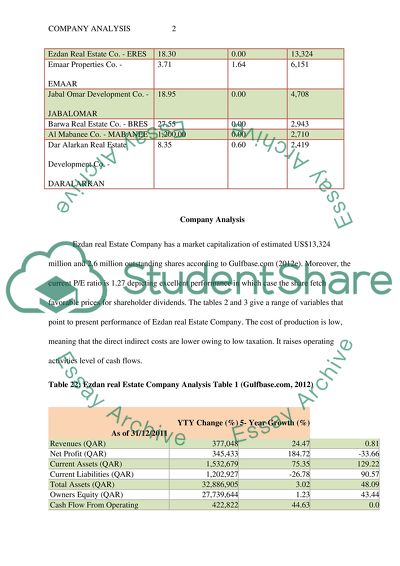

Company analysis of the Qatari Ezdan real estate company Research Paper. Retrieved from https://studentshare.org/marketing/1465449-company-analysis-of-the-qatari-ezdan-real-estate

Company Analysis of the Qatari Ezdan Real Estate Company Research Paper. https://studentshare.org/marketing/1465449-company-analysis-of-the-qatari-ezdan-real-estate.