Macroeconomics and Microeconomics - Interest Rate Assignment. Retrieved from https://studentshare.org/macro-microeconomics/1439368-interest-rate-bahrain-usa

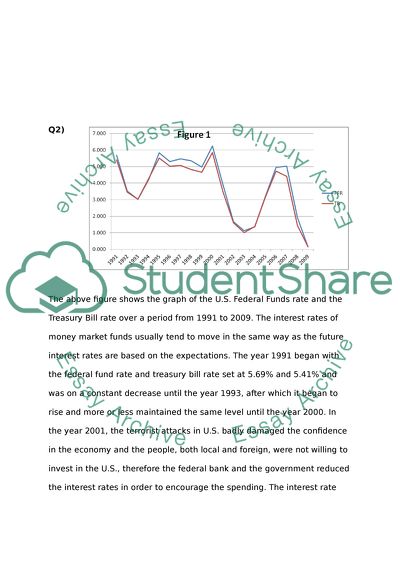

Macroeconomics and Microeconomics - Interest Rate Assignment. https://studentshare.org/macro-microeconomics/1439368-interest-rate-bahrain-usa.