StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Financial Accounting and Reporting

Free

Financial Accounting and Reporting - Assignment Example

Summary

The paper “Financial Accounting and Reporting” is an affecting example of a finance & accounting assignment. The paper begins with Income Statement for the year ending 31st May 2012: Sales 80,900 / Less: Sales returns 2400 / Net sales 78,500 / Less cost of goods sold / Purchases 37,900 / Add: Opening inventories 8200 / Cost of goods available for sale 46100…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER91% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

- Author: msawayn

Extract of sample "Financial Accounting and Reporting"

FINANCIAL ACCOUNTING AND REPORTING By of the of the School Task 2 J. Lewisham

Income Statement

For the year ending 31st May 2012

Sales 80,900

Less: Sales returns 2400

Net sales 78,500

Less cost of goods sold

Purchases 37,900

Add: Opening inventories 8200

Cost of goods available for sale 46100

Less closing inventories 6400

Less: Drawings (J.L) 600

Cost of goods sold 39,100

Gross profit 39,400

Add other income revenue

Discount received 700

Total profit 40,100

Less operating expenses

Depreciation expense 8400

Insurance 2900

Heating and lighting 1500

Wages 12200

Rates 3700

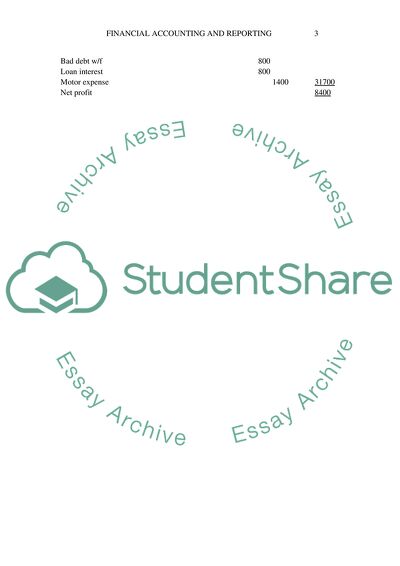

Bad debt w/f 800

Loan interest 800

Motor expense 1400 31700

Net profit 8400

Workings

1) Purchases=A/P+ discount received-opening creditors+ closing creditors

=37000+700-4800+500= $37,900

2) Drawings= Balance + J>L drawings

=19000+600= $19,600

3) Sales calculation

Cash sales 28,000

Add: A/R @ June 1 52,000

Less: A/R opening bal 12600

Add: closing debtors 10000

Add A/R @ May 31 800

Bad debts w/o 800

Add credit not issued 2400

Less dishonored cheque 500

Total sales 80,900

J. Lewisham

Balance sheet

As at 31st May 2012

Non-current assets

Equipment 40,200

Less accumulated depreciation 8400 31,800

Current assets

Cash in hand (700)

Cash at the bank 5200

Accounts receivable 10000

Inventory 6400

Total Current assets 20,900

Total assets 52,700

Less liabilities

Current liabilities

Accounts payable 5000

Rates owing 500

Loan interest owing 200

Total current liabilities 5700

Long-term liabilities

Loan from bank 10,000

Total liabilities 15,700

Net Assets 37,000

Financed by

Capital 48200

Less drawings 19600

Add net profit 8400

Total equity 37,000

Workings

1) Equipment = Beginning bal = new purchases

=25200+15000= $40200

2) Calculation of capital

Statement of affairs

As at June 1, 2011

Cash in hand (June 1) 600

Cash at the bank (June 1) 16,000

Inventory 8200

Accounts receivable 12600

Prepaid rent 400

Equipment 25200

Less liabilities

Accounts payable 4800

Loan from bank 10,000

Capital (June 1) 48,200

Calculation of ratios

Gross Profit margin = gross profit / total sales

=39,400 / 80,900 * 100% = 48.7%

Gross profit margin indication the proportion of the total sales revenue that remains after deducting cost of sales or cost of goods sold. A gross profit margin of 48.7% indicates the company is realizing a gross profit of $48.8 for every $100 of sales revenue. The company is very profitable.

Net Profit margin = net profit / total sales

=8,400 / 80,900 * 100% = 10.4%

This ratio indicates the profitability of the company. It shows the proportion of gross profit that remains after meeting operating expenses. A net profit margin of 10.4% indicates the company is realizing a net profit of $10.4 for every $100 of sales revenue. In comparison with gross profit, the net profit margin is relatively low as the company has more operating expenses.

ROCE ratio = net profit / capital employed

=8,400 / 47,000 *100% = 17.9%

ROCE shows how efficient the company is using its capital employed to generate profit. Being high, the company makes more profit for each dollar of capital employed.

Stock turnover rate =cost of goods sold / average stock

=39,100 / 7,300 = 5.36 Times.

This ratio shows how well a firm is managing its inventory levels by measuring the number of times inventory is sold and replaced. An inventory turnover of 5.36 times is very good and the company is very efficient in managing its inventories.

Current ratio = current assets / current liability

=20,900 / 5,700 = 3.667= 1: 3.7

Current ratio (working capital ratio) measures the ability of a firm to meet its near-term obligations. Having a current ratio of more than 2 is very good and the company is very liquid and is able to meet its short-term obligations with lots of ease.

Acid test ratio = (current assets - stock) / current liability

= (20,900 - 6,400) / 5,700 = 2.54

=1:2.5

Acid test ratio measures the ability of a firm to meet its near-term obligations using very liquid assets. A quick ratio of greater than 2 is very good and the company is able to meet its short-term obligations with lots of ease using very liquid assets.

Gearing ratio = long-term liability / capital employed

=10,000 / 47,000 * 100% = 21.28%

This ratio measures how leverage a company is thus showing the finance risk of a company. The company has low loan payment as well as risks because its gearing is less than 50%.

Differences between financial statement of sole proprietorship and Limited Liability Company.

Because all profits belong to the owner, a Sole proprietorship firm should only prepare capital account. A sole proprietor does not need to prepare income statement because but should only show capital account on the balance sheet.

However, on the other hand, limited li88ability company is required to prepare both balance sheet and income statement for the public to see the financial performance and financial position.

Task 3

Atlantic UK plc and Subsidiary Shire UK ltd

Consolidated income Statement

For the year ended 31 December 2012

Total revenue 1075000

Less: cost of sales 497,500

Gross profit 577,500

Less operating expenses

Sundry expense 237,500

Profit before taxation 340,000

Less: taxation 25,000

Profit after taxation 315,000

Less: Non-controlling interest 18,000

Net profit 297,000

Workings

a) total revenue= 850000+22500= 1075000

b) cost of sales= 460000+37500= $497,500

c) sundry expense= 150000+875000= $237500

d) total taxation= 15000+10000= $25000

e) Non-controlling interest= 20% *$90000=$ 18,000

Atlantic UK plc and Subsidiary Shire UK ltd

Consolidated statement of financial position

As at 31 December 2012

Non-current assets

Goodwill 36,000

Other long term assets 860,000 896,000

Current assets

Cash in hand 7000

Cash at the bank 18000

Accounts receivable 215000

Inventory 275000

Total Current assets 515,000

Total assets 1,411,000

Less liabilities

Current liabilities

Accounts payable 120,000

Other trade accounts payable 115000

Total current liabilities 235,000

Long-term liabilities

Differed taxation 240,000

Total liabilities 475,000

Net Assets 936,000

Financed by

Atlantic’s share Capital 450,000

Reserves plus retained profits 426,000

Add non-controlling interest 60,000

Total equity 936,000

Workings

1) goodwill calculation

Goodwill investments 200,000

Less: Retained profit (80%85000) 4,000

Less: Nominal value of share in Shire UK plc (80%*200000) 160,000

Goodwill 36,000

2) Calculation of reserves plus retained profit

Retained profit

Atlantic (350000+180000-285000) 245,000

Shire (100000+75000-90000) 85,000

Deduct dividend paid 75,000

10,000

Deduct: pre-acquisition retained profit 5,000

5000

Deduct: non-controllable interest (0.2*5000) 1000 4000

Groups retained profit 249,000

Dividend received by Atlantic 60,000

Pre-consolidated profit (297,000-180,000) 117,000

Reserves plus retained profit 426,000

References

Accounting-simplified.com, (n.d.). Purpose of Financial Statements and Users of Financial Statements. [online] Available at: http://accounting-simplified.com/purpose-of-financial-statements.html [Accessed 17 Apr. 2015]

AccountingCoach.com, (2015). Financial Accounting Explanation AccountingCoach. [online] Available at: http://www.accountingcoach.com/financial-accounting/explanation [Accessed 14 Apr. 2015]

Lexicon.ft.com, (2015). International Accounting Standards Definition from Financial Times Lexicon. [online] Available at: http://lexicon.ft.com/Term?term=International-Accounting-Standards--IAS [Accessed 16 Apr. 2015]

www.iasplus.com, (2005). Comparison between PRC GAAP and IFRS. [online] Available at: http://www.iasplus.com/en/binary/dttpubs/2005ifrsprc.pdf [Accessed 15 Apr. 2015]

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Financial Accounting and Reporting"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY