StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Financial Statement and Cash Flow Analysis

Free

Financial Statement and Cash Flow Analysis - Assignment Example

Summary

The paper "Financial Statement and Cash Flow Analysis" is a perfect example of an assignment on finance and accounting. Though the current ratio of the company is lower than the industry, yet it has the capability to pay off liabilities in the short run with the help of short-term assets…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER92.9% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

- Author: ckemmer

Extract of sample "Financial Statement and Cash Flow Analysis"

Part A a) Free Cash Flow of Jaeden Industries Free cash Flow ment Operating Activities

Amount in $

Amount in $

Net income

6268975

Adjustments to reconcile net income to net cash

Accounts Receivable decrease

2555500

Accounts Payable increase

190000

Depreciation

800000

3545500

Net cash flow from Operating activities

9814475

Investing activities

Debt

-3046000

Net cash flow from investing activities

-3046000

Financing activities

10228819

Net increase in cash equivalents

4136819

Cash equivalent at the beginning of period

871319

Net cash flow at the end of period

5008138

The table above denotes the cash flow statement of Jaeden Industries, which determines free cash flow of the company. It is noticed that net cash flow at the end of the period is quite satisfied for the year 2010. The company has been incurring a satisfied cash flow, which they can utilize in extension of the company.

b)

Jeaden’s Liquidity

Ratios

Jaedens’s Liquidity Ratio

Industry Liquidity ratio

Current Ratio

2.65

3.26

Quick Ratio

1.84

2.19

Accounts receivable turnover ratio

10.13

Average collection period

36.02

36.17

Inventory turnover

7.22

6.59

Days sales in inventory

50.54

Inventory to net working capital

0.63

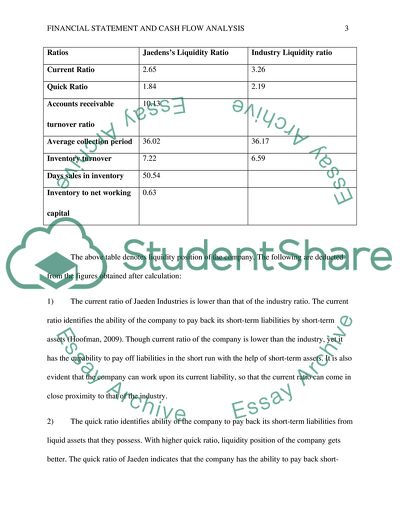

The above table denotes liquidity position of the company. The following are deducted from the figures obtained after calculation:

1) The current ratio of Jaeden Industries is lower than that of the industry ratio. The current ratio identifies the ability of the company to pay back its short-term liabilities by short-term assets (Hoofman, 2009). Though current ratio of the company is lower than the industry, yet it has the capability to pay off liabilities in the short run with the help of short-term assets. It is also evident that the company can work upon its current liability, so that the current ratio can come in close proximity to that of the industry.

2) The quick ratio identifies ability of the company to pay back its short-term liabilities from liquid assets that they possess. With higher quick ratio, liquidity position of the company gets better. The quick ratio of Jaeden indicates that the company has the ability to pay back short-term liabilities from its liquid assets, since value of the ratio is greater than 1. However, the company should concentrate on increasing current asset, so that they are capable enough to match with the industry ratio (Jennings, 2006).

3) The average collection period of the company and the industry are in the same line, which denotes that the company gives the same amount of time to debtors to pay back the debt, as the industry (Albrecht, 2011).

4) Inventory turnover ratio of a company shows the number of times that the company’s inventory are sold and then replaced by new products, so as to fill up the same. It is observed from the inventory turnover ratio of the company and the industry that the former is selling their products 7 times faster than other companies in the industry. Thus, it can be inferred that the company is performing well, as far as sales is concerned and the company’s products have huge demand (Warren , 2009).

c)

Leverage or debt ratio

Ratios

Jaedens’s Solvency Ratio

Industry Solvency ratio

Debt Ratio

0.41

0.39

Times interest earned- income

26.33

Times interest earned - cash flow (interest coverage)

27.86

16.81

Total asset to equity

1.49

16.3

Total liabilities to total assets

0.41

Total liabilities to equity

0.83

The above table denotes profitability ratio of the company and the industry, which indicates the following:

1) The debt ratio denotes the degree of leverage of the company. A higher debt ratio denotes that the company is prone to financial risk. This ratio varies widely across industries. The debt ratio of the company suggests that it is prone to financial risk, as compared to other companies in the industry. This can be so inferred, since debt ratio of the company is greater than that of the industry.

2) Times interest earned - cash flow denotes the ability of the firm to pay back the interest on outstanding debt of the company. The above figures of the company and industry indicate that the former has higher ability to pay off interest on outstanding debts.

3) The total asset to equity of Jaeden and the industry denote that the company has lower total asset as compared to other companies in the industry.

Profitability Ratio

Ratios

Jaedens’s Profitability Ratio

Industry Profitability ratio

Return on assets

38.8%

Return on equity

200%

Gross margin

30.0%

23.74%

Operating margin

25.6%

20.89%

Profit margin

16.3%

17.97%

Total asset turnover

2.39

Fixed assets turnover

2.89

Current asset turnover

3.01

The above table denotes profitability ratio of the company and the industry. The following can be deduced, after drawing a comparison between the two:

1) The gross margin of the company is higher than the industry, which denotes that the former is performing with respect to other companies in the industry. Sales of the company are higher than other competing companies in the industry.

2) The profit margin of the company is lower than that of the industry, which suggests that other companies in the industry are earning more operating revenue than the company.

Market Ratio

The market ratios are calculated in order to get the value of the company and to understand how investors evaluate the company’s financial status. The investors are concerned about investing in the right stock as that enables them to earn a profitable amount. The market ratios actually evaluate market price of the share of the stock that is provided by the company.

Few of the market ratios are calculated for Jaeden Industries:

Ratio

Values

Price to earnings ratio

9.83

Dividend yield ratio

5684

Cash flow ratio

2.4

Price to book ratio

26.46

Price earnings ratio = Price per share/ Earning per share

Dividend yield ratio = Annual dividends per share/ Price per share

Cash flow ratio = cash flow from operation/ Current liabilities

Price to book ratio = Price per share/ Book value per share

Part B

The strength and weakness of a particular company is dependent on their financial status, company reputation, sales revenue and also, external factors, like, economic, political and social aspects. The financial status of the company depends on the debt ratio to a great extent. If the debt ratio increases, it indicates that the company can face financial risk in future. Other than debt ratio, the current ratio also measures the liquidity of the company, which is whether it is capable of paying off its long and short-term liabilities.

The three weakness and strengths that can be determined from the analysis are as follows:

Strengths

1) The company has sufficient cash flow at the end of 2010, which denotes enough cash balance to fund its future development.

2) Jaeden has a greater potential than the industry to pay off its interest on outstanding debt.

3) The gross margin of the company is higher than that of the industry.

Weakness

1) The debt ratio of the company is higher than that of the industry it is indicated of th4 fact that Jaeden is prone to financial risk since the total liabilities are greater than that of the total assets.

2) The profit margin is also lower than other companies in the industry, which suggests that the company has higher expenditure than the others.

3) The company possesses lower total asset to equity ratio, which indicates that the company has lower asset base with respect to equity.

Recommendations

There are many financial risks that threaten companies to a large extent. The threats are to be dealt with great care, since a wrong decision can render a company bankrupted. The following are the ways of improving the financial status of the company, which are relevant for Jaeden Industries too:

1) The total asset of the company should be improved. It is noticed that there has been sharp decline of total asset in 2010 from 2009. The company should reduce the inventory through sales and bring in cash. The company should invest in more and more market securities so that they get increased return in future. If total asset increases, the total asset to total liability will also decrease which indicates that the company is in a stable position and has enough asset to pay off the liabilities. The decrease in the debt ratio will also indicate that the company is free from any financial crunch in future.

2) The company can make investment in purchasing more land and equipments which will help them to expect for good future return.

3) Jaeden can improve its profit margin by concentrating on expenditure of the company; expenditure of the company is higher than the others in the industry. Despite a higher gross margin, the company is unable to earn higher profit margin than the industry average.

4) The company should concentrate on issuing more shares so that they get more investors.

References

Albrecht, W. (2011). Financial accounting. New York: South-Western Cengage Learning.

Hoofman, G. (2009) . Financial accounting. Boston: Houghton Mifflin Company.

Jennings, R. (2006). Financial accounting. Singapore: British Library Cataloguing-in- Publication Data.

Warren , C. (2009). Financial accounting. New York: South-Western Cengage Learning.

Read

More

CHECK THESE SAMPLES OF Financial Statement and Cash Flow Analysis

Embracing Cash Flow Ratios for Predicting Financial Future

This project "Embracing cash flow Ratios for Predicting Financial Future" discusses the presence and use of depreciation in the income statement; by its very nature depreciation does not occur through the exchange of cash; it is unable to facilitate the actual use of cash.... The concept of cash flow ratios is not new to accounting.... The fundamental use of a cash flow statement is to measure and evaluate financial performance.... However, if cash flow information is significant and useful but unutilized, this would lead to conclude that analysts are not evaluating data as they should evaluate them (Carslaw and Mills,1991)....

74 Pages

(18500 words)

Capstone Project

Cash Flows Analysis and Financial Statements

cash flow analysis and financial statements Question 1: A company's financial information is usually utilized by various people and who are impacted directly or indirectly by this information.... The employees of ProTek Company would be interested in the organization's cash flow as well as the sound performance of the company.... Question 7: Ratio analysis was formulated to basically try and provide a synopsis of the company's performance.... Ratio analysis is obtained through dividing very important to the organization since it basically evaluates the company's financial statements and provides recommendations....

4 Pages

(1000 words)

Assignment

Financial Statements

The four basic financial statements are balance sheet, income statement, statement of changes in equity, and cash flow statement.... Statement of cash flows is a record of a company's cash flow activities such as the investing, operating and financing undertakings.... Financial Statements 8th, January, 2013 Introduction A financial statement can be defined as a record that shows the financial activities of a business, individual, or other entity....

4 Pages

(1000 words)

Essay

Finance, Accounting Financial Statement and Cash Flow Analysis

The paper 'Finance, Accounting Financial Statement and Cash Flow Analysis' is a detailed example of a finance & accounting report.... The paper 'Finance, Accounting Financial Statement and Cash Flow Analysis' is a detailed example of a finance & accounting report.... The operating cash flow of the firm is calculated by adding Earnings before interest and tax to the Depreciation and then deducting the tax.... The Free cash flow has been derived from the beginning by calculating the operating cash flow of the firm....

13 Pages

(3250 words)

Financial Statement Analysis for JB Hi-Fi

Moreover, the financial status of the company is shown by an analysis of financial statement ratios like profitability ratios, liquidity, and activity ratios.... PurposeThe purpose of this financial statement exploration is to get a basis for forming opinions about the investment value of JB Нi-Fi Company and the expectations of the future performance.... The financial analysis report surveys JB Нi-Fi Company Limited an Australian-based company....

12 Pages

(3000 words)

Commonwealth Bank of Australia and Satyam - Strengths and Weaknesses of Financial Statements Analysis

As a matter of fact, financial statement analysis means evaluating the fiscal weaknesses and strengths of an organization on the grounds of financial statements and accounting data.... As a matter of fact, financial statement analysis means evaluating the fiscal weaknesses and strengths of an organization on the grounds of financial statements and accounting data.... As a matter of fact, financial statement analysis means evaluating the fiscal weaknesses and strengths of an organization on the grounds of financial statements and accounting data....

12 Pages

(3000 words)

Case Study

The Role of Financial Statements and Financial Analysis for Organizations

The balance sheets, income statements, and cash flow statements are the most important financial statements to the company as well as shareholders.... However, despite their importance to organizations, the usefulness of financial statements will be lost if the information they provide is not interpreted carefully and precisely by those tasked with financial statement analysis (Periasamy2009).... In most cases, companies have gone out of business because the process of financial statement analysis was either not done correctly or organizations' financial officers underestimated the importance of proper financial statement analysis....

12 Pages

(3000 words)

Case Study

Balance Sheet, Cash Flow Statement and Income Statement

Financial statements include balance sheets, income statements, and cash flow statements.... Financial statements include balance sheets, income statements, and cash flow statements.... Financial statements include balance sheets, income statements, and cash flow statements.... Financial statements include balance sheets, income statements, and cash flow statements.... The paper 'Balance Sheet, cash flow Statement and Income Statement' is a comprehensive example of a finance & accounting essay....

9 Pages

(2250 words)

Essay

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Financial Statement and Cash Flow Analysis"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY