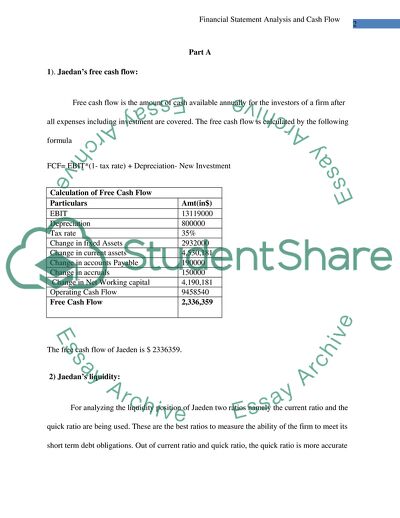

The financial ment and cash flow Part A Jaedan’s free cash flow: Free cash flow is the amount of cash available annually for the investorsof a firm after all expenses including investment are covered. The free cash flow is calculated by the following formula

FCF= EBIT*(1- tax rate) + Depreciation- New Investment

Calculation of Free Cash Flow

Particulars

Amt(in$)

EBIT

13119000

Depreciation

800000

Tax rate

35%

Change in fixed Assets

2932000

Change in current assets

4,530,181

Change in accounts Payable

190000

Change in accruals

150000

Change in Net Working capital

4,190,181

Operating Cash Flow

9458540

Free Cash Flow

2,336,359

The free cash flow of Jaeden is $ 2336359.

2) Jaedan’s liquidity:

For analyzing the liquidity position of Jaeden two ratios namely the current ratio and the quick ratio are being used. These are the best ratios to measure the ability of the firm to meet its short term debt obligations. Out of current ratio and quick ratio, the quick ratio is more accurate measure because it makes use of those current assets which can be converted to cash at the earliest. Hence inventory is excluded from this as inventory can be converted to cash only when it is sold. The table below shows the liquidity position of the firm

Jaeden

Industry Average

Particulars

2009

2010

2009

2010

Liquidity Ratios

Total current assets

15066000

Total current Liabilities

4342000

Current ratio

2.65

3.46983

2.89

3.26

Total current assets

15066000

Inventories

4118000

Total Current Liabilities

4342000

Quick ratio

1.84

2.521419

1.42

2.19

3) Jaedan’s debt and profitability ratios:

In ratio analysis debt ratios help in identifying the debt repaying capacity of the firm and profitability ratios on the other hand show the earnings capability of the firm. The table below shows the debt and profitability ratios of the firm:

Profitability Ratios

Particulars

Jaeden

Industry Average

2009

2010

2009

2010

Operating Profit

13119000

Net Sales

42000000

Operating Profit Margin

25.59%

31%

19.32%

20.89%

Gross Profit

15540000

Net Sales

42000000

Gross Profit Margin

30%

37%

22.19%

23.74%

Net Profit

8410908

Net Profit Margin

16.25%

20%

15.11%

17.97%

Debt Ratios

Particulars

Jaeden

Industry Average

2009

2010

2009

2010

Total Assets

23917000

Common Stock

4000000

Paid up capital

4500000

Retained earnings

7929000

Total Equity

16429000

Assets To Equity

170.35%

145.58%

165.82%

163.13%

Total Current Liabilities

4342000

Long term Bonds

3046000

Total Assets

23917000

debt ratio

40.72%

30.89%

41.93%

39.36%

EBIT

13119000

Interest Expense

375200

Times Interest Earned

26.33

34.96535181

15.72

16.81

4) Jaedan’s market ratios:

The market ratios generally measure the response of the investor to a company’s stock and also the cost involved in issuing of stock. These ratios are primarily concerned with the return an investor gets for his investment and also the relationship between the return and the value of the investment in the shares of the company. The table below is showing the market ratios namely the P/E ratio and the market to book value ratio.

Market ratio

Jaeden

Industry Average

2009

2010

2009

2010

P/E ratio

6.84

6.76

5.41

5.97

Market to Book Value

4.23

3.46

4.19

4.32

5. Highlight at least three financial strengths and three weaknesses Jaeden

Industries may have.

Based on the ratio analysis done above a clear picture of the company’s strengths and weakness can be identified. They are summarized as under:

Strengths:

The liquidity position of the firm is its strong point. Both the current ratio and the quick ratio are well above the industry average thereby indicating that the firm has the capability to meet its short term financial obligations well. As the quick ratio of the industry raised itself in the year 2010 the firm too made efforts to increase its quick ratio and it was well above the industry average. What is observed is that the ratios are not too much higher than the industry average indicating that the firm has managed its working capital well.

The profitability of the firm is well above the industry average. It means that the industry has outperformed the market in making profits. Having the profitability ratios higher than the industry average is always preferred. In the above case the important profitability ratios like the net profit margin and operating profit margin are all well above the industry margin.

Other potential strengths for the company are its free cash flows. The company has generated a free cash flow of $2336359 which is quite substantial. The free cash flows of the firm can be channelized by the firm in other activities like expansion, giving dividends, increasing product lines etc. It can be used as a means to bring further income for the company (Siddique, 2006, p.623).

Weakness

From ratio analysis it has been observed that the market position of the firm is declining. It is not enjoying the same position in the market as it used to enjoy in the past. This has been evident from the falling ratios. Though the P/E ratio is above the market average yet the ratio has fallen as compared to the previous year 2009. This shows that the investors have somewhat low rated the company as compared to the previous year.

The average collection period of the period is perceived as a potential risk for the firm. What has been observed is that the terms of trade being similar the average collection period has almost doubled. It is well above 35 days and it is allowing the customer to pay back for a time much longer than the industry average. This may increase the propensity of doubtful debts for the firm in the future.

Another weakness observed is the firm’s payment period. The average payment period to its creditors like the suppliers has increased. This might have happened due to lengthening of the firm’s average collection period. The lengthening of the average collection period shall lead to poor credit rating of the company and this will be a risk for the firm for this might lead to fall in its already declining stock price.

6. Provide recommendations along with rationale on how Jaeden’s Management may improve upon these weaknesses.

Few recommendations that can help Jaeden to eliminate the potential risk are mentioned below:

In order to eliminate the risk of its falling market prices what the company can do is that it can give away its surplus cash in form of dividends. The giving of dividends will be perceived by the investors as something good and this would motivate them to further invest in the company (Peterson, 1999, p.172). As a result there are chances for the falling share prices to once more get a foothold in the market. The free cash flows can be channelized for this purpose.

The average collection period of the firm needs to be minimized. This can be done by offering attractive discounts to the debtors for speedy recovery of the debts. Instead of lengthening the collection period, more discounts should be allowed for payments before the due date. Moreover there should be effective communication in place that can keep the debtors intimidated about their impending deadlines.

The average payable period can be shortened by decreasing the average collection period as both are interlinked. A contingency fund can be created out of the free cash flow to make use of it to make the payments right on time. The company can also go for few cost cutting measures like decreasing the operational cost which can be done by negotiating with its clients at rates lower than before.

References

Peterson, P. P. (1999). Analysis of Financial Statements. John Wiley & Sons.

Siddique, S. A. (2006). Managerial Economics And Financial Analysis. New Age International.

Read

More

CHECK THESE SAMPLES OF Free Cash Flow Ratio

GOODYEAR WILL IT SURVIVE THIS ECONOMY

4% Levered free cash Flow Margin Industry Comparison 2.... ratio Industry Comparison 1.... x Quick ratio Industry Comparison 0.... ble Book ratio -18.... % Debt/Equity ratio 5.... 4 Total Debt/Equity ratio 5.... 3 Price Earnings Ratios P/E ratio 26 Weeks Ago 17.... 12 Month Normalized P/E ratio 150.... The price/tangible book ratio is -18....

5 Pages

(1250 words)

Research Paper

Business Environment and the Analysis of the Financial Health of Bank of America Corporation

Nevertheless, notwithstanding the modest economic augmentation in 2010, BAC generated free cash flows worth $1.... The study accentuates on the business environment and the analysis of the financial health of Bank of America Corporation (BAC).... The study also includes a review of BAC's best practices, operational processes, products and technological advantages....

10 Pages

(2500 words)

Essay

Company Background - Microsoft Corporation

The liquidity position of the company will also be analyzed by calculating the Free Cash Flow Ratio and through analysis of the cash flow statement of the company.... A ratio analysis of Microsoft is illustrated below ratio Analysis.... Accountants and business analysts can utilize ratio analysis to evaluate the financial performance of an enterprise.... ratio analysis uses the input from the common size.... The five major categories of ratio analysis are profitability, market value, liquidity, leverage, and efficiency....

4 Pages

(1000 words)

Essay

Capital Structure of Industries in the UK

Only in the case of the basic materials sector, the model is significant and we find a significant relationship between the leverage ratio with free cash flow and tax benefits.... OLS method is used to test four hypotheses based on the factors affecting leverage ratio or debt-to-equity ratio using 40 companies from each of the five sectors....

52 Pages

(13000 words)

Dissertation

The Financial Position of Aytoun

It has always been observed that in times of tough economic environment, the already aggravated financial position of medium-sized entities is further downgraded due to the lack of enough cash flows and weak asset backing ability.... This report "The Financial Position of Aytoun" elaborates on and analyzes the financial position of Aytoun which has been prepared to keep in consideration the feasibility for MMU of increasing its equity investment in Aytoun....

6 Pages

(1500 words)

Report

The Dynamics of Goodyears Financial Performance

Goodyear acknowledges the WACC is 15% and its average leverage ratio of 40%.... This report will provide the dynamics of Goodyear's financial performance.... This is a prestigious company that has dominated the market by producing a tire, rubber, and glass products.... The author analyzes the factors that could affect it аnd gives advice on how it could avoid marginality....

11 Pages

(2750 words)

Research Paper

Activity-Based Costing for Logistics and Marketing

Making of decisions in an organization involves the assessment of production costs, quality management, and various other costs which involve material acquisition, security of products, and maintenance of production machines.... In the selection of costing methods, this report.... ... ... The paper "Activity-Based Costing for Logistics and Marketing" is a brilliant example of a term paper on finance and accounting....

16 Pages

(4000 words)

Term Paper

London Mining Financial Analysis

The paper "London Mining Financial Analysis" is an amazing example of a Finance & Accounting research paper.... London Mining Plc is a United Kingdom-based company whose headquarters is located in Wigmore Street, London W1U 1QS.... The company is incorporated under the Companies Act and listed in the AIM stock exchange....

25 Pages

(6250 words)

Research Paper

sponsored ads

Save Your Time for More Important Things

Let us write or edit the report on your topic

"Free Cash Flow Ratio"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY