StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Macro & Microeconomics

- The Perfect Competition Type of Market

Free

The Perfect Competition Type of Market - Assignment Example

Summary

The paper "The Perfect Competition Type of Market" highlights that the bonus comes to zero this to mean that the agent has not put a lot of effort into the contract that the principal offered or that the agent rejected the contract that makes it fail in the market…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER93% of users find it useful

- Subject: Macro & Microeconomics

- Type: Assignment

- Level: Undergraduate

- Pages: 4 (1000 words)

- Downloads: 0

- Author: jernser

Extract of sample "The Perfect Competition Type of Market"

ASSIGNMENT, POLITICAL SCIENCE OTHER TOPIC By Introduction It is important to highlight that this paper in the discussion of market structure with the major focus being on the perfect competition type of market. In this paper therefore, it is in order if the features of this type of market structure are highlighted for the effective understanding of the calculations that will follow thereafter. In perfect market competition, it is important to highlight that the following are the assumptions that are always made (Mas-Colell, and Green, 2005).

Assumptions of perfect competition

i. There is perfect knowledge of the market by both the sellers and the buyers.

ii. There is no government intervention in the market.

iii. There are freedoms of entry into and exit out of the market.

iv. The all the quantities supplied in the market is fully consumed as there is a perception that the total consumer demand is met. This therefore means there is neither excess demand nor excess supply in the market (Slackman, 2010).

1. a). from the fourth assumption in the market, it can be noted that

Qd=Qs where Qd is the quantity demanded while Qs is the quantity supplied

This therefore implies that the demand and supply is equal therefore the equilibrium quantity (E*) and equilibrium price (Q*) can be calculated as shown below:

5.5-P =1.5 + 2P

5.5- 1.5= 2P + P (factorization to find all the likes terms together)

3P= 4 (divide both sides by 3)

P= £ 4/3

From this, P can be substituted in any of the equations to find the value of Q and it is as shown below.

Q=5.5-4/3

= 25/6 units

From this, it can be noted that equilibrium price is £4/3 while the equilibrium quantity is 25/6.

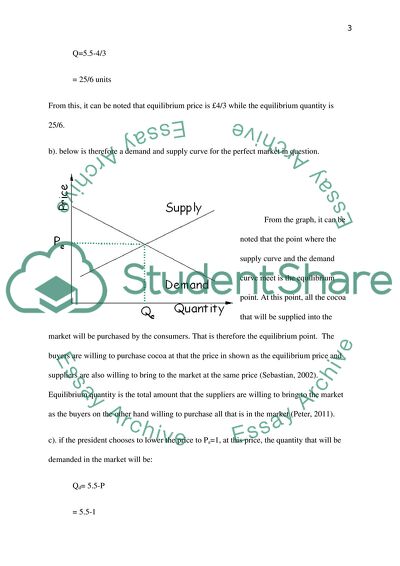

b). below is therefore a demand and supply curve for the perfect market in question.

From the graph, it can be noted that the point where the supply curve and the demand curve meet is the equilibrium point. At this point, all the cocoa that will be supplied into the market will be purchased by the consumers. That is therefore the equilibrium point. The buyers are willing to purchase cocoa at that the price in shown as the equilibrium price and suppliers are also willing to bring to the market at the same price (Sebastian, 2002). Equilibrium quantity is the total amount that the suppliers are willing to bring to the market as the buyers on the other hand willing to purchase all that is in the market (Peter, 2011).

c). if the president chooses to lower the price to Pa=1, at this price, the quantity that will be demanded in the market will be:

Qd= 5.5-P

= 5.5-1

=4.5 units

On the other hand the quantity supplied in the market will be as shown below:

Qs= 1.5 +2P

= 1.5+2(1)

=3.5 units

In a normal market structure, lowering the price of a commodity will definitely increase the demand for that particular commodity. In this market, demand for cocoa is not an exception. It can be noted that the demand for the quantity of cocoa that is demanded increases to 4.5 units. However, the quantity of cocoa that is supplied in the market reduces due to the shortage that arose (Ruggles, and Silverman, 2008).

This therefore shows that there is excess demand in the market .and that the quantity of cocoa that the customers want and are willing to purchase is more that the quantity of the same commodity that the sellers are willing and are able to bring to the market. The policy can however not be in favour of the sellers due to the fact that they had probably purchased at some higher value but they are obliged to sell at the price set by the government thereby making them to incur heavy losses (Roedy, 2011).

d). if the government want to purchase or rather import cocoa at price, P1=1/2 , The total cost of importing the commodity will be the product of the buying price and the quantity that the customers want and are willing to purchase in the market. This is the commodity needed at the price of Pa=1 which is 4.5 units. Therefore the cost incurred is found as shown below:

4.5 × 0.5= 2.25

This is a cheaper cost of doing purchases from the international market. The consumers will therefore get all they deserve and willing to buy and then get satisfied on demand for cocoa (Ronald, 2003).

2. From the behavior of the politician, it can be noted that the behaviour is not for someone who can be trusted and by the politician is no too bad to trust. This is because there is a benefit of doubt on the behaviour of the politician. In rating the politician using Bayes Theorem, she can be at a scale of 0.5 that is top man she is Not Too Bad (NTB). This is because the politician can be so vocal and forget the secrecy and confidentiality of the issue at the same time she may be very cautious to protect the deal that we stroke. Random behaviour in the politician is quite unpredictable and trusting her to infinity definitely is not possible (Griffin, and Moorhead, 2011).

3. a). the pay offs for the game cab seen as $12 for the principal with that for the agent being $ 4.

b). in the game, there are various motivational factors that ate referred to as the incentive compatibility. It begins from the pint that the wage is there whether the agent rejects or accepts the contract. This is a reason that makes one to be so hard working in order to get the additional bonus besides the known wage. Incentive compatibility is on the exertion of high efforts by the agent because here again the agent is rest assured of higher returns from the efforts with the aim to make the project by the principal quite successful (Bechet, 2008).

c). from the game, it can be said that the agent can only work harder and exert high pressure after the acceptance of the contract. The wage is there whether the project is successful or not but the bonus depends on the efforts of the agent. From the game therefore, it can be seen that the wages for the agent is (w+b) (Andersen, 2009)

d). the relationship between bonus and probability as shown below:

e). when p is close to 0, it can be clearly noted and seen that the bonus is likely to go higher. This therefore means that the two variables are indirectly related and one variable affects the other indirectly. Whenever P=1, it can be clearly seen that the bonus comes to zero this to mean that the agent has not put a lot of effort in the contract that the principal offered or that the agent rejected the contract that makes it to fail in the market. The two variables therefore work in the same range at the point of 0.5 and not any other were they can interact or intersect (Albert, 2008).

References

Albert F. (2008) Lessons from the Past: Capital Markets during the 19th Century. Oxford: Oxford University Press, p. 56.

Andersen E. (2009) Goal Directed Project Management: Effective Techniques and Strategies. Kogan Page Publishers, p.123

Bechet, T. (2008) Strategic Staffing: A Comprehensive System for Effective Workforce Planning. New York: AMACOM, p.102

Griffin, W. and Moorhead, G. (2011) Organizational Behaviour Managing People and Organizations Cengage learning, p.231

Mas-Colell, A. and Green, J. R. (2005) Microeconomic theory New York: Oxford University Press, p.125

Peter, K. (2001) The International Financial Architecture: What’s New? What’s missing? Interwar Period International Organization, 39, pp. 383-439.

Roedy, B. (2011) What Makes Business Rock: Building the World’s Largest Global Networks. John Wiley & Sons, p.154

Ronald, I. (2003) The Order of Economic Liberalization: Financial Control in the Transition to a Market Economy. Baltimore: Johns Hopkins University Press, p. 231

Ruggles, D. and Silverman, H. (2008) Cultural Heritage and Human Rights Springer, p.214

Sebastian, E. (2002) Crisis and Reform in Latin America: From Despair to Hope. Washington D.C.: Institute for International Economics, pp. 231

Slackman, M. (2010) Privilege Pulls Qatar Towards Unhealthy Choices. New York Times, p.231

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"The Perfect Competition Type of Market"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY