StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Julyfest Limited Financial Analysis

Free

Julyfest Limited Financial Analysis - Assignment Example

Summary

The paper "Julyfest Limited Financial Analysis" is a great example of a finance and accounting assignment. Statement of cash flows provides important information to those using it as it provides information about the outflows and inflows that have taken place in a certain financial year or within a specific period of time (Baker 2005)…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER97.4% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

- Author: amaya77

Extract of sample "Julyfest Limited Financial Analysis"

Julyfest Limited Financial analysis Task One a) Trial Balance Julyfest Limited Trial Balance as at 31st May Account Debit(£)

Credit (£)

Sales

352,000

Purchases

150,000

Opening Inventory

65,000

Property

102,000

Cost of plant and equipment

98,000

Accumulated depreciation 1/6/2011

Property

20,000

Plant and equipment

10,000

Administrative expenses

38,000

10% Bonds

65,000

Equity shares (£1 each)

100,000

Share premium

30,000

Distribution costs

58,000

Trade receivables

87,000

Trade payables

37,000

Retained profits 1/1/2010

59,500

Cash and cash equivalents

63,500

Dividends paid

12,000

Total

673,500

673,500

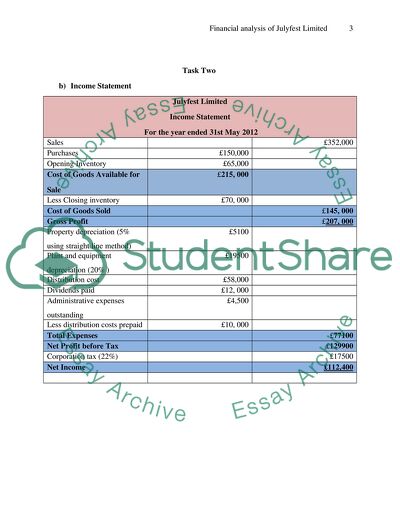

Task Two

b) Income Statement

Julyfest Limited

Income Statement

For the year ended 31st May 2012

Sales

£352,000

Purchases

£150,000

Opening Inventory

£65,000

Cost of Goods Available for Sale

£215, 000

Less Closing inventory

£70, 000

Cost of Goods Sold

£145, 000

Gross Profit

£207, 000

Property depreciation (5% using straight line method)

£5100

Plant and equipment depreciation (20% )

£19500

Distribution cost

£58,000

Dividends paid

£12, 000

Administrative expenses outstanding

£4,500

Less distribution costs prepaid

£10, 000

Total Expenses

£77100

Net Profit before Tax

£129900

Corporation tax (22%)

£17500

Net Income

£112,400

c) Statement of financial position

Julyfest Limited

Balance Sheet

for the year ended 31st May 2012

ASSETS

Current Assets

Inventory

70,000

Cash and cash equivalents

63,500

Account Receivables

87,000

Prepaid distribution cost

10,000

Total Current Assets

230,500

Fixed Assets

Property

102,000

Cost of plant and equipment

98,000

Less Accumulated Depreciation

30,000

Total Fixed Assets

170,000

TOTAL ASSETS

400,500

LIABILITIES

Current Liabilities

Trade payables

37,000

Interest Unpaid Bond

6,500

Taxes

17,500

Purchases

150,000

SHAREHOLDERS’ EQUITY

Equity shares

100,000

Retained Profits

59,500

Share premium

30,000

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

400,500

Task Two

Statement of cash flows provides important information to those using it as it provides information about the out flows and inflows that have taken place in a certain financial year or within a specific period of time (Baker 2005). The main importances of statement of cash flow are as discussed below.

First statement of cash flows enables users to identify as well as understand the sources from which the funds used in the business during a specific period as the uses into which these funds were used (Philips 2008). Other financial statements such as balance sheet and trial balances are not able show sources of funds as well uses into which these finances were put into use (Baker 2005).

Statement of cash flow also plays an important role in enhancing management of businesses as well as management of business resources (Baker 2005). It also enhances planning of business funds as well as ensuring that business cash flows (outflows and inflows) conform to each other (Tailor 2003). This is as opposed to other financial statements such as balance sheet which only shows assets and liabilities of business. Balance sheet cannot account for both cash outflows and cash inflows.

Another importance of statement of cash flow is that it shows how efficient an organization is able to generate income (cash inflows) from its operation (Baker 2005). Other financial statements such as balance sheet which only shows assets and liabilities of business but cannot show shows how efficient an organization is able to generate income (cash inflows) from its operation (Philips 2008).

Another importance of cash to those whose use it is that it is a report of funds that have been used during a specific period of time for various business activities (both short term and long term) such organization’s long term investment (Baker 2005). This information can also be shown by balance sheet.

Another importance of cash to those whose use it is that it is a report of funds that have been received by the business during a specific period of time from various business activities such as debentures, share issue and loans among others (Baker 2005). These information can also be shown by balance sheet.

Statement of cash flow also plays an important role in enhancing and appraising business capital investment among other investments in order to determine profitability of programs supporting these capital investments (Baker 2005).

Task three

PART A

Return on capital employed (abbreviated as ROCE) is calculated using the formula below:

Net profit before tax and interest = £129900

Total Assets = £400,500

Current Liabilities = £211,000

Therefore,

= 68.54%

Acid Test Ratio is normally calculated using the formula below:

Total Assets = £230,500

Current Liabilities = £211,000

Inventories = £70,000

Therefore,

= 0.76

Current Ratio is calculated using the formula below:

Current Liabilities = £211,000

Current Assets = 230,500

Therefore,

= 1.092

Trade Payables was calculated using the equation below:

Trade Payables = 37,000

Cost of sales = 145, 000

= 93 days

Earnings per Share

Net Profit after tax = 112,400

Number of ordinary share issue = 100,000

= 112.4%

PART B: Financial position of Julyfest Limited

Financial Position by use of Current Ratio

Current ratio is normally used to show ability of organizations to pay their current liabilities (short term liabilities) by using their current assets (also known as short term assets) (Brigham & Ehrhardt 2011). This ratio should be maintained at values or one or more than one. If this ratio less than one, it means that the organization is not able to pay its current liabilities using its assets (Brigham & Ehrhardt 2011). As for the Julyfest Limited this ratio was 1.8 in the financial year ending 31st May 2011, and 1.092 in the financial year ending 31st May 2012. Even though this value was more than 1 in the financial year ending 31st May 2012, it is clear that the ability of the business paying for its current liabilities by using its current assets has reduced greatly.

Financial Position by use of Acid test ratio

The use current liabilities to determine ability of ability of organizations to pay their current liabilities (short term liabilities) by using their current assets (also known as short term assets) is insufficient since converting inventories into cash may not be easy; therefore, may be misleading (Thukaram 2007). Acid test ratio ignores inventory. Just as in Current ratio, acid test ratio should be maintained at values or one or more than one. If it is less than one, it means that the organization is not able to pay its current liabilities using its assets (Brigham & Ehrhardt 2011). As for the Julyfest Limited this ratio was 1.2 in the financial year ending 31st May 2011, and 0.76 in the financial year ending 31st May 2012. It is clear from this ratio that the Julyfest Limited was not able to pay for its current liabilities by using its current assets in the financial year ending 31st May 2012.

Financial Position by use of Earnings per Share

Earnings per share indicates how profitable an organization is (Brigham& Ehrhardt 2011). As for the Julyfest Limited this ratio was 60 percent in the financial year ending 31st May 2011, and 112.4 percent in the financial year ending 31st May 2012. It is, therefore, clear from this ratio that the Julyfest Limited was more profitable in the financial year ending 31st May 2012 than in the financial year ending 31st May 2012.

Financial Position by use of Payable period

This ratio is used to determine number of days an organization is able to pay its suppliers for the supplies and purchases (Brigham& Ehrhardt 2011). As for the Julyfest Limited this ratio was 70 days in the financial year ending 31st May 2011, and 93 days t in the financial year ending 31st May 2012. It is clear from this ratio that the Julyfest Limited would take more time to pay its suppliers the financial year ending 31st May 2012 than in the financial year ending 31st May 2012. Therefore, it was financially sound in the financial year ending 31st May 2011 than in the financial year ending 31st May 2012.

Financial Position using Return on capital employed

This ratio how an organization is benefiting from the assets it has (Baker 2002). It may also show how an organization is losing from the liabilities it has (Baker 2002). As for the Julyfest Limited this ratio was 25% in the financial year ending 31st May 2011, and 68.54% in the financial year ending 31st May 2012. It is clear from this ratio that the Julyfest Limited is benefiting more from its assets in the financial year ending 31st May 2012 than in the financial year ending 31st May 2011.

References

Baker, R., 2002. Project Financing Guide. The Journal of Bank Cost & Management Accounting, 5(7), p. 5.

Brigham, E., & Ehrhardt, M., 2011. Financial Management. London: Springer.

Philips, M., 2008. Rights Issue as source of business financing. Manson: Canage Learning.

Tailor S., 2003. Sources of organizations Finances. The Journal of Bank Cost & Management

Accounting, 7(17), p. 22

Thukaram, R., 2007. Management Accounting. New York: New Age International.

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Julyfest Limited Financial Analysis"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY