StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Macro & Microeconomics

- A Primer on Endogenous Credit-Money

Free

A Primer on Endogenous Credit-Money - Assignment Example

Summary

In the paper “A Primer on Endogenous Credit-Money” the author depicts that the profit at the output level of three units. Profit maximization is achieved at the point where marginal cost is equal to marginal revenue. The maximization of the profit should derive a marginal cost…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER97.7% of users find it useful

- Subject: Macro & Microeconomics

- Type: Assignment

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

Extract of sample "A Primer on Endogenous Credit-Money"

A Primer on Endogenous Credit-Money

Question 1

(a) Revenue = output * price

Accordingly, the revenue generated by the firm in each of the output level is reflected in the table below.

Output

Price (£)

Total Revenue (£)

0

20

0

1

18

18

2

16

32

3

14

42

4

12

48

5

10

50

(b) Profit = revenue – cost

Accordingly, the profit derived at each production level for the firm is reflected in the table below.

Output

Revenue (£)

Total cost (£)

Total Profit (£)

0

0

10

-10

1

18

15

3

2

32

18

14

3

42

20

22

4

48

27

21

5

50

41

9

(c) The table above depicts that the firm maximizes the profit at the output level of three units since it has the highest profit amount compared to the other output levels.

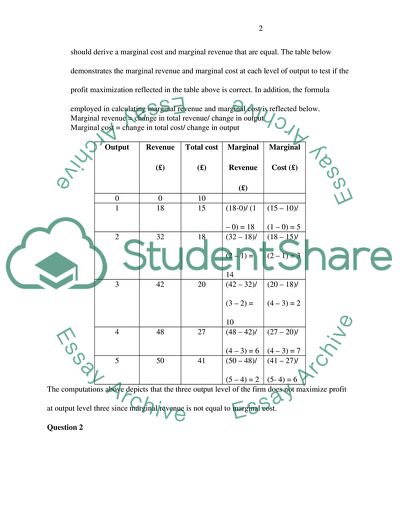

(d) Profit maximization is achieved at the point where marginal cost is equal to marginal revenue (Tucker, 2011). Thus, the maximization of the profit reflected in the table above should derive a marginal cost and marginal revenue that are equal. The table below demonstrates the marginal revenue and marginal cost at each level of output to test if the profit maximization reflected in the table above is correct. In addition, the formula employed in calculating marginal revenue and marginal cost is reflected below.

Marginal revenue = change in total revenue/ change in output

Marginal cost = change in total cost/ change in output

Output

Revenue (£)

Total cost (£)

Marginal Revenue (£)

Marginal Cost (£)

0

0

10

1

18

15

(18-0)/ (1 – 0) = 18

(15 – 10)/ (1 – 0) = 5

2

32

18

(32 – 18)/ (2 – 1) = 14

(18 – 15)/ (2 – 1) = 3

3

42

20

(42 – 32)/ (3 – 2) = 10

(20 – 18)/ (4 – 3) = 2

4

48

27

(48 – 42)/ (4 – 3) = 6

(27 – 20)/ (4 – 3) = 7

5

50

41

(50 – 48)/ (5 – 4) = 2

(41 – 27)/ (5- 4) = 6

The computations above depicts that the three output level of the firm does not maximize profit at output level three since marginal revenue is not equal to marginal cost.

Question 2

A perfectly competitive market is a type of a market that is characterized by homogenous product, numerous firms, perfect knowledge, freedom of entry and exit, and price taker. Thus, establishment of a market model inspired by regulations of a perfect market has raised questions on whether it can hamper innovation. The extent of perfect market model depicts that innovation is likely to be hampered in future. One of the aspects that depict that innovation is likely to be hampered under regulations inspired under perfect competition is homogeneity or standardization of product. The requirement that product be homogenous in regulating the market as required under perfect competition characteristic will hinder traders and manufacturers from undertaking product differentiation. This implies that manufacturers and producers of products supplied in the market will not undertake individual initiative of introducing new features in the product that enhances usage and efficiency. The extent of market regulations been inspired by perfectly competitive market in hindering market players from undertaking product enhancement initiative from established standard implies that investment in research and development will be eliminated. This is because the manufacturers and producers of products will be forced to wait for new standard of product to be established to ensure all product of certain application are homogenous. Consequently, innovation that is driven by need to differentiate the superiority of individual firm’s product from others to generate more sales revenue and market share.

Another dimension that demonstrates that establishing market regulations that are inspired by model of perfectly competitive market has potential of hampering innovation is aspect of firms been price taker. Firms been price takers under perfect competitive market imply that firms have to sell their products at a given price to survive. This scenario has the potential of hindering firms from undertaking capital investment to enhance quality of their products since the cost will be higher than the given market price of the given product. Thus, the extent of firms in undertaking innovative investment on their product superiority will be hampered since it will cause los due to price adjustment limitation to cater for increased cost. In addition, the characteristic of perfect knowledge under perfect competitive market has potential of hampering innovation if market regulations are inclined towards perfect competitive market. The aspect of perfect knowledge implies that consumers have information readily available about product and prices from competing traders that they can access at zero cost. The ability of consumers in accessing information on prices and products offered by diverse firms in market at zero cost has potential of hindering innovative marketing strategies by firms. This is because incentive for firms to undertake market awareness strategies from traditional methods will be eliminated since the market regulations will provide for a single marketing platform. Consequently, market regulations that is inclined towards a model perfect competitive market has potential of hampering innovation.

Question 3

Monetary sector in a given economic setup is composed of two distinct but interrelated components. Of the aspect of monetary sector is covered under the Central Bank of a country and the monetary policies it undertakes on money supply and interest rate formulation. The Central Bank is involved in supply of money in the country that is essential in influencing the prevailing interest rate in the market (Mandal & Gupta, 2010). Indeed, the Bank of England is responsible of issuing coins and notes that are used by consumers in making purchases. Furthermore, the Central Bank like Bank of England is the government’s banker. The other aspect of the monetary sector is the private financial sector. The private financial sector is made up of commercial banks and other financial institutions that are privately controlled. Private financial sector under the monetary sector p

The running of the monetary sector is highly determined by two key determinants of liquidity preference and interest rates. Liquidity preference under macro-economic theory means the money demand that is considered liquidity (Mankiw, 2014). Thus, liquidity preference implies the extent to which households in the economy are demanding to have liquid currency for consumption. On the other hand, the interest rates imply the cost of capital derived from borrowing and savings (Gnos & Rochon, 2009). The two dimensions are essential under the monetary sector since they influence the supply of money in the general economy. Indeed, a higher preference by households to hold more cash has the effect of causing money supply in the economy to increase. Similarly, a lower interest rate has the effect of encouraging households and firms to borrow more cash from commercial banks that increases money supply in general economy (Tucker, 2011). Consequently, the two variables are instrumental in influencing the monetary sector of a given country.

Question 4

Interest rate and level of uncertainty in the general economy have been cited to be essential in determining money supply. Interest rates determine money supply due to the ability of consumers and households in accessing capital from banks. Indeed, a lower interest rate has the tendency of encouraging households and investors to borrow more money from the banks to make purchases and investments that increases money supply in the general economy (Lavoie, 2003). In contrast, uncertainty determines the money supply in the economy through fears that households and investors hold about future economic performance. Indeed, the uncertainty on price of bonds and unexpected social problems has the tendency of causing people to prefer liquidity cash to ensure they are able to react to any eventuality when it arises that causes money supply in the general to increase (Hicks, 1980). Consequently, the two variables have contrasting ability of determining money supply in the economy.

References

Gnos, C., & Rochon, .-P. (2009). Post-Keynesian Principles of Economic Policy. Boston: Wiley.

Hicks, J. R. (1980). IS-LM: An Explanation. Journal of Post Keynesian Economics , 3 (2), 139-154.

Lavoie, M. (2003). A Primer on Endogenous Credit-Money', in L.-P. Rochon and S. Rossi, eds., Modern Theories of Money. The Nature and Role of Money in Capitalist Economies , 506-543.

Mandal, R. K., & Gupta, A. (2010). Macroeconomics. New York: Wiley.

Mankiw, N. (2014). Principles of Economics. New York: Cengage Learning.

Tucker, I. B. (2011). Macroeconomics for today. Mason, OH: South-Western Cengage Learning.

Read

More

CHECK THESE SAMPLES OF A Primer on Endogenous Credit-Money

The Impact and Implication of the Credit Crunch in the UK

The paper "The Impact and Implication of the Credit Crunch in the UK" suggest that the credit crunch, which began in August 2007, was due to the poor health of America's mortgage intermediaries Fannie Mae and Freddie Mac.... It shocked the financial market around the world and led to the economic crisis....

15 Pages

(3750 words)

Essay

Invisible Hand Principle

The essay "Invisible Hand Principle" focuses on the critical, and multifaceted analysis of the major issues in the principle of an invisible hand.... Adam Smith, a Scottish moral philosopher, is believed to be the father of the classical school of social sciences.... ... ... ... His work involved the comparison of the 'invisible hand' which leads to individuals seeking self-interests with the maximizing of the overall public good....

12 Pages

(3000 words)

Essay

Subprime Mortgage Crisis and East Asia

This research paper "Subprime Mortgage Crisis and East Asia" evaluates the financial crisis issues that were triggered by the U.... subprime mortgage crisis, and affected the East Asian economy.... The subprime mortgage crisis was a result of speculative issues in the housing market.... ... ... ...

11 Pages

(2750 words)

Research Paper

Unemployment in Classical Economy

Unemployment is of different types and their causes are also of different types.... Insufficient effective demand for goods and services in an economy is the main cause of cyclical unemployment according to Keynesian economics.... ... ... ... Classical economics or neoclassical economics focus on rigidities in the labor market caused by the operating laws such as minimum wage act, taxes, and other regulations that restrict employers to hire more workers in the job....

14 Pages

(3500 words)

Essay

The market segmentation strategy for the manufacturer of the washing machine

This research presents the market segmentation strategy for the manufacturer of the washing machine targeting the 'Silver Market' or the Baby Boomers'.... The paper will also describe the segmentation process and the bases for segmentation.... .... ... ... The conclusion from this study states that Silver market in the UK has to be targeted by using mainly psychographic segmentation strategies....

16 Pages

(4000 words)

Essay

Responses of European Countries to the Global Financial Crisis

This literature review looks at the reasons for the response of the different countries in the EU to the global economic crisis.... The review attempts to answer the question: Why did different European countries respond to the global economic crisis in the same way?... .... ... ... Much has been written about the ongoing global economic crisis and the response of countries around the world to deal with the fallout of the same....

7 Pages

(1750 words)

Literature review

The Relationship Between Entrepreneurship, Innovation and Economic Development

"The Relationship Between Entrepreneurship, Innovation, and Economic Development" paper examines the relationship between entrepreneurship, innovation, and economic development.... The paper also considers the role of creativity and problem-solving play in this relationship.... ... ... ... Baum, Frese, and Baron (2007) note that past conceptions of entrepreneurial personality research have always attempted to identify a positive correlative connection between creativity and success....

5 Pages

(1250 words)

Coursework

House Price Expectations and Market Frictions

It will take a look at how periods of irresponsibility and irrational exuberance by the key players of the housing market; home owners.... ... ... The paper "House Price Expectations and Market Frictions" is a perfect example of a report on macro and microeconomics.... This report will attempt to analyze the U....

12 Pages

(3000 words)

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"A Primer on Endogenous Credit-Money"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY