StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Relative Performance Trade

Free

Relative Performance Trade - Essay Example

Summary

Equities have outperformed other investments. Assets within the equities asset class include investment company stock and bank stocks. Investment…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER93.4% of users find it useful

- Subject: Finance & Accounting

- Type: Essay

- Level: Ph.D.

- Pages: 4 (1000 words)

- Downloads: 0

- Author: mernser

Extract of sample "Relative Performance Trade"

Develop a well-reasoned hypothesis regarding the relative performance of two assets within the asset Equities Interest rates

Energy

Agriculture

Equities (stocks); involves the investment in shares of public traded companies either for short term trading or long term holding. Equities have outperformed other investments. Assets within the equities asset class include investment company stock and bank stocks. Investment companies stocks usually perform well in the long run. Bank stocks perform well both in the short term and in the long run. In this case, Investment company stock is likely to outperform bank stocks in the long run mainly due to the fact that they are diversified and usually invest aggressively to maximize on long term returns. Banks although they also perform well, they are limited to only one sector.

Interest Rates; this involves the trading in options for future performance of interest rates and coupon rates like for treasury bonds. This are either exchange traded or over the counter instruments. An investor taking a long option in interest call options believes that the interest rates will rise.

Energy; this options include trading on speculation of future energy prices like gas and oil. This vary depending on issues like oil exploration findings, oil spills. Future options in energy sector

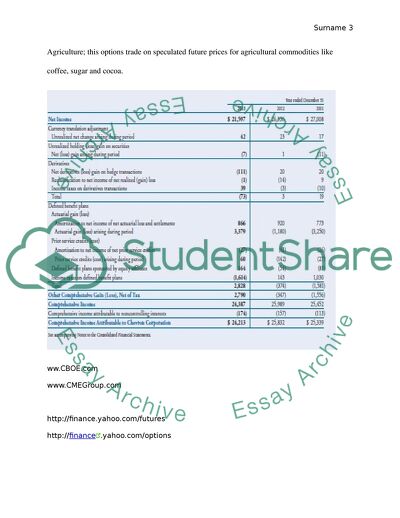

Agriculture; this options trade on speculated future prices for agricultural commodities like coffee, sugar and cocoa.

ww.CBOE.com

www.CMEGroup.com

http://finance.yahoo.com/futures

http://finance.yahoo.com/options

You may also use the Bloomberg Terminals available on Paces 1 Pace Plaza, White Plains, and Pleasantville campuses.

Relative performance trade

Option traders use calls and puts to hedge risks and exploit volatility. A call option gives a writer a right to sell a stock at a given price in the future. A put option gives a writer the right to purchase a share at given price in future. Whereas futures require no upfront costs (other than commissions), options require upfront payment of premium. Market neutral pairs provide a hedge against market risk. Exposure to market is exchanged with relationship between short and long position. Therefore trade pairs reduce returns loss due to variability of the market. The first step in each of the assets; Equities, interest rates, Energy and agriculture is to select 2 securities that are related. The first step is to select closely related securities. This may be done by using a correlation coefficient. Traders try to look for securities with a high level of correlation so that they can profit when prices behave outside the statistical mode. Thereafter we can determine a price ratio between the 2 selected securities. The disadvantages of trade pairs is that the trader faces twice the fees and commissions, this is in entering the trade and in exiting the trade.

The potential for profit can be identified when the profit ration hits its first or second deviation. The trader waits for weakness in the correlation and then go long on the underperformer while going short on the over performer. Profit is realized if long position goes up more than the short or short position goes down more than the long. Trader will sell the over performing security and purchase more of the underperforming security. This means from the proposed strategy, the trader will over the assigned 12 week period monitor the stocks and gradually sell the over performing stock while simultaneously purchase more of the underperforming stock. In this example if maybe in week 6 Walmart share is at $ 80, and those for Target are at $80, the trader will sell the Walmart over performing shares and purchase more of Target underperforming shares.

www.onechicago.com

www.Optionmonster.com

In interest rates market, the trader may use closely related bonds

In the energy market, Exxon and Chevron may be selected as the 2 are closely related. They recorded quarterly and yearly profits that triggered the response of the congress in a bid to control the unregulated markets that supply energy. The Foundation of Taxpayer and consumer Rights claims that the energy providing company. Exxon was making over 70,000 per minute by adulterating the crude oil prices. This eventually made the price of oil to reach unjustifiable levels. From such profits, other oil companies have been forced to implement the electronic energy trading so it can be regulated.

As the housing collapse started the economic meltdown the energy prices were doomed to rice. Despite the fact that the demand of gasoline reduced drastically, the prices of their shares during the third quarter and fourth quarter were not drastically affected. The oil and fuel have a tremendous effect on all parts of the economy. This is evident from the $300 plus of the fuel surcharges that are sued in the long air lines.

The Enron legacy is been seen as an out of control price that has seen the hedg funds and the various oil companies to add more money in a bid to regulate the market. The speculators are usually able to create hysteria for all the oil producing companies and reflect a different picture in the actual market conditions. All the major oil companies are able to make incredible profits that are facilitated by the multibillion dollar tax subsidies that are very evident in this industry. There are few publicly available databases that have historical profit that the oil companies make. Most of them are hidden so that they will not be taxed. There is little or any data that is available that can show how the influence market factors. Things such as the price of the oil, the pump price of gasoline will greatly influence the price of oil products in the online market. Merging of different oil segment can also have great influence.

In the equities security market, an example of related stocks is Wal-Mart and Target, if for example Walmart shares are trading at $ 50 per share and Target at $ 100 per share, we can have long of shares of Walmart trading at $ 50 for $500,000 and short of Target trading at $ 500,000. The aim is to trade one share long and the other short if the pair price ratio diverges X number of standard deviation – X is optimized by standard deviation. If the pair reverts to its mean trend, a profit is made on one or both of the positions. In this example the price ratio is 100/50 = 2. The hypothesis is that the 2 stocks will face the same dynamics and almost exhibit similar price rises and fall. However when there is a deviation, it is minimized.

Work cited

www.onechicago.com

www.Optionmonster.com

Read

More

CHECK THESE SAMPLES OF Relative Performance Trade

Production and Trade at the International Arena

The paper "Production and trade at the International Arena" states that the comparison of the relative gains that countries get for taking part in a certain form of trade would assist countries to find the appropriate beneficial combination of international trade engagements.... From a basic application perspective, the theory of comparative advantage is the analysis that countries ought to approach venturing into international trade, in light of the relative cost-benefit assessment....

5 Pages

(1250 words)

Assignment

Discuss the Role of Exchange Traded Currency Options in Risk Management

Over the counter (OTC) transactions are primarily utilized in currency options trade.... Numerous international corporations face unaccountable business risks that do not threaten their daily business aspects, but also the long term operations and performance.... Topic: Discuss the role of exchange traded currency options in risk management Institution Affiliation: Date: Contents Trading Currency Options 7 Currency volatilities and the underlying risks 8 Interest rate consideration 9 Hedging with Options-Risk Management Factor 10 Conclusion 11 References 12 Introduction Exchange traded currency options make use of contracts that are standardized, given the specific currency underlying in such exchange transaction....

9 Pages

(2250 words)

Essay

The Impact of International Trade on U.S. Economy

The world has witnessed rapid economic regionalization in the last decade, as evidenced by the proliferation of free trade agreements among nations.... Running head: The Impact of International trade on U.... Economy The Impact of International trade on U.... Economy Insert Name Insert Grade Course Insert Tutor's Name 26 March 2012 The Impact of International trade on U.... Economy Introduction The world has witnessed rapid economic regionalization in the last decade, as evidenced by the proliferation of free trade agreements among nations....

5 Pages

(1250 words)

Essay

Currency Trader/ Forex Trader/ Day Trader

In this regard, I calculate the amount I might lose in a trade even before I get into the trade.... For instance, I made a purchase in the morning, convinced that the trade would give me a clean profit of $500.... Thus, the point is that my opinion of a hike in the market should not influence me to flicker away from the pre set parameters of my trade.... Stopping loss at the right point and aborting the market at the right juncture would be the key for a day trader to realistically improve his/her performance....

4 Pages

(1000 words)

Essay

Absolute Returns and Relative Performance in Investment Management

From the paper "Absolute Returns and relative performance in Investment Management" it is clear that the diversification of firm-specific risks by shareholders on capital markets acts as an efficient social insurance method that mitigates risks of job loss as a result of globalization.... relative performance describes the difference between absolute return and market performance.... relative performance enhances the measurement of performance of the actively managed funds with higher returns than the market (Brown & Kapadia 2007, p....

10 Pages

(2500 words)

Assignment

Laws of Comparative Advantage

The causal chain of the Ricardian theory runs from labor costs to autarky prices to the direction of trade.... Given the imperfections in a trade that we postulated above, however, post-trade prices in each country should partly reflect autarky prices.... Ricardo encouraged each country to specialize in producing commodities for which it is best suited and then trade with other countries to obtain a wide variety of goods.... This theory suggests that all nations have an interest in opposing restraints on trade....

12 Pages

(3000 words)

Essay

Export response to trade liberalisation in india: a cointegration analysis

Under global trade regime countries get the chance to indulge itself in specialization in the sphere of production.... Global trade allows country to specialize in those goods, which they.... Under global trade arena countries can also buy other things which After setting up of WTO with an aim to enhance international trade to a large extent by demolishing all kinds of trade barriers imposed by individual countries, the member states of WTO has been making extensive efforts to liberalize their trade with each other and with other countries as well....

32 Pages

(8000 words)

Essay

The US Trade Deficit

This essay "The US trade Deficit" focuses on the U.... economy has had a growing trade deficit over the recent past, few decades.... trade has undergone evolution and is currently defined as the cost incurred by companies, individuals and government agencies over the products produced in foreign countries annually.... Many countries, if not all, rarely import a similar amount of products they export; this underperformance leads to an imbalance in trade....

7 Pages

(1750 words)

Essay

sponsored ads

Save Your Time for More Important Things

Let us write or edit the essay on your topic

"Relative Performance Trade"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY