StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Current Assets and Current Liabilities

Free

Current Assets and Current Liabilities - Assignment Example

Summary

The paper "Current Assets and Current Liabilities" analyzes that from the information provided above, prepare a summary of Lulu the Clown’s income and expenses for the week ended 7 May, showing the profit earned. Ignore any depreciation on Lulu the Clown’s assets…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER96.8% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

- Author: dinaharvey

Extract of sample "Current Assets and Current Liabilities"

TMA 03 a) From the information provided above, prepare a summary of Lulu the Clown’s income and expenses for the week ended 7 May, showing the profit earned. Ignore any depreciation on Lulu the Clown’s assets. (2 marks)

Income and Expenses

£

Appearance Fees

650

Travel Expenses

(15)

Profit Earned

£635

1 (b) Draw up a list as at 7 May of Lulu the Clown’s fixed assets, current assets and current liabilities, and then calculate what Lulu’s net assets are at that date. (6 marks)

Fixed Assets

£

Costume

500

Equipment

1,000

Puppet Dolls

200

Total

1,700

Current Assets

Bank

650

Current Liabilities

Clown Party Supplies

200

Net Assets

2,150

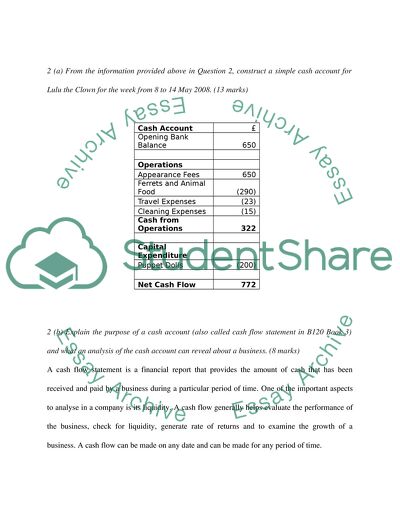

2 (a) From the information provided above in Question 2, construct a simple cash account for Lulu the Clown for the week from 8 to 14 May 2008. (13 marks)

Cash Account

£

Opening Bank Balance

650

Operations

Appearance Fees

650

Ferrets and Animal Food

(290)

Travel Expenses

(23)

Cleaning Expenses

(15)

Cash from Operations

322

Capital Expenditure

Puppet Dolls

(200)

Net Cash Flow

772

2 (b) Explain the purpose of a cash account (also called cash flow statement in B120 Book 3) and what an analysis of the cash account can reveal about a business. (8 marks)

A cash flow statement is a financial report that provides the amount of cash that has been received and paid by a business during a particular period of time. One of the important aspects to analyse in a company is its liquidity. A cash flow generally helps evaluate the performance of the business, check for liquidity, generate rate of returns and to examine the growth of a business. A cash flow can be made on any date and can be made for any period of time.

3 (a) From the information provided in Question 3 above, prepare Lulu’s profit and loss account (or income statement) for the trading period ended 31 December 2008. (Note: you should use the format of the profit and loss account as it has been used in Section 3 of Book 3). (20 marks)

Profit and Loss Account

£

Revenue

Sales of Gifts

1,850

Appearance Fees

10,350

Costs

Gifts (Clown Party Suppliers)

1,100

Stock in hand

50

Gross Profit

11,150

Operating Expenses

Wages

1,300

Travel Expenses

950

Ferrets and Ferret Food

290

Cleaning

110

Depreciation

540

Operating Profit (PBIT)

7,960

Withdrawals

3,985

Retained Profit

3,975

3 (b) Explain the purpose of a profit and loss statement and what an analysis of the profit and loss statement can reveal about a business. (8 marks)

A profit and loss statement is a report that summarizes the revenues and expenses of a company. This report shows the net profit or loss of the company for a specified period. It generally includes all the operating activities and all activities that would affect the gains or losses of a business. The total revenues and the expenses incurred are presented in the income statement, irrespective of the actual cash received for sales or the actual cash paid out on expenses. Both the operating and non operating expenses are included and the statement also lists any dividend payments made or the earnings available to the shareholders. This statement is one of the most useful statements for investors as it provides the investors with a detailed report of the company’s performance. The overall operating performance of a company and its income can be obtained only from a Profit and Loss Account.

4 (a) From the information given in questions 1 to 3 above, prepare Lulu’s balance sheet as at 31 December 2008. (25 marks)

Balance Sheet

£

Fixed Assets

5,200

Accumulated Depreciation

540

Total

4,660

Current Assets

Cash

460

Bank

120

Stock

50

Accounts Receivable

350

Prepaid Expenses

50

Total

1,030

Current Liabilities

Accounts Payable

200

Net Assets

5,490

Owners Equity and Reserves

Owners Capital

1,515

Retained Profit

3,975

Total

5,490

4 (b) Explain the purpose of a balance sheet and what an analysis of the balance sheet can reveal about a business. (8 marks)

A balance sheet is a statement of the financial position of an organization. This financial report is normally prepared at the end of a financial year and includes details of all the assets owned by the company, liabilities, and ownership equity as of a particular date. A balance sheet is a snap shot of a company’s financial condition and is one of the most important financial statements. This is the only statement that applies to a single point in time. The balance sheet provides a clear view on what the company owns and what it owes, in other words, the value of the company is depicted in the balance sheet. It also includes the details of the investments made by the investors and shareholders.

Read

More

CHECK THESE SAMPLES OF Current Assets and Current Liabilities

Working capital management

In other words, the system of working capital management intends to establish a relationship between a firm's Current Assets and Current Liabilities.... Effective management of working capital assists organisations to deploy Current Assets and Current Liabilities efficiently and thereby to maximise short term liquidity.... The gross concept indicates current assets and this model is known as quantitative aspect of working capital.... Through proper management of working capital, a firm aims to make optimum level of investment in various working capital assets....

7 Pages

(1750 words)

Essay

Working capital

Current Assets and Current Liabilities are an important determinant of a company's operational performance.... Hence a company should pay a lot of attention to managing its Current Assets and Current Liabilities in order to remain in the business in a profitable manner.... Current Assets and Current Liabilities are an important determinant of a company's operational performance.... Hence a company should pay a lot of attention to managing its Current Assets and Current Liabilities in order to remain in the business in a profitable manner....

3 Pages

(750 words)

Essay

Review of The Ryan Boot Company Financical Statement

It is seen from the balance sheet that while the long term debt of the company stands at 2,500,000 the current liabilities are 2,750,000.... Although there is no harm in carrying larger current liabilities since they are non-interest bearing, it is important that the company maintains proper short term liquidity position to meet these liabilities as and when they become due.... However the company would be able to raise the profit margin by a judicious employment of its assets....

5 Pages

(1250 words)

Essay

Working Capital Management Practices

ypically, the difference between the Current Assets and Current Liabilities of the firm is called working capital... Such practice may be healthy as the firms often attempt to save finance cost if ernal short term financing is secured to finance the working capital however; firms also tend to tie most of their productive funds with non-productive assets.... However, roughly, it is often estimated at 25 to 40% of the total assets of the firm hence indicating a substantial amount of investment into assets which are typically unproductive in nature....

4 Pages

(1000 words)

Essay

Management of Working Capital

he working capital of the business is defined as the net of current assets over current liabilities.... The current assets include not only cash, receivables but also inventories as it can be easily liquidated whereas the current liabilities include short term loans and creditors (the University of California, n.... orking capital consists of current assets like cash, inventory, and current liability like creditors and short term loans....

6 Pages

(1500 words)

Coursework

Define Working Capital

In other words, it can be defined as a difference between Current Assets and Current Liabilities.... In other words, it can be defined as a difference between Current Assets and Current Liabilities.... Debtors and creditors can increase or decrease the working capital Define Working Capital Working capital is a measure of liquid assets that an organization requires to manage its business....

1 Pages

(250 words)

Research Paper

The Ratios Determined For BAE Systems

Moreover, total assets turnover is also influenced by the working capital of the company as it includes the Current Assets and Current Liabilities of the company.... Keeping in view the financial statements of the BAE Systems for the last 6 years, it can be noted that the current liabilities of the company have fluctuated over the years and the relative changes in the current assets of the company have not been such to maintain a constant liquidity position of the company....

13 Pages

(3250 words)

Essay

Current Ratio of Levy and Parcells

igh fluctuation among the figures of CR, Current Assets, and current liabilities has been envisaged throughout the selected analytical period.... The CR of the company remained in the congestion band from 1:5 to 2:8 except for one year in which the CR of the company touched the record level of 3:5 because of the increment in total current assets of the company by 66.... In the second part, the author gives the liabilities, payroll accounting and issuance of stock of Levy and Parcells ....

6 Pages

(1500 words)

Assignment

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Current Assets and Current Liabilities"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY