StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- XYZ Non-Profit Corporation

Free

XYZ Non-Profit Corporation - Report Example

Summary

This report "XYZ Non-Profit Corporation" discusses XYZ non-profit corporation that has performed especially well in the year 2004 which has proven the worth of the management. The corporation saw an increase of 98 percent in the number of clients in the last two years…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER94% of users find it useful

- Subject: Finance & Accounting

- Type: Report

- Level: Undergraduate

- Pages: 4 (1000 words)

- Downloads: 0

- Author: augustine86

Extract of sample "XYZ Non-Profit Corporation"

Running Head: ABBREVIATED OF YOUR CHOICE (all caps) and Section # of Analyzing Financial Statements

1.

XYZ Non-Profit Corporation

2002

2003

2004

Current Ratio

0.75

0.87

0.90

Long term Solvency Ratio

1.26

1.38

2.06

Contribution Ratio

0.53

0.51

0.49

Program/Expense Ratio

0.70

0.72

0.77

G&M/Expense Ratio

0.30

0.28

0.23

Revenue/Expense Ratio

0.98

0.94

1.11

Improving Ratio Deteriorating Ratio

3.

The financial ratios demonstrate the strength and vigor of an organization. The current ratio portrays the ability of a company to pay its short term obligations whereas the long term solvency ratio measures the capacity of the company to repay it long term liabilities. These are two important ratios because they represent the safety net for the creditors in the market.

On the other hand, the contribution ratio evaluates the composition of the funding sponsored by the grants and contributions. This will allow the company to monitor and establish the short and long term trends and adjust the plans according to the funding obtained. The program expense ratio identifies the amount of the money spent on the arrangement of the programs as compared to the total expenses incurred by the company. At the same time, the management expense ratio evaluates the percentage of the total expense incurred by the company on the management and administrative expenses sustained while providing the services to the public. (Johnson, 2003)

The efficiency ratio, denoted by the revenue expense ratio, measures the competitiveness and the good governance of the company. A ratio of greater than 1 signifies that the company is earning more than the expenses incurred. (Johnson, 2003)

XYZ non-profit corporation’s financial position has improved over the three years period. The company has broken even and is making a profit while rendering services to an increasing number of clients. At the same time, the company has improved in the liquidity position as compared to the last years and is depicting a better picture to the creditors as well as the market. The company has also been able to control the management expenses as compared to former years.

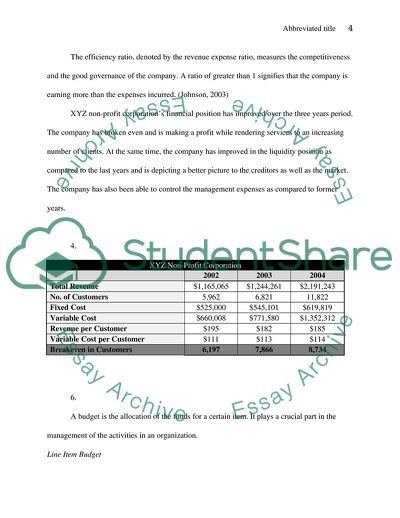

4.

XYZ Non-Profit Corporation

2002

2003

2004

Total Revenue

$1,165,065

$1,244,261

$2,191,243

No. of Customers

5,962

6,821

11,822

Fixed Cost

$525,000

$545,101

$619,819

Variable Cost

$660,008

$771,580

$1,352,312

Revenue per Customer

$195

$182

$185

Variable Cost per Customer

$111

$113

$114

Breakeven in Customers

6,197

7,866

8,734

6.

A budget is the allocation of the funds for a certain item. It plays a crucial part in the management of the activities in an organization.

Line Item Budget

A line item budget is the most widely used budgeting tool in the non-profit organizations due to its simplicity, lenience in preparation and flexibility in the control over the allocation of the resources. It also is consistent with the lines of authority in the company and provides a better control as it allows accrual of expenses individually at each functional unit. At the same time, this tool is criticized on the grounds that it does not provide information on the activities or events of the company for effective decision making. It does not even have performance data which leads to micro-management by the administrators. (Johnson, 2003)

Performance Budget

A performance budget is based on the standard cost of the inputs and the number of units of the service provided to the clients in a given period. At times, it is also based on the level of services to be provided and a historical comparison. This approach is considered more useful compared to the line item approach as the former provides more important information on activities and cost for effective decision making by the administrators. The budget revisions are also more convenient and legislative. On the other hand, it has certain limitations as well. The standard costing data is unreliable and defective at times. The approach also does not measure the quality of the services being provided and is more appropriate for routine type activities only. (Johnson, 2003)

Program Budget

A program budget basically bases its expenditures on the programs of work irrespective of the objects involved. It is, in essence, considered a changeover of the line item budget and the performance budget. The focal advantage of this approach is the spotlight on the long term planning and the realization of the stated goals and objectives in the long run. It basically provides a summarized report of the programs and its costing for decision making. However, this approach is incapable of making modifications in the long run objectives as well as provides a lesser amount of data on the activities of an organization. (Johnson, 2003)

7.

The non-profit corporations fund their development as well as expenses from the grants, contributions, donations, gifts as well as small commercial activities. There are several traditional and non-traditional approaches to the fund development for the non-profit organizations. The two most common types of traditional approaches that XYZ Corporation could use are:

1. Getting a high powered CEO or a famous personality to steer the campaign: In this approach, the company management signs up a famous powerful personality that is more likely to attract and pull a lot people towards it elf to head the campaign. The team moves around the cities and country to collect donations and gifts from the local people as well as the other big shots.

2. Documenting the needs of the company through a presentation of a strong case: In this approach, the management of the company develops a case that answers the overall needs of the company in the coming years. The case is circulated and presented to a number of powerful and rich individuals who are then asked to answer to the required needs.

The non-profit organizations are facing ever-increasing costs, strong competition from the rivals for a lesser amount of donations as well competition from the for-profit organizations; therefore, these corporations have moved to more creative, entrepreneurial and non-traditional approaches to the fund development. XYZ Corporation could use these two basic non-traditional approaches:

1. Video Presentations and printed advertisements: In this approach, the management develops creative and dramatic video presentations as well as creative prints to attract local and powerful groups and individuals for donations and contributions to the fund development.

2. Selling immaterial things for $10: In this approach, the company management sells immaterial items such as bricks, plagues and small gift items for a higher price and gathers a huge sum of money from these charity sales.

These creative, entrepreneurial activities tend to be expensive and ineffective in achieving the focal objectives of the fund-raising. Huge costs are involved which result in the fewer collections as compared to the traditional approaches. Hence, to date, the old customs of fund development are effective and valuable to the XYZ non-profit corporation.

Conclusion

XYZ non-profit corporation has performed especially well in the year 2004 which has proven the worth of the management. The corporation saw an increase of 98 percent in the number of clients in the last two years whereas its revenue increased by 88 percent during the same period. Therefore, the corporation has a strong financial picture in the future.

References

Johnson, F. (2003). Financial accounting for local and state school systems. National Center for Education Statistics, Institute of Education Sciences, U.S. Department of Education.

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the report on your topic

"XYZ Non-Profit Corporation"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY