StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Risk-Return Analysis of the Ten Stocks

Free

Risk-Return Analysis of the Ten Stocks - Essay Example

Summary

retail, oil industry), and the corresponding weights and the number of shares are represented in the following table. It were considered stocks of companies from different industries in…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER94.6% of users find it useful

- Subject: Finance & Accounting

- Type: Essay

- Level: Ph.D.

- Pages: 4 (1000 words)

- Downloads: 0

- Author: erichowell

Extract of sample "Risk-Return Analysis of the Ten Stocks"

Report The portfolio is composed from ten stocks of companies from different areas of service (e.g. retail, oil industry), and the corresponding weights and the number of shares are represented in the following table. It were considered stocks of companies from different industries in order to diversify the risks, which may affect one or another industry

Table no. 1 Initial Investment

Stock

Symbol

Number of shares held

Weight in the portfolio

JB HI-FI LIMITED

JBH

573

10.00%

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED

ANZ

215

10.04%

CUDECO LIMITED

CDU

1493

10.00%

TELSTRA CORPORATION LIMITED

TLS

1289

10.00%

OIL SEARCH LIMITED

OSH

714

10.00%

WOOLWORTHS LIMITED

WOW

176

10.08%

BHP BILLITON LIMITED

BHP

160

10.02%

CROMWELL PROPERTY GROUP

CMW

6944

10.00%

COMMONWEALTH BANK OF AUSTRALIA

CBA

88

9.85%

RETAIL FOOD GROUP LIMITED

RFG

1931

10.00%

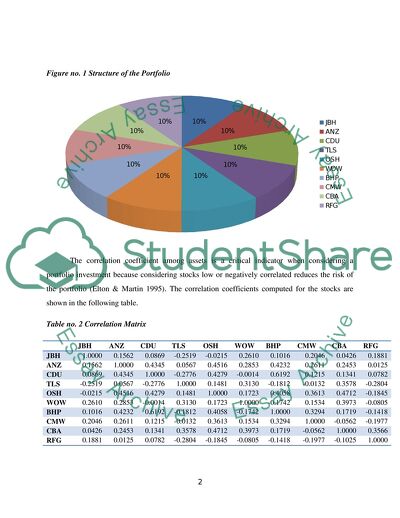

The strategy adopted when it was decided in which stocks to invest the initial capital was an almost equally weighted portfolio (a structure of the portfolio can be seen in figure no. 1). The reason for considering this strategy was the diversification benefit of investing reasonably amount of money in a large number of stocks. Although, it was not the most profitable strategy, it brought a sufficient return to outperform the market. The daily returns for Archie’s portfolio are presented in Exhibit 1.

Figure no. 1 Structure of the Portfolio

The correlation coefficient among assets is a critical indicator when considering a portfolio investment because considering stocks low or negatively correlated reduces the risk of the portfolio (Elton & Martin 1995). The correlation coefficients computed for the stocks are shown in the following table.

Table no. 2 Correlation Matrix

JBH

ANZ

CDU

TLS

OSH

WOW

BHP

CMW

CBA

RFG

JBH

1.0000

0.1562

0.0869

-0.2519

-0.0215

0.2610

0.1016

0.2046

0.0426

0.1881

ANZ

0.1562

1.0000

0.4345

0.0567

0.4516

0.2853

0.4232

0.2611

0.2453

0.0125

CDU

0.0869

0.4345

1.0000

-0.2776

0.4279

-0.0014

0.6192

0.1215

0.1341

0.0782

TLS

-0.2519

0.0567

-0.2776

1.0000

0.1481

0.3130

-0.1812

-0.0132

0.3578

-0.2804

OSH

-0.0215

0.4516

0.4279

0.1481

1.0000

0.1723

0.4058

0.3613

0.4712

-0.1845

WOW

0.2610

0.2853

-0.0014

0.3130

0.1723

1.0000

-0.1742

0.1534

0.3973

-0.0805

BHP

0.1016

0.4232

0.6192

-0.1812

0.4058

-0.1742

1.0000

0.3294

0.1719

-0.1418

CMW

0.2046

0.2611

0.1215

-0.0132

0.3613

0.1534

0.3294

1.0000

-0.0562

-0.1977

CBA

0.0426

0.2453

0.1341

0.3578

0.4712

0.3973

0.1719

-0.0562

1.0000

0.3566

RFG

0.1881

0.0125

0.0782

-0.2804

-0.1845

-0.0805

-0.1418

-0.1977

-0.1025

1.0000

It would be better when considering diversification to have a negative correlation coefficient (which can be seen in the table, but not for all stocks) and this probably will serve for future trading; to study the historical returns and to compute a correlation coefficient before deciding which stocks to include in the portfolio.

When computing the results, it was considered the following equation in order to test the proposition of the CAPM.

Rp-Rf= αi + βi(RM-Rf) (1)

The results obtained for Rp-Rf and RM-Rf can be seen in Exhibit 2. In the following table, there are presented return and risk indicators of market portfolio as well as Archie’s portfolio.

Table no. 3 Comparison between Archie portfolio and the Market portfolio

Market Portfolio

Archie Portfolio

Mean

0.08%

0.42%

Standard deviation

0.54%

4.83%

Sharpe Ratio

0.152

0.088

Although the standard deviation of Archie’s portfolio is higher than the market’s portfolio, is also under normal limits, and the return obtained compensates this level of risk. The fact that the return obtained for Archie’s portfolio beat the market return proves that the efficient market hypothesis, which asserts that the markets are information efficiently and it cannot be obtained above average-market returns on a constant basis (Fabozzi & Drake, 2009), it is not true.

It is better to consider portfolios not very risky because in the literature, Haugen and Hains (1975) documented the low-volatility anomaly i.e. portfolios with lower volatility, generated higher returns. Even more recent studies (Clarke et al., 2006) arrived at the same results in this matter.

Although for choosing the most appropriate weights for the stocks which made the portfolio, a solution would have been the mean - variance analysis, implemented by Markowitz (1952), it is difficult to apply it for ten stocks. If it were considered only 2-3 stocks, it would have been appropriate in order to find the best combination of stocks i.e. with the highest expected return for the level of risk taken.

However, in order to evaluate the results obtained for the portfolio, the following figure provides an overview of the respective returns and standard deviations of the stocks from the portfolio.

Figure no. 2 Risk-return analysis of the ten stocks

Starting from the results obtained in the period of trading, it was applied the single - index model, developed by Sharpe (1964). This model considers the return of a stock as the sum of three components: a constant, an indicator of the firm’s sensitivity to the market’s movements, and finally a random and unpredictable component i.e. error, and the equation for this model can be seen below:

Ri= αi + βiRM + ε (2)

This model states that correlation between stocks exists because each stock is dependent on an underlying systematic factor (Fabozzi & Markowitz, 2002). The rationale behind choosing as benchmark the market portfolio of risky assets is that rational, risk adverse investors will never keep only a risky asset because they can eliminate a part of risk by diversification, and the market portfolio represents the most diversified portfolio (Howells & Bain, 2007).

The parameters of the model are shown in table no. 4.

Table no. 4 Parameters for the model

Intercept

0.0048

Slope

-0.7065

Steyx

0.0498

R squared

0.62%

The capacity of the market return to predict the changes in the portfolio is shown by the coefficient of determination (R squared), which has a small value, of only 0.62%. A comparison between the results obtained for market portfolio and Archie’s portfolio is depicted in the following graph.

The equation estimated through this model is:

RP= 0.0048-0.7065RM +0.0498

Figure no. 3 Comparison between Archie’s portfolio and the Market portfolio

As it can be seen from the graph, returns of Archie’s portfolio have been more volatile, explained by the higher standard deviation of 4.83%, compared with only 0.54% for the index taken as proxy for the market portfolio.

It is also important to consider the systematic and idiosyncratic influences for the portfolio, and the trading activity. A measure for the systematic risk, is the beta computed (slope), which had a negative value of -0.7, suggesting that Archie’s portfolio moves in an opposite direction than the market portfolio (this can also be seen in the returns provided in Exhibit 2).

The idiosyncratic risk (i.e. unsystematic risk) is specific for any individual security and can be eliminated in a large, diversified portfolio (Reilly & Brown, 2002). As it was mentioned at the beginning of this report, this was the reason for choosing ten stocks, and also why the weights in the portfolio were almost equal. The changes in prices over the period of trading determined the decision of buying or selling the shares of the companies considered.

References

Clarke, R., De Silva, H. and Thorley, S. (2006) Minimum-Variance Portfolios in the U.S. Equity Market, The Journal of Portfolio Management, 33(1): 10–24.

Elton, E.J., and Martin J. (1995) Modern Portfolio Theory and Investment Analysis, 5th edn. New York: John Wiley & Sons.

Fabozzi, F.J. and Drake, P. (2009) Capital Markets, Financial Management, and Investment Management, New Jersey: John Wiley & Sons.

Fabozzi, F.J. and Markowitz, H. (2002) The Theory and Practice of Investment Management. New Jersey: John Wiley & Sons.

Haugen, F. and Hains, R. (1975) Risk and The Rate of Return on Financial Assets: Some Old Wine in Financial Bottles, Journal of Financial and Quantitative Analysis, 10(5): 775–784.

Howells, P. and Bain, K. (2007) Financial Markets and Institutions. Harlow: Pearson Education Limited.

Markowitz, H. (1952) Portfolio Selection, Journal of Finance, 7(1): 77–99.

Reilly, F. and Brown, K. (2002) Investment Analysis and Portfolio Management, 7th edn. Boston: South-Western College Pub.

Sharpe, W.F. (1964) Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk, Journal of Finance, 19(1): 425-442.

Appendix

Exhibit 1

Daily returns – Archie Portfolio

Date

Wealth

Return

Opening prices { Friday, August 3, 2011}

$50,000.00

Monday, August 06, 2012

$50,368.38

0.0074

Tuesday, August 07, 2012

$50,507.25

0.0028

Wednesday, August 08, 2012

$50,428.60

-0.0016

Thursday, August 09, 2012

$50,898.47

0.0093

Friday, August 10, 2012

$47,820.35

-0.0605

Monday, August 13, 2012

$46,588.90

-0.0258

Tuesday, August 14, 2012

$47,375.89

0.0169

Wednesday, August 15, 2012

$51,006.86

0.0766

Thursday, August 16, 2012

$50,568.41

-0.0086

Friday, August 17, 2012

$51,414.66

0.0167

Monday, August 20, 2012

$51,214.45

-0.0039

Tuesday, August 21, 2012

$45,898.32

-0.1038

Wednesday, August 22, 2012

$52,151.30

0.1362

Thursday, August 23, 2012

$53,091.66

0.0180

Friday, August 24, 2012

$52,903.30

-0.0035

Monday, August 27, 2012

$53,397.75

0.0093

Tuesday, August 28, 2012

$53,839.10

0.0083

Wednesday, August 29, 2012

$50,320.83

-0.0653

Thursday, August 30, 2012

$52,385.26

0.0410

Friday, August 31, 2012

$54,634.41

0.0429

Monday, September 03, 2012

$48,152.81

-0.1186

Tuesday, September 04, 2012

$48,722.80

0.0118

Wednesday, September 05, 2012

$47,984.71

-0.0151

Thursday, September 06, 2012

$48,818.45

0.0174

Friday, September 07, 2012

$48,865.21

0.0010

Monday, September 10, 2012

$52,808.47

0.0807

Tuesday, September 11, 2012

$53,743.79

0.0177

Wednesday, September 12, 2012

$54,465.50

0.0134

Thursday, September 13, 2012

$54,284.14

-0.0033

Friday, September 14, 2012

$54,970.61

0.0126

Exhibit 2

Returns – Rm-Rf and Rp-Rf

Date

Rm-Rf

Rp-Rf

Monday, August 06, 2012

1.17%

0.73%

Tuesday, August 07, 2012

0.42%

0.26%

Wednesday, August 08, 2012

0.49%

-0.17%

Thursday, August 09, 2012

-0.08%

0.92%

Friday, August 10, 2012

-0.64%

-6.06%

Monday, August 13, 2012

0.14%

-2.59%

Tuesday, August 14, 2012

0.17%

1.68%

Wednesday, August 15, 2012

-0.25%

7.65%

Thursday, August 16, 2012

1.06%

-0.87%

Friday, August 17, 2012

0.93%

1.66%

Monday, August 20, 2012

-0.05%

-0.40%

Tuesday, August 21, 2012

0.42%

10.39%

Wednesday, August 22, 2012

-0.18%

13.61%

Thursday, August 23, 2012

0.18%

1.79%

Friday, August 24, 2012

-0.81%

-0.37%

Monday, August 27, 2012

-0.09%

0.92%

Tuesday, August 28, 2012

0.31%

0.82%

Wednesday, August 29, 2012

-0.14%

-6.55%

Thursday, August 30, 2012

-0.95%

4.09%

Friday, August 31, 2012

-0.04%

4.28%

Monday, September 03, 2012

0.28%

11.87%

Tuesday, September 04, 2012

-0.61%

1.17%

Wednesday, September 05, 2012

-0.66%

-1.53%

Thursday, September 06, 2012

0.78%

1.73%

Friday, September 07, 2012

0.39%

0.08%

Monday, September 10, 2012

0.20%

8.06%

Tuesday, September 11, 2012

-0.23%

1.76%

Wednesday, September 12, 2012

0.79%

1.33%

Thursday, September 13, 2012

-0.54%

-0.34%

Friday, September 14, 2012

0.01%

1.25%

Read

More

CHECK THESE SAMPLES OF Risk-Return Analysis of the Ten Stocks

Risk Assessment and Return Analysis

This paper will provide a comprehensive risk assessment and return analysis of the investment portfolio encompassing investments in Dell, Home Depot, Procter & Gamble, General Electric, IBM bond and Disney.... Risk assessment entails the analysis of investment vehicles to discover their capacities to ensure sufficient returns on investment.... Risk assessment entails the analysis of an asset's standard deviation or risk with regard to the expected return on investment (Bodie, Kane & Marcus, 2006)....

3 Pages

(750 words)

Essay

How Does a Rational Investor Build the Optimal Portfolio

ctive portfolio managers constantly buy and sell a great number of common stocks.... To keep on top, active managers try to predict what will happen with stocks in the coming six months and continually churn the portfolio, hoping to take advantage of their predictions.... n average, today's common stock mutual funds own more than one hundred stocks and generate turnover ratios of 80 percent (Lewis, Mizen 2000).... It involves assembling, and then holding, a broadly diversified portfolio of common stocks deliberately designed to mimic the behavior of a specific benchmark index, such as the Standard & Poor's 500 Price Index (S&P 500)....

8 Pages

(2000 words)

Term Paper

Investor Psychology and Return Predictability

More pronounced results expected in the case one consider portfolios of individual stocks.... A further question is how the allocation would change in a conditional setting, or with individual stocks rather than with portfolios, since in such circumstances, one may expect that higher moments take larger values than in the present setting....

11 Pages

(2750 words)

Essay

Funds Management and Portfolio Selection

esults from the selection of more stocks into the portfolioWhen the extra stock is added in each portfolio, the level of Beta reduces from 0.... At first, Beta declines increasingly; however, the trend changes as more stocks are added to the portfolios.... It implies that systematic risks can be minimized by adding more stocks, hence diversification.... The author illustrates ten companies' regression relative to all ordinary indexes....

2 Pages

(500 words)

Essay

How does a Rational Investor Build the Optimal Portfolio

Active portfolio managers constantly buy and sell a great number of common stocks.... To keep on top, active managers try to predict what will happen with stocks in the coming six months and continually churn the portfolio, hoping to take advantage of their predictions.... On average, today's common stock mutual funds own more than one hundred stocks and generate turnover ratios of 80 percent (Lewis, Mizen 2000).... It involves assembling, and then holding, a broadly diversified portfolio of common stocks deliberately designed to mimic the behavior of a specific benchmark index, such as the Standard & Poors 500 Price Index (S&P 500)....

8 Pages

(2000 words)

Coursework

Asset Pricing and Default Risk

Groppelli and Nikbakht (2012) denote that the task of project appraisal, and investment capital budgeting is a challenging and complex managerial issue.... On this basis, a variety of methods have been developed for purposes of aiding investment analysts and managers to find a.... ... ... The paper "Asset Pricing and Default Risk" is a wonderful example of an essay on finance and accounting....

6 Pages

(1500 words)

Essay

Risk Management and Investment of Investment Trust Fund

All securities are comprised of stocks listed on the London Stock Exchange while none of them is a bond.... The particular fund is comprised of ten assets, namely, I Shares FTSE Bric 50 Fund, BP PLc, TUI Travel, Barclays PLC, Lloyds Banking Group PLC, ETFS Gold, I Shares FTSE/Xinhua China 25, BT 5....

14 Pages

(3500 words)

Case Study

Analysis of Risk and Returns Relationship in Australian Stock Market Exchange

The paper "analysis of Risk and Returns Relationship in Australian Stock Market Exchange" is a perfect example of a finance and accounting report.... The paper "analysis of Risk and Returns Relationship in Australian Stock Market Exchange" is a perfect example of a finance and accounting report.... The paper "analysis of Risk and Returns Relationship in Australian Stock Market Exchange" is a perfect example of a finance and accounting report....

13 Pages

(3250 words)

sponsored ads

Save Your Time for More Important Things

Let us write or edit the essay on your topic

"Risk-Return Analysis of the Ten Stocks"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY