StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Financial Information

Free

Financial Information - Assignment Example

Summary

The “financial information” assignment in the form of questions and answers contains a detailed analysis of financial activities on the example of a particular enterprise, using mathematical forms to calculate efficiency…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER91.5% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: Undergraduate

- Pages: 4 (1000 words)

- Downloads: 0

- Author: yquigley

Extract of sample "Financial Information"

Question The key activities for the business includes making and selling spreads and butter, cheese and whey and the dairies. These key activities form the main source of revenues for the business.

Question 2:

From the audit report, it is clear that the financial statements of the company are kept in accordance to the various regulations and this has been prominently captured by the auditors. The challenge, according to the audit report, is that the way certain figures have been provided for in the books is likely to impact on the profitability values. Indeed, reading through the audit report, it is clear that the auditors did not agree with the management with regards to a number of issues such as the how promotional accruals are accounted for and the specification of exceptional items have been done. This however does not means that money is being lost, rather it means that the final value may be too large or smaller than would have been the case if a different approach was employed.

Auditors report are important because they help to point out malpractices in business. Sometimes business executives, may present financial statements with rosy figures while in actual sense, a lot of hidden in those figures and this may lead to the collapse in the business in the long term (Kakani 2).

Besides, another issue is that auditors report contribute to improved performance of the business in the sense that they point out areas of weaknesses which needs to be addressed. For instance, the auditors can advise on ways of reducing tax burden and therefore improve on profitability.

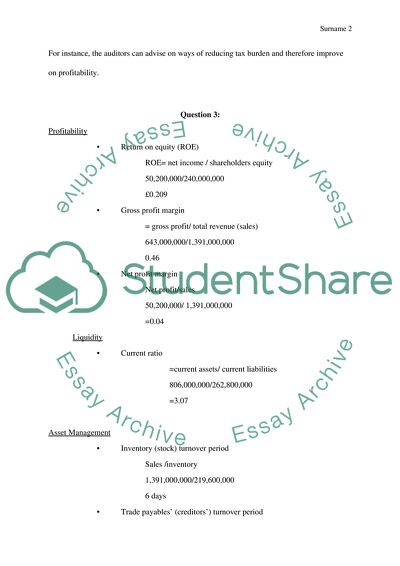

Question 3:

Profitability

• Return on equity (ROE)

ROE= net income / shareholders equity

50,200,000/240,000,000

£0.209

• Gross profit margin

= gross profit/ total revenue (sales)

643,000,000/1,391,000,000

0.46

• Net profit margin

Net profit/sales

50,200,000/ 1,391,000,000

=0.04

Liquidity

• Current ratio

=current assets/ current liabilities

806,000,000/262,800,000

=3.07

Asset Management

• Inventory (stock) turnover period

Sales /inventory

1,391,000,000/219,600,000

6 days

• Trade payables’ (creditors’) turnover period

[Trade payables/cost of sales]*365

218,300,000/1,040,400,000

0.21*365

=76 days

Other

• Gearing ratio

[Long term debt + short term debt]/ shareholders’ equity

516,600,000/111,800,000

4.62

• Price earnings ratio

Market value per share/ earnings per share

Market value per share

342,000,000/240,000

£142.5

EPS= 142.5/ [15.4+5.9]

=£6.69

Question 4

• Sales

[1391-1381.6]/1381.6*100

= 9.4/1381.6*100

=0.68%

• Operating Profit

[64.3-20.2]/20.2*100

44.1/20.2*100

218%

• Share Price

2014

34,200,000/240,000

£142.5

2013

34,100,000/240,000

£142.08

[142.5-142.08]/142.08*100

0.42/142.08*100

0.3%

Question 5

Looking at the above ratios, it is important to note a few things that have had an impact on the performance of the company. To begin with, sales grew by 0.68 per cent in the years 2014. This is a small growth in sales and it is an indicator that the company is struggling to make its sales. It may be due to the fact that the current market is mature and there are no opportunities for growth (Moore and Pareek 35). The company should now look for growth opportunities elsewhere as there is a danger that sales may eventually fall.

Operating profit in the same years grew by 218% in a period where the sales did not perform well. It can therefore be said that most of revenues contributing to operating profit came from other sources other than sales. It has to be noted that these sources are never permanent and in most cases are a one off (Kakani 76), hence contributing to the fact assertion that the company should look for ways of growing its sales.

The gearing ratio of 4.62 shows that the company is highly geared. There are a lot of debts such that for every £1, the company owes £4.62. The problem with this is that a lot of revenues goes to fund repayment of debts rather than grow the business. It is for this reason that the company should start looking for ways of reducing its debt burden. It should not be forgotten that a highly geared venture is always in a risk of collapse should it fall behind the debt repayments (Weil, Schipper and Francis 122) . The company can also look for ways of prolonging its creditor’s turnover period from the current 76 days as a way of reducing its repayments. Even though this is expensive in the long run, it can help boost short term profitability.

The current ratio of 3.07 is also advantageous to the firm as it shows that it can meet its short term obligations and is in no way in a danger of failing to meet its obligations. For every liability of £ 1 the company is able to quickly raise £3.07.

Question 6

2014

Return on Equity = Net Income /Sales × Sales /Total Assets ×Total Assets/ Total Equity

50,200,000/1,391,000,000*1,391,000,000/806,000,000*806,000,000/111,800,000

0.036089*1.726*7.209

0.4490

44.9%

2013

46,600,000/1,381,600,000*1,381,600,000/689,300,000*689,300,000/111,600,000

0.03373*2.0044*6.1765

0.41758

41.758

Looking at the above analysis, a number of issues which have led to the company’s profitability can be pointed out.

Net income has risen slightly. This increase has helped to stabilize the value of equity. Indeed, the value of net income divided by sales shows only a slight increase from the 2013 figures of 0.00235. This difference has helped to keep this indicator stable at around 0.03. Whereas net income grew by£ 3,600,000 the sales grew by £9,400,000 translating to about £0.38 for every pound in sales.

A huge increase in total assets was also witnessed in the year 2014 and this helped to add on the profitability of the company and helped to improve the value of the equity. It shows that the company was more prudent in applying it assets leading to an increase in value of the assets in the year 2014.

The above working also shows that total equity did not grow as faster to cope with the growth of total assets. Looking at a difference in total equity of £200,000 and that of £116,700,000, it can be deduced that for every growth in £1 in total equity, the total assets grew by approximately £583.5.

It has to be noted that the growth of sales has been slow and this shows when one of the values is arrived at by dividing sales by the total assets. Hence, the fall opf the value from 2.0044 in 2013 to 1.726 in the year 2014, shows that the sales in comparative figured dropped in 2014 from the levels of 2013. In actually sense, the total assets grew faster than the growth of sales in the years 2014.

Works Cited

Kakani, Ramachandran. Financial Accounting For Management. Delhi: Tata McGraw-Hill Education, 2007.

Moore, Karl and Niketh Pareek. Marketing: The Basics. London: Taylor & Francis, 2006.

Weil, Roman, Katherine Schipper and Jennifer Francis. Financial Accounting: An Introduction to Concepts, Methods and Uses. Washington: Cengage, 2011.

Read

More

CHECK THESE SAMPLES OF Financial Information

Qualitative Characteristics of Financial Information

The paper "Qualitative Characteristics of Financial Information" has put forth the financial reporting framework and the role of qualitative characteristics of Financial Information.... Generally speaking, this essay aims to present an analysis of the qualitative characteristics of Financial Information and the major constraints presented by these characteristics.... The financial reporting conceptual framework is a coherent system of concepts that underlie Financial Information reporting....

8 Pages

(2000 words)

Essay

Analysing Financial Information

ANALYSING Financial Information Table of Contents Regulation of Accounts in UK…………………………………………………………….... rs of the business entity about its Financial Information.... to gather information about various financial aspects of the company which can help them in various decision making process.... Regulation of accounts in UK Accountancy can be defined as a process of bookkeeping of financial transaction records in order to help communicating it to the stakeholde....

4 Pages

(1000 words)

Essay

Corporate Financial Information Analysis

This picture suddenly changed its color in the summer of 2007, after the advent of global credit crisis and financial downturn.... his report aims to offer an insight into the financial analysis of the two companies in the light of the credit crisis on the financial state of these companies.... The past and current financial performances of any company are significant to shape up the future funding strategies of the respective organisation....

18 Pages

(4500 words)

Essay

The Simplifying Financial Information

This paper ''The Simplifying Financial Information'' tells us that ratios are important in simplifying Financial Information for easy interpretation by different users of Financial Information.... The standardized scope of financial ratios also limits quantitative aspects of the communicated information because the ratios do not communicate exact values of Financial Information.... Pending litigations about an entity are for example not reflected in financial statements and therefore do not affect financial ratios....

1 Pages

(250 words)

Essay

Integrating Financial Information

This paper ''Integrating Financial Information'' tells us that the status of a company does not depend on its financial position alone.... Specifically, the program uses both financial and non-Financial Information to establish the effectiveness of the business in maintaining a viable and sustainable business environment (IIRC n.... hy do you think NASDAQ is beginning to require more information on a firm's corporate governance and environmental activities?...

2 Pages

(500 words)

Essay

Managing Financial Information

This paper ''Managing Financial Information'' tells that Management of Financial Information is becoming one of the toughest and most challenging tasks in the ever-changing business environment.... It is very much required by a business organization to clearly analyze its financial situation and then act accordingly....

5 Pages

(1250 words)

Case Study

Activities and Financial Position of Greencore Group Plc

The paper "Activities and financial Position of Greencore Group Plc" is a perfect example of a case study on finance and accounting.... The paper "Activities and financial Position of Greencore Group Plc" is a perfect example of a case study on finance and accounting.... This report presents analyses of the company's activities and financial position using ratios, DuPont model, and trend performance.... market was characterized by two major acquisitions with the first one settled in the financial year 2008 and the second, the financial year 2010....

7 Pages

(1750 words)

Case Study

The Provision of Financial Information

The paper 'The Provision of Financial Information' is a detailed example of a finance and accounting essay.... The paper 'The Provision of Financial Information' is a detailed example of a finance and accounting essay.... The paper 'The Provision of Financial Information' is a detailed example of a finance and accounting essay.... Financial Information is considered material if it has the capacity to influence the economic decisions of investors or inferences drawn by interested parties....

6 Pages

(1500 words)

Essay

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Financial Information"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY