StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Management

- Data Analysis for Managers

Free

Data Analysis for Managers - Report Example

Summary

This paper 'Data Analysis for Managers' tells that Data analysis is part of a wider scoped statistical research that plays an important role in managerial decision-making processes. It forms a basis for understanding the property of data and trends in time series data for forecasting…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER93.6% of users find it useful

- Subject: Management

- Type: Report

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

- Author: solon33

Extract of sample "Data Analysis for Managers"

Data analysis for managers Data analysis is part of a wider scoped statistical research that plays an important role in managerial decision-making processes. It forms a basis for understanding property of data and trend in time series data for forecasting. This paper explores the scope and applicability of data analysis for managerial application within Tsuneishi Holdings Corporation.

Introduction

This paper seeks to determine and report on existence of a significant relationship between demand for the corporation’s tanker order vessels, tanker fleet vessels and tanker demolition vessels, and a number of identified independent variables. The independent variables are Brent crude oil price, global oil productivity, and percentage industrial production by identified countries, growth rate in industrial production by regions, and the Libor interest rates.

Hypothesis

Based on a time series set of data for the random variables, the analysis seeks to test the general null hypothesis that there is no significant relationship between demand for each of the tanker vessels and the independent variables as expressed bellow.

βi= 0, for all the independent variables in relation to each of the tanker vessel types. This means that there is no significant relationship.

The general expression for the alternative hypotheses is expressed bellow.

βi≠0. βi are the coefficients of the independent variable in a given expression for a vessel. This indicates existence of significant relationship between the dependent variable and at least one of the independent variables.

Analytical techniques

The report applies inferential statistics to explore the data. It explores correlation and regression analysis to test the sets of hypotheses for each of the vessel type. Identification of a significant relationship is identified in a model of best fit leads to further analysis to determine the independent variables that significantly affect demand (Mann, 2010).

Data analysis

Correlation

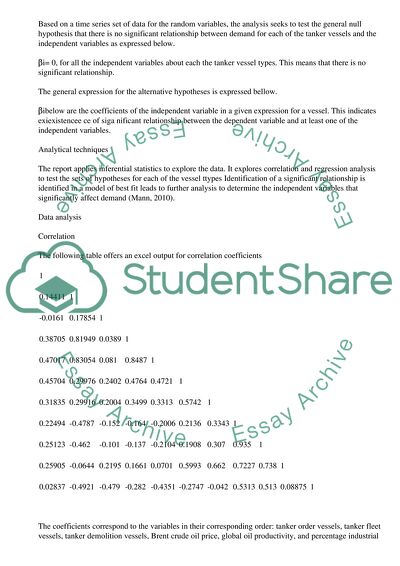

The following table offers an excel output for correlation coefficients

1

0.14411

1

-0.0161

0.17854

1

0.38705

0.81949

0.0389

1

0.47017

0.83054

0.081

0.8487

1

0.45704

0.29976

0.2402

0.4764

0.4721

1

0.31835

0.29916

0.2004

0.3499

0.3313

0.5742

1

0.22494

-0.4787

-0.152

-0.164

-0.2006

0.2136

0.3343

1

0.25123

-0.462

-0.101

-0.137

-0.2104

0.1908

0.307

0.935

1

0.25905

-0.0644

0.2195

0.1661

0.0701

0.5993

0.662

0.7227

0.738

1

0.02837

-0.4921

-0.479

-0.282

-0.4351

-0.2747

-0.042

0.5313

0.513

0.08875

1

The coefficients correspond to the variables in their corresponding order: tanker order vessels, tanker fleet vessels, tanker demolition vessels, Brent crude oil price, global oil productivity, and percentage industrial production by identified countries, growth rate in industrial production by regions, and the Libor interest rates

Regression analysis

In order to complete a regression analysis for the entire set of data, missing values were fixed through estimation from neighboring data sets. The following is a summary of regression analysis output for the relationship between the demand for tanker orders vehicles and the other factors. Test was done at 0.05 % level of significance.

SUMMARY OUTPUT

Regression Statistics

Multiple R

0.717313

R Square

0.514538

Adjusted R Square

0.484937

Standard Error

18.39523

Observations

175

ANOVA

df

SS

MS

F

Significance F

Regression

10

58818.9

5881.89

17.38226

2.87E-21

Residual

164

55495.08

338.3846

Total

174

114314

Coefficients

Standard Error

t Stat

P-value

Intercept

-282.493

50.51021

-5.59279

9.17E-08

X Variable 1

-0.03089

0.005886

-5.24718

4.72E-07

X Variable 2

0.341644

0.286063

1.194297

0.234086

X Variable 3

0.122769

0.125334

0.979533

0.328759

X Variable 4

5.025838

0.780561

6.43875

1.28E-09

X Variable 5

1.351591

0.516873

2.614939

0.009756

X Variable 6

1.205266

0.569503

2.116348

0.035825

X Variable 7

-2.73541

1.103409

-2.47905

0.014185

X Variable 8

0.026582

0.009517

2.793206

0.00584

X Variable 9

-0.00695

0.005734

-1.2117

0.22737

X Variable 10

3.024191

1.211288

2.496673

0.013524

The following is the significant regression model

Y= -282.493-0.03089x1+5.025838x4+1.351591x5+1.205266x6-2.73541x7+0.026582x8+3.024191x10

The following tables summarize the regression analysis results for demand for tanker fleet vessels and the other factors with demand for tanker order vessels and demand for tanker demolition vessels as the first and second independent variables respectively followed by the other variables in their original consecutive order.

SUMMARY OUTPUT

Regression Statistics

Multiple R

0.943315

R Square

0.889844

Adjusted R Square

0.883127

Standard Error

225.802

Observations

175

ANOVA

df

SS

MS

F

Significance F

Regression

10

67546607

6754661

132.4792

3.73E-73

Residual

164

8361796

50986.56

Total

174

75908403

Regression model

Coefficients

Standard Error

t Stat

P-value

Intercept

-2719.99

642.3588

-4.23438

3.81E-05

X Variable 1

-4.654

0.886954

-5.24718

4.72E-07

X Variable 2

2.966333

3.519048

0.842936

0.400492

X Variable 3

7.3959

1.430814

5.169017

6.77E-07

X Variable 4

82.46209

8.575956

9.615497

1.23E-17

X Variable 5

-25.878

6.152183

-4.20631

4.26E-05

X Variable 6

23.58251

6.841997

3.44673

0.000721

X Variable 7

-65.5795

12.8102

-5.11932

8.51E-07

X Variable 8

-0.07895

0.119403

-0.66123

0.50939

X Variable 9

0.267504

0.067547

3.960266

0.000111

X Variable 10

21.92639

15.05146

1.456762

0.147094

The following is the significant regression model

Y= -2719.99-4.654x1+7.3959x3+82.46209x4-25.878x5+23.58251x6-65.5795x7+0.267504x9

The following tables summarizes the regression analysis results between demand for tanker demolition vessels and the other factors with demand for tanker order vessels, and tanker fleet vessels as the first and second independent variables respectively followed by the other variables in their original consecutive order.

SUMMARY OUTPUT

Regression Statistics

Multiple R

0.717313

R Square

0.514538

Adjusted R Square

0.484937

Standard Error

18.39523

Observations

175

ANOVA

df

SS

MS

F

Significance F

Regression

10

58818.9

5881.89

17.38226

2.87E-21

Residual

164

55495.08

338.3846

Total

174

114314

Regression model

Coefficients

Standard Error

t Stat

P-value

Intercept

-282.493

50.51021

-5.59279

9.17E-08

X Variable 1

0.341644

0.286063

1.194297

0.234086

X Variable 2

-0.03089

0.005886

-5.24718

4.72E-07

X Variable 3

0.122769

0.125334

0.979533

0.328759

X Variable 4

5.025838

0.780561

6.43875

1.28E-09

X Variable 5

1.351591

0.516873

2.614939

0.009756

X Variable 6

1.205266

0.569503

2.116348

0.035825

X Variable 7

-2.73541

1.103409

-2.47905

0.014185

X Variable 8

0.026582

0.009517

2.793206

0.00584

X Variable 9

-0.00695

0.005734

-1.2117

0.22737

X Variable 10

3.024191

1.211288

2.496673

0.013524

The following is the significant regression model

Y= -282.493-0.03089x2+5.025838x4+1.351591x5+1.205266x6-2.73541x7+0.026582x8+3.024191x10

Interpretation of analyzed data

The correlation analysis results identify both direct and inverse proportionality relationship between the variables. This can however be explored further through regression analysis. The model for factors affecting demand for tanker orders fleet identifies a general existence of significant relationship. From a further analysis of each factor, the dependent variable is significantly accounted for by all the factors except demand for tanker demolition vessels, crude oil price, and production growth in pacific.

The general model for factors affecting demand for tanker fleet vessels also identifies a general significant relationship that is significantly accounted for by all the independent variables except demand for demolition vessels, production growth rate in Atlantic region and Libor interest rate.

Similarly, the general model for the demand for tanker demolition vessels identifies a significant relationship that is accounted for by all factors except demand for tanker orders vessels, Brent crude oil price, industrial production in India, and production growth in Pacific.

Decision

All the factors affect the shipyard industry. This is identifiable from a review of the three models because each factor is significant in at least one of the models.

The demand for tank orders vessels is directly proportional to its significant determinants that have increasing trends. The management should therefore consider increasing production level of the type of ship because of expected increase in demand.

The management should consider maintaining the production level of tanker fleet vessels because both of its negative and positive determinants are significantly and therefore cancel out for a constant trend.

The major determinants for the demand for tanker demolition vessels are directly proportional to its demand and bear an increasing trend. The management should therefore consider increasing production of the type of ships.

Conclusion

The factors; Brent crude oil price, global oil productivity, and percentage industrial production by identified countries, growth rate in industrial production by regions, and the Libor interest rates, therefore affect performance of the shipyard industry. This is realized through the three identified models for each type of ship. Based on the null hypothesis that the factors are not significant in the industry, the report recommends that the corporation’s management keenly track the factors in predicting demand for its types of ships.

Reference

Mann, P. (2010). Introductory statistics. New Jersey, NJ: John Wiley & Sons.

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the report on your topic

"Data Analysis for Managers"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY