StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Finance and Accounting - Net Profit

Free

Finance and Accounting - Net Profit - Coursework Example

Summary

This paper "Finance and Accounting - Net Profit" focuses on the net profit which is generated from profit and loss account, and cash flow from operations is generated from cash flow statement. Thus, there is the difference between net profit and cash flow from operating activities. …

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER94.2% of users find it useful

- Subject: Finance & Accounting

- Type: Coursework

- Level: Undergraduate

- Pages: 4 (1000 words)

- Downloads: 0

- Author: ufadel

Extract of sample "Finance and Accounting - Net Profit"

Net Income - The Profit of a Business After Deducting

Contents

Net Income - The Profit of a Business After Deducting 1

Task 2:- 3

Task 3. 4

Task 4. 5

References 7

Appendices 8

Task 1:-

Net profit is generated from profit and loss account and cash flow from operations is generated from cash flow statement. Thus there is difference between net profit and cash flow from operational activities and they might not b equal during a specific period. Profit and loss account can be defined as the statement where expenses and income of a company is calculated and net profit/loss is generated. Cash flow can be stated as the money that comes in and out because of different operating, investment and financial activities. But net profit can be derived by subtracting all expenses from the sales revenue of the firm. Generally accrual method of accounting is followed by all the firms worldwide and according to this method of accounting, net profit/income is generated from the difference3 between all the expenditures which are incurred by the firms and the sales revenue of the firm. For example, if a company earns sales revenue in the month of December and from that 90% is credit sales which will be recovered in the month of February then the amount of revenue will be increased for the month of December but the net cash flow of the company not increase in December. Thus when income and expenses occur in one accounting period and payments and received get done in another period then it makes the change between cash flow from operating activities and net cash flow oaf the company.

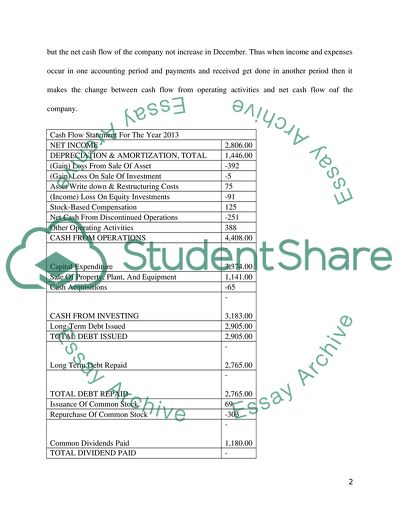

Cash Flow Statement For The Year 2013

NET INCOME

2,806.00

DEPRECIATION & AMORTIZATION, TOTAL

1,446.00

(Gain) Loss From Sale Of Asset

-392

(Gain) Loss On Sale Of Investment

-5

Asset Write down & Restructuring Costs

75

(Income) Loss On Equity Investments

-91

Stock-Based Compensation

125

Net Cash From Discontinued Operations

-251

Other Operating Activities

388

CASH FROM OPERATIONS

4,408.00

Capital Expenditure

-3,374.00

Sale Of Property, Plant, And Equipment

1,141.00

Cash Acquisitions

-65

CASH FROM INVESTING

-3,183.00

Long-Term Debt Issued

2,905.00

TOTAL DEBT ISSUED

2,905.00

Long Term Debt Repaid

-2,765.00

TOTAL DEBT REPAID

-2,765.00

Issuance Of Common Stock

69

Repurchase Of Common Stock

-303

Common Dividends Paid

-1,180.00

TOTAL DIVIDEND PAID

-1,180.00

Other Financing Activities

-92

CASH FROM FINANCING

-1,366.00

Foreign Exchange Rate Adjustments

24

Miscellaneous Cash Flow Adjustments

-6

NET CHANGE IN CASH

-123

Net Profit $2806 million.

From the above hypothetical cash flow statement, it can be seen that the net profit is $2806 million and cash flow from operation is $4408 million. We can see the difference between the net profit and the cash from operating activities. It is because calculation of net profit includes all the expenses incurred by the company and the sales revenue but cash generated from operating activities include cash acquisitions, revenue from selling of plants, capital expenses. Thus both cannot be equal at all the time. An organization can have net profit but it may also have negative cash flow from operating activities and it indicates that liquidity of the company is not good.

Task 2:-

International Accounting Standard 7 statement of cash flow has shown two methods to calculate the cash flow generated from operating activities and those are direct and indirect method. According to the direct method of calculation, information about major elements of gross cash receipts and cash payments is shown as separately and the records of accounts, cost of sales, income statement and sales revenue amount can be used to get the information about the gross cash payments and cash receipts (Thornton, 2012, p.16). But in case of indirect method, profit and loss of the company is adjusted on the items related to investing and financing activities and it also considers the effect of non cash items like inventory, depreciation, provisions, gains and loss in foreign currency transaction, changes in the amount of payables and receivables and tax liabilities.

Task 3.

a. The cash flow from operating activities for the company Cisco is $12894 million for the year 2013 and it is $ 11491 million for the year 2012. The cash flow has increased over the years as the company has gained on sale of investment and the net income of the company has also improved over the years from 2012 to 2013.

The cash flow from operating activities for the company Motorola is $944 million for 2013 and it is $1070 for the year 2012. The net cash flow from operating activities has reduced over the years due to due to increase in the amount of depreciation and amortization and negative income from operating activities.

b. The working capital for the company Cisco is $44202 million for 2012 and $43329 million for the year 2013. Increment in working capital indicates that the company is effective enough to manage its day to day activities.

The working capital for the company Motorola is $4066 million for 2012 and $3800 million for 2013. The working capital of the company has decreased over the years which indicate that the management is not efficient enough to increase the current assets and decrease the current liabilities of the company.

c. The cash flow from financing activities for the company Cisco is negative for both years 2012 and 2013. It is due to increase in issuance of common stock and repurchase of common stock.

The cash from financing activities is negative for both the years for the company Motorola. Though the negative amount has decreased over the years but still the company has negative cash flow from financing activities. Although both the companies has earned negative cash flow but it can be said that Motorola will face lower risk than Cisco as it has less negative amounts than Motorola.

d. The cash flow from investing activities for the company Cisco is negative for both years. The cash flow from investing activities for the company Motorola is $797 million for 2012 and it has increased to $2010 for 2013. Thus it can be said that the company Motorola has prudent investment strategy as compared to Cisco.

Task 4.

From the above study we can analyze the cash flow of both the companies. The cash flow from operating activities is better for Cisco as compared to Motorola is terms of amount of cash flow. In case of working capital management we can see that the company Cisco is more efficient than the Motorola in terms of managing working capital for day to day activities. But in case of cash flow from financing activities, Motorola will face lower risk than Cisco and Motorola has more prominent investment strategy as compared to Cisco as the company ahs positive cash flow from investment activities. Thus it can be said that Motorola is more efficient than Cisco in terms of investment strategy and less risk from long term debts but Cisco is better than Motorola as it is more efficient in generating cash flow from operating activities and in working capital Management.

References

Thornton, G., 2012. IAS 7: Statement of Cash Flows. [Pdf]. Available at: http://www.grantthornton.se/Global/Dokument/Tjanster/Radgivning/IFRS/2012/IAS%207%20Statement%20of%20Cash%20Flows.pdf. [Accessed on February 18, 2014].

Bloomberg., 2014. Cisco Systems Inc. [Online]. Available at: http://investing.businessweek.com/research/stocks/financials/financials.asp?ticker=CSCO&dataset=cashFlow&period=A¤cy=native. [Accessed on February 18, 2014].

Bloomberg., 2014. Motorola Solutions Inc. [Online]. Available at: http://investing.businessweek.com/research/stocks/financials/financials.asp?ticker=MSI&dataset=cashFlow&period=A¤cy=native. [Accessed on February 18, 2014].

Appendices

Cash Flow Statement Of Cisco

Currency in

28-Jul

27-Jul

Millions of US Dollars

2012

2013

Reclassified

Reclassified

NET INCOME

8,041.00

9,983.00

Depreciation & Amortization

2,219.00

1,956.00

Amortization Of Goodwill And Intangible Assets

383

395

DEPRECIATION & AMORTIZATION, TOTAL

2,602.00

2,351.00

(Gain) Loss On Sale Of Investment

-31

9

Asset Writedown & Restructuring Costs

--

--

Other Operating Activities

-314

-37

Tax Benefit From Stock Options

-60

-92

Provision & Write-Off Of Bad Debts

50

44

Change In Accounts Receivable

272

-1,001.00

Change In Inventories

-287

218

Change In Accounts Payable

-7

164

Change In Unearned Revenues

727

598

Change In Income Taxes

418

-239

Change In Other Working Capital

-1,321.00

-224

CASH FROM OPERATIONS

11,491.00

12,894.00

Capital Expenditure

-1,126.00

-1,160.00

Cash Acquisitions

-375

-6,766.00

Investments In Marketable & Equity Securities

-2,480.00

-3,916.00

CASH FROM INVESTING

-3,815.00

-11,768.00

Short-Term Debt Issued

--

--

Long-Term Debt Issued

--

24

TOTAL DEBT ISSUED

--

24

Short Term Debt Repaid

-557

-20

Long Term Debt Repaid

--

-16

TOTAL DEBT REPAID

-557

-36

Issuance Of Common Stock

1,372.00

3,338.00

Repurchase Of Common Stock

-4,760.00

-3,103.00

Common Dividends Paid

-1,501.00

-3,310.00

TOTAL DIVIDEND PAID

-1,501.00

-3,310.00

Other Financing Activities

-93

87

CASH FROM FINANCING

-5,539.00

-3,000.00

NET CHANGE IN CASH

2,137.00

-1,874.00

Particulars

2012

2013

Working Capital

44,202.00

43,329.00

Cash Flow Statement of Motorola

Currency in

31-Dec

31-Dec

Millions of US Dollars

2012

2013

NET INCOME

881

1,099.00

Depreciation & Amortization

179

202

Amortization Of Goodwill And Intangible Assets

29

26

DEPRECIATION & AMORTIZATION, TOTAL

208

228

(Gain) Loss From Sale Of Asset

--

--

(Gain) Loss On Sale Of Investment

-39

-40

Other Operating Activities

256

-243

Minority Interest

--

6

Net Cash From Discontinued Operations

2

--

Change In Accounts Receivable

81

-66

Change In Inventories

-3

-10

Change In Accounts Payable

-162

-201

Change In Other Working Capital

-338

18

CASH FROM OPERATIONS

1,070.00

944

Capital Expenditure

-187

-191

Sale Of Property, Plant, And Equipment

56

66

Cash Acquisitions

-109

-65

Investments In Marketable & Equity Securities

1,075.00

2,200.00

CASH FROM INVESTING

797

2,010.00

Long-Term Debt Issued

747

593

TOTAL DEBT ISSUED

747

593

Short Term Debt Repaid

--

--

Long Term Debt Repaid

-413

-4

TOTAL DEBT REPAID

-413

-4

Issuance Of Common Stock

133

165

Repurchase Of Common Stock

-2,438.00

-1,694.00

Common Dividends Paid

-270

-292

TOTAL DIVIDEND PAID

-270

-292

Other Financing Activities

-53

25

CASH FROM FINANCING

-2,294.00

-1,207.00

Foreign Exchange Rate Adjustments

14

10

NET CHANGE IN CASH

-413

1,757.00

Particulars

2012

2013

Working Capital

4,066.00

3,800.00

Read

More

CHECK THESE SAMPLES OF Finance and Accounting - Net Profit

Finance for Leisure, Tourism, and Hospitality

There as per the accrual concept, any amount that is owed by the business in the current accounting period needs to be recorded in books of accounts so that it is added to expenses in the profit and loss account.... Similarly, any income that is earned during the current accounting year but not received must be credited to the profit and loss account for the year.... Those advance payments of expenditure and advance receipts of income will not be shown in the profit and loss account of the current period but will be treated as current assets and current liabilities in the balance sheet....

7 Pages

(1750 words)

Essay

Finance in the Hospitality Industry

The only disadvantage of this source of capital is that it is not always available, especially during periods when the business is not making the profit.... This paper "finance in the Hospitality Industry" focuses on a business that has several options from which the trader can access finances for capital expenditure.... This source of finance is the most economical for funding business enterprises because there is no interest charged (Drury, 2003)....

17 Pages

(4250 words)

Assignment

Financial Management Questions

A listed company's directors have the power to decide when the distribution of profit should occur, depending on whether the company has made profits or not.... A listed company ought to embrace a proactive profit distribution strategy.... It should be noted that a profit distribution exercise should not reduce the company's net assets below the aggregate of its called-up share capital and undistributed reserves.... Managers of listed companies should invest cash in hand on projects that have positive net present values....

7 Pages

(1750 words)

Essay

Accounting and Finance Trump Ltd

he net profit margin ratio tells us the amount of net profit per £1 of turnover a business has earned.... That is, after taking account of the cost of sales, the administration costs, the selling and distributions costs, and all other costs, the net profit is the profit that is left, out of which they will pay interest, tax, dividends and etc.... here is a favorable amount of increase in the net profit margin of British airways this is because the company may able to control its operating expenses as compared to last year for example British airways depreciation and amortization expense have decreased to 714m from 715m....

8 Pages

(2000 words)

Assignment

Governmental and Non-Profit Accounting

This paper "Governmental and Non-profit Accounting" explains that accounting is a process involving recording, classifying, and summarizing financial transactions.... Accountability is a key theme found whenever a study is carried out on governmental and non-profit accounting.... Governments and non-profit organizations do not have services or products that are judged by the bottom-line profits to shareholders or the commercial marketplace as noted by Siegel and Shim (2006)....

6 Pages

(1500 words)

Report

Managing Financial Resources and Divisions

This largely affects their profit margins.... This paper under the title "Managing Financial Resources and Divisions" focuses on the fact that, for instance, the company for which you are a senior accountant has recently won a major government contract to supply equipment to the health service and it is the biggest contract ever won by them....

16 Pages

(4000 words)

Assignment

Finance in Hospitality

This paper seeks to describe the sources of funds, their contribution to the businesses; elements of costs, gross profit percentages and selling prices for products and services, and methods of controlling stock and cash; the budgetary control; the trial balance and financial ratios.... According to the report, the business and services industries require capital in order to finance the initial costs, maintenance and repair of the business from time to time.... These aspects of finance are discussed below....

20 Pages

(5000 words)

Assignment

The Role of Accounting Information in a Business Context

This will help the owners to establish the status of the business, and that is whether it is operating at a loss or on profit and the magnitude of each.... This paper 'The Role of accounting Information in a Business Context' seeks to investigate the various forms of business enterprises, accounting practices, as well as the sources of business capital.... To successfully run any of the three forms of business, proper accounting records have to be maintained by qualified personnel, either a management accountant or a financial accountant....

7 Pages

(1750 words)

Essay

sponsored ads

Save Your Time for More Important Things

Let us write or edit the coursework on your topic

"Finance and Accounting - Net Profit"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY