StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Classifications of Leases and Preference for Operating Leases

Free

Classifications of Leases and Preference for Operating Leases - Assignment Example

Summary

This paper is to bring to attention the issues that were raised during the last meeting of the Board of Directors to wit: The company's Draft Statement of Financial Position did not include entries pertaining to one of the company's lease transactions (Lease A)…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER94.2% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

- Author: dfunk

Extract of sample "Classifications of Leases and Preference for Operating Leases"

MEMORANDUM

TO: The Chairman of the Board

FROM: The Finance Director

SUBJECT: Accounting of Leases

This is to bring to your attention the issues that were raised during the last meeting of the Board of Directors that was held on 04 January 2011, to wit:

The company's Draft Statement of Financial Position as at 31 December 2010 did not include entries pertaining to one of the company's lease transactions (Lease A).

The Managing Director is not keen on including Lease A in the books as a finance lease and, instead, wants it recorded as an operating lease.

A new accounting standard that will replace International Accounting Standard (IAS) 17, which covers 'Leases', is due to be finalized within the year. (IFRSF 2011)

These issues have to be resolved in the next Board Meeting for the Finance Department to be able to finalize the company's financial statements for the year 2010. The following is a brief discussion of the points that have to be considered:

Classifications of Leases

As an agreement that binds the lessor to grant the lessee the right to use an asset for an agreed length of time, a lease can be classified as either a finance lease or an operating lease. While a finance lease passes on to the lessee practically all the risks and rewards that go with ownership of the asset, an operating lease clearly declares that ownership of the asset is retained by the lessor. (IASCF 2009)

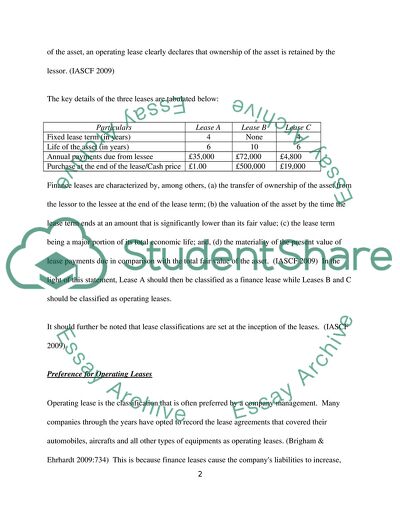

The key details of the three leases are tabulated below:

Particulars

Lease A

Lease B

Lease C

Fixed lease term (in years)

4

None

4

Life of the asset (in years)

6

10

6

Annual payments due from lessee

£35,000

£72,000

£4,800

Purchase at the end of the lease/Cash price

£1.00

£500,000

£19,000

Finance leases are characterized by, among others, (a) the transfer of ownership of the asset from the lessor to the lessee at the end of the lease term; (b) the valuation of the asset by the time the lease term ends at an amount that is significantly lower than its fair value; (c) the lease term being a major portion of its total economic life; and, (d) the materiality of the present value of lease payments due in comparison with the total fair value of the asset. (IASCF 2009) In the light of this statement, Lease A should then be classified as a finance lease while Leases B and C should be classified as operating leases.

It should further be noted that lease classifications are set at the inception of the leases. (IASCF 2009)

Preference for Operating Leases

Operating lease is the classification that is often preferred by a company management. Many companies through the years have opted to record the lease agreements that covered their automobiles, aircrafts and all other types of equipments as operating leases. (Brigham & Ehrhardt 2009:734) This is because finance leases cause the company's liabilities to increase, thereby rendering its debt-related financial ratios like its debt-to-equity ratio unattractive to investors and other interested parties. The same is true to the resulting gearing ratios and returns on assets that are all computed based on the company's total assets, liabilities and equity. (Mills 2008)

Consequences of Recording Leases as Operating Leases

There are misleading consequences that arise from recording the company's lease transactions as operating leases. Operating leases are recognised only as expense accounts. They are reflected only in the company's income statement for the period and are not at all included in its balance sheet. Thus, the economic resources and the level of obligations of the company, as shown by its balance sheet, are all understated. Needless to say, the computed ratios would turn out to be inaccurate. (IASCF 2009)

It is, then, clear that the balance sheets and income statements of a company that records its lease transactions as finance leases would be greatly different from the financial statements that would have been generated had the company booked the same lease transaction as operating leases. (Mills 2008) This negatively affects the transparency of the company's accounts and the comparability of its financial statements with those of other companies. (IASCF 2009)

Joint Project of IASB and FASB

Users of financial statements have, thus, complained that such instruments do not clearly give an accurate picture of the effects of the company's leases on its operations. In response to the growing clamour for a better way to record leases, the International Accounting Standards Board (IASB) and the US Financial Accounting Standards Board (FASB) have resolved to act on it. The issues that need to be settled have, thus, been made open for public comment; these issues included the recognition of the assets and liabilities arising in a lease contract and the initial measurement of the assets and liabilities arising in a lease. (IFRSF 2011)

The boards have analysed lease contracts and, in line with the views of many users of financial statements, have concluded that, whether classified as operating leases or as finance leases, lease contracts always create rights and obligations that meet the boards' definitions of assets and liabilities. On the basis of their analysis the boards believe that the underlying principle for a new model on lease accounting should be: Lease contracts create assets and liabilities that should be recognised in the financial statements of lessees. If this principle is adopted in a new standard on lease accounting, it would results in the lessee recognising an asset for its right to use the leased item and a liability for its obligation to pay rentals. The boards think that ensuring that all leases are depicted on the statement of financial position would significantly increase the transparency and the comparability of lease accounting." (IFRSF 2011)

"The Boards have published a discussion paper 'Leases - Preliminary Views' that sets out their poliminary views on accounting for leases by lessees and describes some of the issues that they will need to resolve in developing a new standard on lessor accounting. The project is being undertaken jointly by the International Accounting Standards Board (IASB) and the US Financial Accounting Standards Board (FASB). Project objective: Creation of a common standard on lease accounting to ensure that the assets and liabilities arising from lease contracts are recognised in the statement of financial position." (IFRSF 2011)

IASB) and the US Financial Accounting Standards Board (FASB

Therefore, it is appropriate for a finance lease to be recognised in the lessee’s statement of financial position both as an asset and as an obligation to pay future lease payments. At the commencement of the lease term, the asset and the liability for the future lease payments are recognised in the statement of financial position at the same amounts except for any initial direct costs of the lessee that are added to the amount recognised as an asset." (IASCF 2009)

Body - explanation

Closing - recommendations

Thank you.

"Minimum lease payments shall be apportioned between the finance charge and the reduction of the outstanding liability. The finance charge shall be allocated to each period during the lease term so as to produce a constant periodic rate of interest on the remaining balance of the liability. Contingent rents shall be charged as expenses in the periods in which they are incurred. In practice, in allocating the finance charge to periods during the lease term, a lessee may use some form of approximation to simplify the calculation. A finance lease gives rise to depreciation expense for depreciable assets as well as finance expense for each accounting period. The depreciation policy for depreciable leased assets shall be consistent with that for depreciable assets that are owned, and the depreciation recognised shall be calculated in accordance with

IASB) and the US Financial Accounting Standards Board (FASB "The deadline for comments on the exposure draft is 15 December 2010. The boards will consider all feedback and discuss responses to the proposals in public meetings. The boards also plan to hold public round-table meetings towards the end, or after the end, of the comment period. The boards plan to issue the new standard in 2011." (IFRSF 2011)

"Accounting for a lease as an operating lease is generally not acceptable to a lessor engaged in the business of long-term leasing because of the deferral of income which results. Where it is important to the lessee to have the lease treated as an operating lease for accounting purposes, it is equally important for the lessee to realize that the lessor would ormally desire to account for the transaction as a capital lease. Thus, in a situation where the lessee wants to keep a lease off its balance sheet and/or out of its income statement except as rental expense, a potential conflict exists as to classification of the lease with the lessor who will, in nearly all cases, want to record the lease as a capital lease."(Nevitt & Fabozzi 2000: 141)

List of References

Brigham, E. & Ehrhardt, M. (2009).Financial Management: Theory and Practice 13th Edition. Mason, CH: South-Western Cengage Learning

International Accounting Standards Committee Foundation or IASCF (2009) International Accounting Standard 17

International Financial Reporting Standards Foundation or IFRSF (2011) Exposure Draft Snapshot: Leases [online] available from [accessed 16 March 2011]

Mills, J. (2008) Update on Lease Accounting. Leaseurope: The Voice of Leasing and Automotive Rental in Europe.

Nevitt, P. & Fabozzi, F. (2000) Project Financing 7th Edition. London: Euromoney Institutional Investor PLC

Read

More

CHECK THESE SAMPLES OF Classifications of Leases and Preference for Operating Leases

The decision regarding the equipment composition - Individual assignment

here are two primary classifications of leases which are capital and operating leases.... The two primary classifications of capital or operating lease mentioned are from the perspective of the lessee.... 13, Accounting for leases.... 13 the FASB has issued a total of six statements, six interpretations, and 11 technical bulletins on leases.... When working with accounting for leases there are two different perspective or elements....

4 Pages

(1000 words)

Essay

Hire purchase contracts and Lease in business and how they work

The study consists of various procedures regarding the “SSAP 21” (SSAP 21 Accounting for leases and Hire Purchase Contracts 1997) and its recent amendment.... This research aims to evaluate and present the way in which leases are currently differentiated and accounted for; in accordance with SSAP 21.... Accounting for hire purchase and lease agreements are dealt with in the provisions offered in SSAP 21 ‘accounting for hire purchase and leases contracts' and IAS 17 leases....

6 Pages

(1500 words)

Essay

CORPORATE FINANCIAL REPORTING (accounting knowledge require)

(IASCF 2009) preference for operating leases Operating lease is the classification that is often preferred by a company management.... The following is a brief discussion of the points that have to be considered: classifications of leases As an agreement that binds the lessor to grant the lessee the right to use an asset for an agreed length of time, a lease can be classified as either a finance lease or an operating lease.... Many companies through the years have opted to record the lease agreements that covered their automobiles, aircrafts and all other types of equipments as operating leases....

4 Pages

(1000 words)

Essay

Key Features of Accounting Standard Board

This accounting standard is quite comprehensive in its nature such that it encompasses different aspects of leases in a very detailed manner.... This section briefly analyzes 1) Scope of IAS 17, 2) Classification of leases, 3) Accounting by Lessor, 4) Accounting by Lessee, 5) Disclosure Requirements for Lessor and, 6) Disclosure Requirements for Lessee.... This article ' IAS 17 'leases' mainly discusses three important elements regarding IAS 17 such that the first section describes the accounting treatment provided in the standard along with an illustrated example....

6 Pages

(1500 words)

Essay

Comparison between Generally Accepted Accounting Principles and International Financial Reporting Standards

Leases must be classified as either financial leases or operating leases.... This is based on the perspective of lessee which entails both the operating leases and capital.... From the perspective of the leasor, this entails the direct financing, sales type and operating leases.... GAAP and IFRS Author Institution Comparison between GAAP and IFRS IAS17: leases Introduction The FASB and IASB have taken considerable steps towards converging the IFRS and GAAP content....

3 Pages

(750 words)

Essay

Accounting Lease

Assets and liabilities are understated in the operating lease accounting that is why investors need to adjust the information presented in the statement of financial position that is based more on arbitrary and estimation.... The scope of the proposed improvement involves the US - SFAS 13 and IFRS - IAS 17 wherein the aim is to develop a new single approach instead of the previous operating and finance lease approaches (ACCA 2009)....

6 Pages

(1500 words)

Essay

The International Accounting Standards Board

The current standard requires the accounting of operating leases as periodic costs that are equal for each period while the proposals males a distinction by requiring leases cost to be accounted as one amortization part and another interest expense part.... IAS 17 does not apply in the measurement of property held by lessees that are accounted as investment property under IAS 40, the investment property provided by the lesser under operating leases (IAS 40), the biological assets that are held by the lesser finance leases such as agricultural biological assets (IAS 41) and biological assets that are provided by the lessors under operating leases (IAS 41)....

12 Pages

(3000 words)

Accounting for Leases - Historical Development of Lease Accounting

The paper "Accounting for leases - Historical Development of Lease Accounting" is a perfect example of a case study on finance and accounting.... The paper "Accounting for leases - Historical Development of Lease Accounting" is a perfect example of a case study on finance and accounting.... The paper "Accounting for leases - Historical Development of Lease Accounting" is a perfect example of a case study on finance and accounting.... At the time of issuing ARB 38, accounting professionals worried that companies were not reporting leases as liabilities, which gave misleading information....

13 Pages

(3250 words)

Case Study

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Classifications of Leases and Preference for Operating Leases"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY