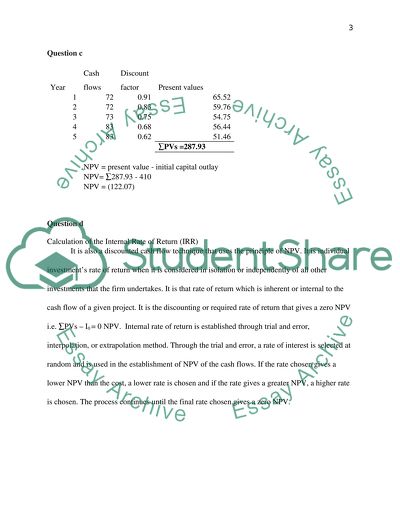

Calculating cash flow and net present value (see paper for details) Assignment. Retrieved from https://studentshare.org/finance-accounting/1694499-calculating-cash-flow-and-net-present-value-see-paper-for-details

Calculating Cash Flow and Net Present Value (see Paper for Details) Assignment. https://studentshare.org/finance-accounting/1694499-calculating-cash-flow-and-net-present-value-see-paper-for-details.