StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Management Accounting

Free

Management Accounting - Case Study Example

Summary

This paper 'Management Accounting' tells that The total cost is calculated by adding direct materials, direct labor, and overhead expenditures in the above numerical. The price for the natural material is provided. The direct labor charge is calculated by multiplying the wage rate pour with the cyber of hours worked…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER95.7% of users find it useful

- Subject: Finance & Accounting

- Type: Case Study

- Level: Masters

- Pages: 4 (1000 words)

- Downloads: 0

- Author: toneyrussel

Extract of sample "Management Accounting"

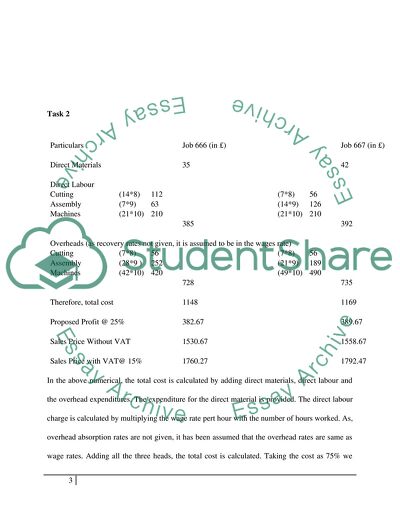

MANAGEMENT ACCOUNTING Table of Contents Task 2 3 Task 3 5 Task 4 7 Memo to the Sales Manager 10 Task 5 12 Bibliography 15 Task 2 Particulars Job 666(in £)

Job 667 (in £)

Direct Materials

35

42

Direct Labour

Cutting

(14*8)

112

(7*8)

56

Assembly

(7*9)

63

(14*9)

126

Machines

(21*10)

210

(21*10)

210

385

392

Overheads (as recovery rates not given, it is assumed to be in the wages rate)

Cutting

(7*8)

56

(7*8)

56

Assembly

(28*9 )

252

(21*9)

189

Machines

(42*10)

420

(49*10)

490

728

735

Therefore, total cost

1148

1169

Proposed Profit @ 25%

382.67

389.67

Sales Price Without VAT

1530.67

1558.67

Sales Price with VAT@ 15%

1760.27

1792.47

In the above numerical, the total cost is calculated by adding direct materials, direct labour and the overhead expenditures. The expenditure for the direct material is provided. The direct labour charge is calculated by multiplying the wage rate pert hour with the number of hours worked. As, overhead absorption rates are not given, it has been assumed that the overhead rates are same as wage rates. Adding all the three heads, the total cost is calculated. Taking the cost as 75% we derive at the expected (or proposed) profit of 25%. This gives the sale price. Then, the Value Added Tax (VAT) is calculated over the sales price at the rate of 15%. In this way, the sales price of £1760.27 and £1792.47 is arrived for the job number 666 and 667 respectively.

Task 3

To – The Director, Finance

From – The Management Accountant

Date – 11th May 2009

Subject – Working of ABC costing

Activity Based Costing (ABC) method has many advantages over traditional method of costing. The total cost incurred is assigned to the particular activities which have a direct relationship with it. Therefore, cost for any particular activity can be easily calculated and all sorts of redundant expenditures can be checked. Activity Based Costing has come up as a major cost cartel weapon. At the outset, overhead costs of manufacturing are allocated to the activity cost pool. Activity cost pool is a pool of various costs which are caused because of a particular activity. The next step is to find out the contribution of each activity to the finished product. Then, the overhead of every activity is divided by the cost driver. Cost driver denotes any activity which has a direct relation with the resources consumed. This provides with the activity based overhead rate. Overhead costs of manufacturing are assigned to each product of each activity cost pool. Overhead costs of manufacturing can be obtained by multiplying the number of units of the cost driver which was utilised by the product with the activity based overhead rate.

Hope, the above note on working of Activity Based Costing would clarify your query.

Task 4

Note 1 – To calculate the variable cost, we add up the variable part of the production overhead with direct materials and direct wages. Contribution is calculated by deducting variable expenses from sales. Net profit is calculated by deducting fixed expenses from the contribution.

Note 2 – We can find contribution per unit by dividing total contribution (= sales – variable cost) by the number of units produced i.e. 70,000 units. Therefore, contribution per unit is £ 4.44

3) Fixed Cost £ 290000

Contribution £ 311000

Sales £ 1400000

C/S Ratio 0.222142857

BEP (Sales) £ 1305466.238

BEP (Units) 65315.31532 Units

Note 3 – BEP is the Break Even Point. It denotes the point at which the firm earns neither profit nor it incurs any loss. BEP in sales value can be calculated if we divide the fixed cost by the contribution-sales ratio. This figure denotes the sales value for which firm has a zero profit margin.

Dividing the fixed cost by the contribution per unit, BEP in units can be determined. BEP in unit is important because if the firm cannot sale at least the BEP units, it will incur loss but if the firm can sale more than the BEP units with the given sales price, it can earn profit

.

Note 4 – If the price is reduced by 25% i.e. by £ 5 and if the sales is doubled (i.e. from 70000 units to 140000 units), we find the business will incur a loss of £ 368000.

5)

No of Units to be sold

80000

Sales Price per unit

£

20

Therefore, Sales Price

£

1600000

Expected Variable Cost

£

1244571.429

Contribution

£

355428.5714

Fixed Cost

£

290000

C/S Ratio

0.222142857

BEP (Sales)

£

1305466.238

Therefore, Break Even Price Per Unit

£

16.31832797

Note 5 – If there is an additional order of 10,000 units, then the total number of units will amount to 80,000 units (70,000 + additional 10,000). The sales price remains same at £ 20. The Contribution-Sales ratio and the fixed cost remain same. With all these considerations, the BEP sales amount to £ 130546. So, the BEP per unit is £ 16.3. If SG Printers sale catalogue below this price, it will make loss. Therefore, it cannot afford to sale at £ 9.1 per catalogue. The minimum price affordable for the company is £ 16.3.

Memo to the Sales Manager

To - The Sales Manager, SG Printers

From – Management & Cost Accountant, SG Printers

Date – 11th May, 2009

Subject – Minimum sales price allowable

It is hereby informed that SG Printers cannot afford to sale additional 10,000 units at £ 9.1. The reason behind the decision is the break-even sales for 80,000 units (70,000 units plus additional 10,000 units) is £ 1305466 which implies for 80,000 units of production, the company cannot afford to sale below £ 16.3.

It is advised to convey the message to the customer.

Task 5

Direct Material

Metal (Assumed to be direct material)

14700

Less- Closing Stock of Raw Material

3500

11200

Direct Labour

Wages of machine operators

70000

Fitting Dept Wages

7700

77700

Direct Charges

Factory Power

5880

Prime Cost

94780

Factory Overhead

Factory Depreciation

1050

Factory Cleaning

4200

Security of Factory

3500

Factory Expenses

3150

Machine Depreciation

2800

Paint used in production

3850

Factory Insurance

4900

23450

Less - Closing Stock of WIP

5600

17850

Factory Cost

112630

Administration Overhead

Depreciation of office equipments

770

Telephone

3500

Canteen Costs

8400

Plastic

24500

Admin Wages

22400

Print Post & Stationary

2100

Admin Expenses

3920

Insurance

1400

89390

Cost of Production

202020

Less - Closing Stock of Finished Products

10,500

Cost of Goods Sold

191,520

Selling & Distribution Overhead

Selling Exp

1330

Distribution Cost

23800

25130

Cost of Sales

216,650

Sales Price (Given)

280,000

Therefore, Net Profit

63,350

In the above numerical, metal has been assumed as the direct material or the raw material. Adding up the direct material, the direct labour and the direct charges, we get Prime Cost. With Prime Cost when factory overhead is added, we find factory cost or works cost. Adding administration overhead with the factory cost, the cost of production is determined. With the cost of production when the closing stock is deducted, cost of goods sold is calculated. Adding up selling and distribution overhead (selling expense and distribution cost), we get Cost of Sales. Deducting the Cost of Sales from the Sales value (given), we arrive at the net profit.

Bibliography

Activity Based Costing, No Date, Georgia Perimeter College, [Online], Available: facstaff.gpc.edu/~jpatters/PowerPoint-ACCT%202102%20(Wiley)-outline/JWMaCh04-outline.doc [May 11, 2009]

Mc Dermott R. E., No Date, Activity Based Costing, [Online], Available: faculty.weber.edu/rmcdermott/Acc%202020/PowerPoints%20McD/Ch%20%204%20Activity%20Based%20Costing.ppt [May 11, 2009]

How to Write Memos?, No Date, The Hong Kong Polytechnic University, [Online], Available: http://elc.polyu.edu.hk/CiLL/eiw/memos.htm [May 11, 2009]

Sample Memo, No Date, The Purdue Online Writing Lab, [Online], Available: http://owl.english.purdue.edu/owl/resource/590/04/ [May 11, 2009]

Tulsian P.C., Cost Accounting, Published by Tata McGraw-Hill, ISBN 0070620431, 9780070620438

Read

More

CHECK THESE SAMPLES OF Management Accounting

The Nature and Role of Management Accounting

This paper ''The Nature and Role of Management Accounting'' tells us that British Airways plc is one of the largest airlines worldwide and is considered the national carrier of the United Kingdom-based on its large fleet, international flights, and destinations.... he purpose of this paper is to explain how Management Accounting can supply information to assist the management of British Airways, particularly the key techniques that favorable to the company.... eview of the Nature and Role of Management Accounting

...

6 Pages

(1500 words)

Essay

Management Accounting - Johnson and Kaplans Relevance Lost

This present paper is a research paper that looks at the criticisms, which were made by Johnson and Kaplan (1987) in regards to Management Accounting/ control systems.... The paper "Management Accounting - Johnson and Kaplan's Relevance Lost" is an excellent example of a research paper on finance and accounting.... This present paper is a research paper that looks at the criticisms, which were made by Johnson and Kaplan (1987) in regards to Management Accounting/ control systems....

11 Pages

(2750 words)

Research Paper

Continuous Improvements in the Accounting Information Systems of Businesses

The paper 'Continuous Improvements in the accounting Information Systems of Businesses ' is an affecting example of finance & accounting literature review.... The use of traditional cost accounting systems was mainly done when the components of cost mainly comprise direct labor and direct materials.... The paper 'Continuous Improvements in the accounting Information Systems of Businesses ' is an affecting example of finance & accounting literature review....

8 Pages

(2000 words)

Literature review

Management Accounting - Benefits and Problems Associated with Financial Performance Indicators

The paper "Management Accounting - Benefits and Problems Associated with Financial Performance Indicators" is a good example of coursework on finance and accounting.... The paper "Management Accounting - Benefits and Problems Associated with Financial Performance Indicators" is a good example of coursework on finance and accounting.... Financial performance measurement is an important part of business management, which help the managers to advance the objectives of the business, which in turn improves the competitiveness of the firm, and the market share associated with it (Neely, 2007, p....

14 Pages

(3500 words)

Coursework

Why ABC System Results in More Accurate Costing

Costing is a subdivision of Management Accounting, which is usually practiced by the organizations with the aim of identifying the costs involved during the manufacturing procedure.... Costing is a subdivision of Management Accounting, which is usually practiced by organizations with the aim of identifying the costs involved during the manufacturing procedure.... Costing is a subdivision of Management Accounting, which is usually practiced by organizations with the aim of identifying the costs involved during the manufacturing procedure....

6 Pages

(1500 words)

Activity Based Costing

The paper "Activity Based Costing " is an outstanding example of a finance and accounting literature review.... The paper "Activity Based Costing " is an outstanding example of a finance and accounting literature review.... Activity-based costing refers to a managerial accounting system that is responsible for the estimation of the costs of services and products by passing on the overhead costs, to the direct costs.... This is a departure from the previous cost accounting techniques that involved the sharing of overhead costs in an equal manner or even allowing overheads to be part of an estimate of the overall profit or loss....

6 Pages

(1500 words)

Literature review

Traditional Costing and Activity-Based Costing

Traditional costing and Activity-Based Costing (ABC) techniques are the common costing methods used in Management Accounting.... Traditional costing and Activity-Based Costing (ABC) techniques are the common costing methods used in Management Accounting.... The paper "Traditional Costing and Activity-Based Costing " is a great example of a finance and accounting essay.... The paper "Traditional Costing and Activity-Based Costing " is a great example of a finance and accounting essay....

8 Pages

(2000 words)

Essay

Management Accounting for Sports Company

Management Accounting is a robust tool for.... The paper 'Management Accounting for Sports Company ' is a useful example of a finance & accounting business plan.... The paper 'Management Accounting for Sports Company ' is a useful example of a finance & accounting business plan.... Management Accounting is a robust tool for making these decisions, and the team has employed it in the analysis....

7 Pages

(1750 words)

sponsored ads

Save Your Time for More Important Things

Let us write or edit the case study on your topic

"Management Accounting"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY