Mutual Funds Pre and Post Global Financial Crisis: A Perspective on Essay. Retrieved from https://studentshare.org/finance-accounting/1695299-mutual-funds-pre-and-post-global-financial-crisis-a-perspective-on-the-impact-on-performance

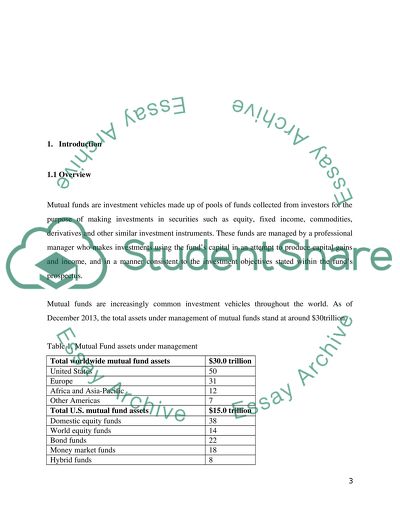

Mutual Funds Pre and Post Global Financial Crisis: A Perspective on Essay. https://studentshare.org/finance-accounting/1695299-mutual-funds-pre-and-post-global-financial-crisis-a-perspective-on-the-impact-on-performance.