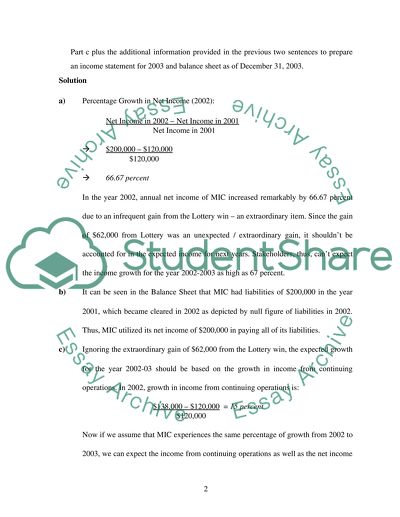

ACC201:PRINCIPLES OF ACCOUNTING Coursework Example | Topics and Well Written Essays - 500 words. Retrieved from https://studentshare.org/miscellaneous/1579266-acc201principles-of-accounting

ACC201:PRINCIPLES OF ACCOUNTING Coursework Example | Topics and Well Written Essays - 500 Words. https://studentshare.org/miscellaneous/1579266-acc201principles-of-accounting.