StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Harry Ltd Finance and Business Performance

Free

Harry Ltd Finance and Business Performance - Case Study Example

Summary

The study "Harry Ltd Finance and Business Performance" focuses on the critical analysis of the major ratios concerning Harry Ltd finance and business performance. The ratio analysis of Harry Limited for the financial years 2008 and 2009 is conducted comprising the eight ratios…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER98.2% of users find it useful

- Subject: Finance & Accounting

- Type: Case Study

- Level: Undergraduate

- Pages: 4 (1000 words)

- Downloads: 0

- Author: ywalker

Extract of sample "Harry Ltd Finance and Business Performance"

Finance and Business Performance Harry Limited: a. Choose and calculate eight ratios that would helpful in assessing the performance of Harry Limited. Use end of year values and calculate ratios for both 2008 and 2009:

The ratio analysis of Harry Limited for the financial years 2008 and 2009 are conducted and the eight ratios are listed in the following table.

Harry Limited

Ratio

Working

2008

2009

Liquidity

Current Ratio

Current Assets / Current Liabilities

1.84

1.36

Quick Ratio

(Current Assets – Stock) / Current Liabilities

1.21

0.54

Profitability

Gross Profit Margin

Gross Profit / Total Sales

40.00%

32.86%

Net Profit Margin

Net Income / Total Sales

5.96%

5.00%

Return on Assets

Net Income / Total Assets

9.69%

10.29%

Return on Equity

Dividends / Common Stock

13.27%

15.31%

Capital Structure

Debt to Capital

Long Term Debt / Total Capital

40.00%

40.00%

Interest Coverage

EBIT / Interest

6.20

7.00

b. Using the ratios calculated in (a) and any others you consider helpful, comment on the company’s performance from the viewpoint of a prospective purchaser of a majority of shares:

It is essential that the company maintains a strong financial position in order to attract potential investors in the company’s shares. From an investor’s viewpoint, the company has to maintain a strong liquidity, profitability and an optimal capital structure. Harry Limited has improved its liquidity position in 2009 by reducing the level of stock and increasing the cash in hand. The gross profit has increased substantially by 8 % compared to that in 2008. It is evident that the operations are being optimized as the net profit has also increased in 2009. The company yields a return on equity of about 13 % while maintaining a healthy debt to capital ratio. The interest cover is also significant indicating that the interest obligations can be easily met by the company’s operations. Hence, as far as an investor is concerned, the company is financially strong and is geared for long term growth.

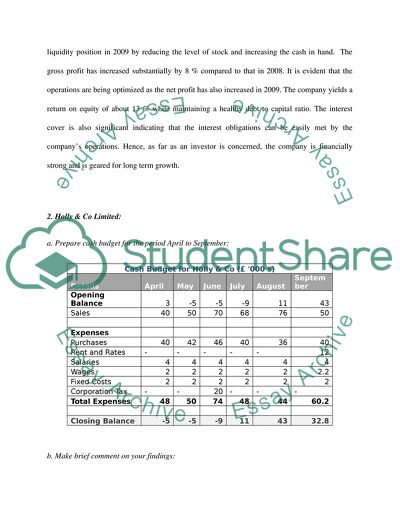

2. Holly & Co Limited:

a. Prepare cash budget for the period April to September:

Cash Budget for Holly & Co (£ 000 s)

Details

April

May

June

July

August

September

Opening Balance

3

-5

-5

-9

11

43

Sales

40

50

70

68

76

50

Expenses

Purchases

40

42

46

40

36

40

Rent and Rates

-

-

-

-

-

12

Salaries

4

4

4

4

4

4

Wages

2

2

2

2

2

2.2

Fixed Costs

2

2

2

2

2

2

Corporation Tax

-

-

20

-

-

-

Total Expenses

48

50

74

48

44

60.2

Closing Balance

-5

-5

-9

11

43

32.8

b. Make brief comment on your findings:

It is evident from the cash budget that Holly & Co has a negative cash balance for the three months from April to June. However from June, the company’s cash inflow from sales increases and the cash position is strong in August and September. In the expenses, except the purchases, the other costs are not significant. Hence the company has to negotiate with its suppliers for a more relaxed credit policy. Cash collection from the customers has to be improved and at least 50 % of the sales in a month are to be settled in the same month. This will improve the operating cash cycle of the company.

3. Confectionary Products:

Are all of these products profitable? If not, what would be the effect of dropping any unprofitable ones?

In order to identify the profitability of the products, the contribution per product is estimated as shown below:

Contribution per Product

Heeney

Meeney

Miney

Sales

£ 50,000

£ 40,000

£ 40,000

Variable Costs

Direct Materials

£ 25,000

£ 12,500

£ 12,500

Direct Labor

£ 20,000

£ 10,000

£ 10,000

Variable Overheads

£ 10,000

£ 5,000

£ 5,000

Total Variable Costs

£ 55,000

£ 27,500

£ 27,500

Contribution

£ (5,000)

£ 12,500

£ 12,500

The contributions per product indicate that the product ‘Heeney’ is not profitable. The variable costs involved in the production of Heeney are higher than the sales revenue generated by the product. Hence it does not contribute towards covering the fixed overhead expenses and has resulted in a loss of $ 5,000. By dropping the sales of Heeney, the company will make an additional profit of $ 5,000 (total profit of $ 15,000) by selling the same volume of the other two products namely Meeney and Miney.

4. Budgeting: Budgeting is an important aspect of any business whereby the management coordinates the various activities for the upcoming financial years using detailed plans of actions. The budgeting process involves establishing the objectives or goals of the company initially. This is followed by identifying potential strategies that can be applied to achieve these objectives. These various options are then evaluated in the next stage and a course of action is finalized. This course of action is then implemented with importance to the long term plans of the organization. Finally, the operations during the year are monitored and any discrepancies in the budgeted and actual outcomes are identified. The process allows the companies to make better plans and allows the companies to decide on the things needed for the production of the goods and services. These budgets are useful in a number of ways. They assist in planning the annual operations, providing a holistic view of the organization and how each department should contribute to achieve the overall organizational goals. The budget also allows ensuring that the right products are available at the right time. Moreover, they also act as tools to communicate the responsibilities of the employees and managers and motivating them to achieve the desired results. By evaluating the outcomes, the performance of the various departments and the employees can be effectively monitored. Correct use and planning of budgets can ensure smoother and more focused decision making within the company. Any mistakes and errors and misappropriations in the budgeting can lead to devastating impact on the business which includes the possibility of slow down of production as well as complete stop of production. Hence it is clear that budgeting is a very essential aspect of business.

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the case study on your topic

"Harry Ltd Finance and Business Performance"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY