StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Macro & Microeconomics

- The Law of Demand

Free

The Law of Demand - Report Example

Summary

From the paper "The Law of Demand" it is clear that price discrimination occurs in the market due to many factors. For price discrimination to be successive, a number of conditions must be met. First, there must be a successive separation of markets into submarkets…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER95.1% of users find it useful

- Subject: Macro & Microeconomics

- Type: Report

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

- Author: terry02

Extract of sample "The Law of Demand"

Mohammed Economics “Microeconomics” The law of demand s that holding all other factors constant, the price of a commodity is inversely related to the quantity of commodity bought. This means that as the prices increases for a given commodity, the demand for a commodity falls. However, there are some essential commodities whose demand does not only depend on the price of the commodity. From our example, oil is a major factor input in the refining process used to produce gasoline. The civil wars in the Middle East disrupt the flow of oil supplies in the world markets. This is likely to cause the price of oil to go up.

S0

D

P1

E1

P0 E0

S1

D

0 Q1 Q0

On the vertical axis, we have the price of oil in the world market. On the horizontal axis, we have the quantity of oil demanded .initially; the price of oil in the world market is given by P0. Moreover, the quantity of oil demanded as [per this price is shown on the graph as Q0. The initial equilibrium price is given by E0. This is obtained by the interaction of the demand and supply curves to yield the initial equilibrium quantities and prices. This is the position of the economy before civil wars disrupted the flow of oil in the Middle East.

As shown from the diagram the higher the prices, the lower the demand for the oil.

The disruption in the flow of oil in the Middle East causes the supply curve to shift backwards to S1-S1. Initially the supply curve is indicated by S0-SO. This causes a shift of the supply curve to the left. The shift of the supply curve to the left is an indication of reduction on the supply of oil.

The law of supply states that as prices increases the quantity supplied also increases holding all other factors constant. Now for this case the war has disrupted this equilibrium position.

The equilibrium position now changes to E1 from an initial position at EO. The demand curve is held constant. The quantity of oil demanded now reduces. Initially Q0 units of oil were demanded. The demand declines to Q1. Due to the reduced supply of oil prices goes up to P1 from an initial price level of P0.

Oil is a major input in the processing of gasoline. The reduction in the supply of oil influences the procession of gasoline. This means that oil and gasoline are complementary commodities.

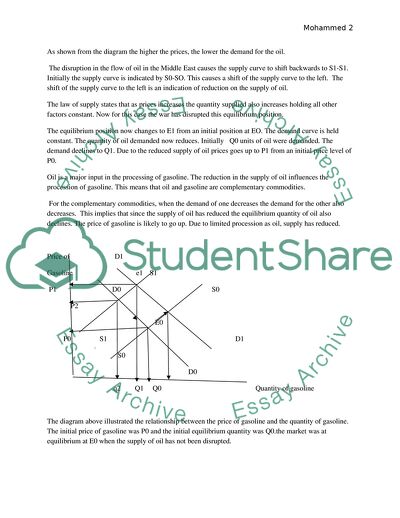

For the complementary commodities, when the demand of one decreases the demand for the other also decreases. This implies that since the supply of oil has reduced the equilibrium quantity of oil also declines. The price of gasoline is likely to go up. Due to limited procession as oil, supply has reduced.

Price of D1

Gasoline e1 S1

P1 D0 S0

P2

E0

P0 S1 D1

S0

D0

q2 Q1 Q0 Quantity of gasoline

The diagram above illustrated the relationship between the price of gasoline and the quantity of gasoline. The initial price of gasoline was P0 and the initial equilibrium quantity was Q0.the market was at equilibrium at E0 when the supply of oil has not been disrupted.

Due to the decline in the supply of oil, the supply of gasoline also decreases. This is shown by the leftward shift of the initial supply curve S0-SO to a new supply curve S1-S1.

Holding demand constant, prices rises. A price of gasoline, increases, the new equilibrium position shifts to e1.

It is clear that in the short run, as the supply of gasoline declines, the market forces adjust the prices upwards to P2. In the short run, demand curve remains constant. The supply deficit is shown by the difference between QO and q2.

Gasoline and automobiles are perfect compliments. Due to the deficit in the supply of gasoline, the prices rise.

The high price of gasoline does not negatively affect the demand of luxury cars. This is an exception to the law of demand. This is because the price of the luxury cars also increases. The demand does not decline due to this increase in price. In this case, the law of demand is violated.

For the case of economy cars, increase in the price of gasoline leads to a decline in the demand of the economy cars in the short run.

Price s0

d0

s1

d1 e0

po

e1

e1

p1 Quantity of economy cars

q0 q1

In the end, the market forces adjust the market equilibrium to a new position e1.the price for the economy cars decrease to increase the demand. This is attributed to the fact that the luxury cars and the economy cars are substitutes. The supplier of the economy cars reduces prices to increase demand for the economy cars.

The derived demand curve for labour

Price of output in the market

D1 S0

pi D0

P0

S0 D1

D0

0 q0 q1 Quantity of output

Wages S0

D0 D1

W1

W0

S0 D0 D1

Q0 Q1 Labour units

From the above diagrams, an increase in demand for is shown by a shift in the demand curve to the right. The quantity demanded for the output increases to q1 from an initial level of q0.prices increases to p1. The demand for labour is a derived demand because the prices increases, the nominal wages also increases. The increase in demand for labour is shown by a rightward shift of the labour demand curve from D0-DO to D1DI.

The increase in demand for labour is attributed to the increase in prices of output in the goods market. The workers now demand high nominal wages to compensate for the high prices of goods. The supply curve is assumed constant.

The demand for labour in the labour market is derived from the goods market. Workers demand for high nominal wages.

Compare and contrast between pure monopoly and price discriminating monopoly

A monopoly is a market model where there is only one seller. The monopoly charges high prices. The output supply is low.

A pure monopoly charges the same price to all buyers. A price discriminating monopoly charges different prices.

There are three categories of price discriminating monopolies. The first category is the first-degree price discrimination. In this case, the seller charges different prices to different quantity of output. This applies to all consumers. It is also called linear price discrimination. The second category is the second-degree price discrimination. The seller charges different prices for the same unit of output to offer to different buyers. The third category is the third degree price discrimination. This is a case where the seller charges different prices for different units of output offered in the market. In this case, the same price is charged to all consumers buying the same quantity of output.

For the two monopoly models, equilibrium price and quantity is at the point where marginal revenue is equal to marginal cost. The monopoly profit margin is the difference between price charged and the marginal cost. The price is usually higher than the marginal cost.

The two monopolies are associated with inefficiency in the provision of the goods in the market. This is because they charge high prices for low output. This leads to the loss of welfare.

Monopoly leads to the loss of consumer surplus. Consumer surplus is the difference between the price consumers are willing to pay and the price they actually pay. The monopoly price is higher the price under perfect competition. The monopoly output is lower than the output offered in the perfect competition market.

Price discrimination occurs in the market due to many factors. For price discrimination to be successive, a number of conditions must be met. First, there must be successive separation of markets into submarkets. This aids in charging different prices in different sub markets. It should also be possible to stop buyers from moving from high price markets to low price markets. The second condition is that there should be different price elasticity of demand.

The different categories of price discrimination offer different profit levels.

The first-degree price discrimination is common among private doctors. The second -degree price discrimination is applicable to watching of movies in the theatre.

The loss of welfare in the monopoly model makes the model to be inefficient. Dead weight loss is the loss in the consumer surplus, which neither goes to the market nor goes to the producer.

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the report on your topic

"The Law of Demand"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY