StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Financial Management: Theory and Practice

Free

Financial Management: Theory and Practice - Report Example

Summary

This report "Financial Management: Theory and Practice" presents the company that believes that it will have to sell the division. However, no formal resolution to sell the unit has been passed until the financial statements are released…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER96.1% of users find it useful

- Subject: Finance & Accounting

- Type: Report

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

- Author: bmclaughlin

Extract of sample "Financial Management: Theory and Practice"

Problem No Original & Adjusting entries for the points 8. Entry No. Entry Type Particulars Dr. Cr Original Insurance Expense a/c Dr. To Cash a/c

(Being Insurance paid).

6,550

6,550

Adjusting

Insurance prepaid a/c Dr. P&L a/c Dr.

To Insurance Expense a/c

(Being prepaid insurance & insurance incurred correctly posted).

2,475

4,075

6,550

2.

Original

Cash a/c Dr.

To Rent Revenue a/c

(Being Rent received)

14,400

14,400

Adjusting

Rent Revenue a/c Dr.

To Rent received in advance

To P&L a/c

(Being rent received in advance and earned rent correctly posted).

14,400

12,000

2,400

3

Adjusting

Depreciation a/c Dr.

To Plant & Machinery a/c

(Being Depreciation charged to P&M a/c)

19,300

19,300

P&L a/c Dr.

To Depreciation a/c

(Being Depreciation posted to P&L a/c).

19,300

19,300

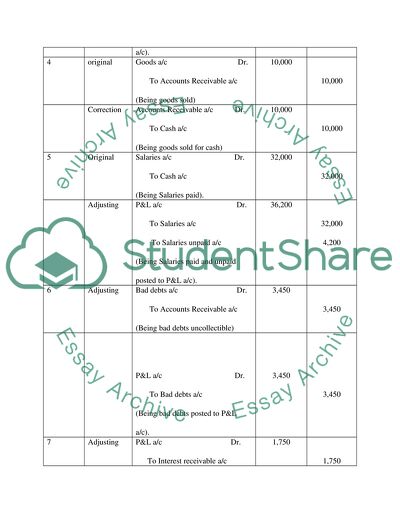

4

original

Goods a/c Dr.

To Accounts Receivable a/c

(Being goods sold)

10,000

10,000

Correction

Accounts Receivable a/c Dr.

To Cash a/c

(Being goods sold for cash)

10,000

10,000

5

Original

Salaries a/c Dr.

To Cash a/c

(Being Salaries paid).

32,000

32,000

Adjusting

P&L a/c Dr.

To Salaries a/c

To Salaries unpaid a/c

(Being Salaries paid and unpaid posted to P&L a/c).

36,200

32,000

4,200

6

Adjusting

Bad debts a/c Dr.

To Accounts Receivable a/c

(Being bad debts uncollectible)

3,450

3,450

P&L a/c Dr.

To Bad debts a/c

(Being bad debts posted to P&L a/c).

3,450

3,450

7

Adjusting

P&L a/c Dr.

To Interest receivable a/c

(Being Interest receivable)

1,750

1,750

8

Original

Rent payable a/c Dr.

To Cash a/c

(Being rent payable)

24,000

24,000

Adjusting

P&L a/c Dr.

Rent paid in advance a/c Dr.

To Rent payable a/c

(Being rent paid posted to P&L and rent paid in advance a/c).

16,000

8,000

24,000

Calculations:

Cost

P&L

BS

Tot

Insurance

Policy 1

Remaining

2550

2550

Policy2

Original

225

2475

2700

Policy3

Original

1300

1300

4075

2475

6550

Rent

2400

12000

14400

P&M

Opening

230000

Closing

156000

Sale

74000

Dep

Sale

3700

Closing

15600

19300

Debit Cash a/c

10000

Credit AR /ac

10000

Debit Salaries

4200

Credit Unpaid Salaries

4200

Bad Debts

69000

3450

Int Received

70000

6%

4200

1750

Rent Paid

16000

8000

24000

Problem 2:

On December 31, 2005, the company believes that it will have to sell the division. However, no formal resolution to sell the unit has been passed until the financial statements are released. Hence, the operating losses of 2004 and 2005 are not to be recorded under the discontinued operations and are to be recorded as loss suffered in the due course of business. The 2005 comparative income statement of buggy whip corporation would look as follows:

Year: 2004 (comparables)

Year: 2005

Particulars Continuing Discontinuing

Particulars Continuing Discontinuing

P&L a/c (Loss) $100,000

P&L a/c (Loss) $120,000

Since there is an operating loss for the division, there can be no incidence of taxation for the same. However, for the 2006 comparative income statement, the presentation would be done as follows:

Year: 2005 (comparables)

Year: 2006

Particulars Continuing Discontinuing

Particulars Continuing Discontinuing

P&L a/c (Loss) $120,000

P&L a/c (Loss) $50,000

P&L a/c (Loss on sale) $80,000

----------------

Total: $130,000

-----------------

These disclosures are to be done in accordance to the guidelines of the US GAAP, FAS 144 and the IFRS – 5 on the topic: Discontinuing Operations. Other than these, assets and liabilities held for the disposal and are classified for sales are disclosed separately in the balance sheet. (Kumar.V. 2008).

Problem No:5: Point 1:

For Vendor A and Vendor C, as there are annual payments, the effective rate of interest is 10%.

For Vendor B, as there are semi-annual payments, the effective rate of return can be calculated

as follows:

(1+rate of interest/number of instalments per year) to the power of the number of instalments.

(1+10/2)*(1+10/2)

11.25%

Point 2:

Year end maintenance contract is included in the first cash outflow in case of

Vendor A : $50,000 +$12,000 = $62,000

For Vendor C, the first year cash outflow includes the

first maintenance cost : $115,000+$1,000 =

$116,000

The cash outflows for the three vendors can be tabulated as follows:

Year

Vendor A

% of Interest

Vendor B

% of Interest

Vendor C

%of Interest

1

$62,000

10%

$16,000

11.25%

$116,000

10%

2

$15,000

$16,000

$1,000

3

$15,000

$16,000

$1,000

4

$15,000

$16,000

$1,000

5

$15,000

$16,000

$1,000

6

$15,000

$16,000

$2,000

7

$15,000

$16,000

$2,000

8

$15,000

$16,000

$2,000

9

$15,000

$16,000

$2,000

10

$16,000

$2,000

11

$16,000

$2,000

12

$16,000

$2,000

13

$16,000

$2,000

14

$16,000

$2,000

15

$16,000

$2,000

16

$16,000

$3,000

17

$16,000

$3,000

18

$16,000

$3,000

19

$16,000

$3,000

20

$16,000

$3,000

NPV:

($129,112.63)

($125,357.97)

($118,689.28)

Thus it is better to purchase the machine at Vendor C which includes the lowest cost.

(Chandra, P. 2006).

Problem No. 3:

Entry No.

Entry type

Particulars

Dr.

Cr.

1.

Original

Purchases a/c Dr.

To Cash a/c

(Being invoice drawn for receiving goods).

$5,000

$5,000

Reverse

Cash a/c Dr.

To Purchases a/c

(Being receiving reporting indicating goods received after the financial closure).

$5,000

$5,000

2.

Original

Purchases a/c Dr.

To Cash a/c

(Being goods shipped, received and entered before financial closure).

$300

$300

Reverse

No adjustment required.

3.

Entry inclusion

Purchases a/c Dr.

To Cash a/c

(Being inventory received but no entry entered).

$2,000

$2,000

4.

Original

Purchases a/c Dr.

To Cash a/c

(Being merchandise invoice drawn).

$500

$500

Reverse

Cash a/c Dr.

To Purchases a/c

(Being merchandise receiving report drawn in the next financial year).

$500

$500

5.

Original

Purchases a/c Dr.

To Cash a/c

(Being goods shipped, received and entered before financial closure).

$500

$500

Adjustment

No adjustment required.

6.

Original

Purchases a/c Dr.

To Cash a/c

(Being inventory received but no entry entered).

$800

$800

7.

Original

Cash a/c Dr.

To Sales a/c

To P&L a/c

(Being goods sold).

18,000

$12,000

$6,000

Problem No. 7:

Dr. Keggs A/C Cr.

Year

Particulars

Amount

Particulars

Amount

2000

To balance b/d

$20,744

By balance c/f

$20,744

Total

$20,744

Total

$20,744

2001

To balance b/d

$20,744

To Purchases (Balancing fig).

$1,275

By PPE a/c

$22,019

Total

$22,019

Total

$22,019

Dr. Plant & Machinery A/C Cr.

Year

Particulars

Amount

Particulars

Amount

2000

To balance b/d (Bal. fig.)

$15,508

By Sales

$565

To Purchases

$5,602

By balance c/f

$20,545

Total

$20,545

Total

$20,545

2001

To balance b/d

$20,545

By Sale

$56

To Purchases

$3,271

By Sale (Bal.fig.)

$3,620

By PPE a/c

$20,150

Total

$23,816

Total

$23,816

.

Dr. Office equipment & furniture A/C Cr.

Year

Particulars

Amount

Particulars

Amount

2000

To balance b/d

$5,721

By balance c/f

$5,721

Total

$5,721

Total

$5,721

2001

To balance b/d

$5,721

To Purchases (Bal.fig.)

$746

By PPE a/c

$6,467

Total

$6.467

Total

$6,467

Dr. Leasehold improvements A/C Cr.

Year

Particulars

Amount

Particulars

Amount

2000

To balance b/d

$3,173

By balance c/f

$3,173

Total

$3,173

Total

$3,173

2001

To balance b/d

$3,173

To Purchases (Bal.fig.)

$134

By PPE a/c

$3,307

Total

$3,307

Total

$3,307

Dr. Land A/C Cr.

Year

Particulars

Amount

Particulars

Amount

2000

To balance b/d

$350

By balance c/f

$350

Total

$350

Total

$350

2001

To balance b/d

$350

By PPE a/c

$350

Total

$350

Total

$350

Dr. Building A/C Cr.

Year

Particulars

Amount

Particulars

Amount

2000

To balance b/d

$1,420

By balance c/f

$1,420

Total

$1,420

Total

$1,420

2001

To balance b/d

$1,420

By PPE a/c

$1,420

Total

$1,420

Total

$1,420

Dr. Accumulated Depreciation A/C Cr.

Year

Particulars

Amount

Particulars

Amount

2000

By balance b/d (Bal.fig.)

$18,606

By Depreciation charged

$6,300

To balance c/f

$$24,906

Total

$24,906

2001

To Accumulated Depreciation on Sale

$1,490

By balance b/d

$24,906

To PPE a/c

$29,816

By Depreciation charged

$6,400

Total

$31,306

Total

$31,306

Dr. Property Plant & Equipment A/C Cr.

Year

Particulars

Amount

Particulars

Amount

2000

To Keggs a/c

$22,019

By Acc. Depreciation a/c

$29,816

To Plant & Machinery a/c

$20,150

By Cash a/c

$23,897

To Office equipment and Furniture a/c

$3,307

To Leasehold improvements a/c

$350

To Land a/c

$350

To Building a/c

$1,420

Total

$53,713

Total

$53,713

The Journal entry to record the disposal of Property, Plant & equipment account is as follows:

Year

Particulars

Dr.

Cr.

2001

Cash a/c Dr.

To Property, Plant & Equipment a/c

(Being Property, Plant & Equipment disposed off for cash).

$23,897

$23,897

Book References:

Chandra. P. 2006. Financial Management: Theory and Practice. Delhi. Tata Mc. Graw Hill Co. Pvt. Ltd. Pg.179.

Kumar V.M.P. 2008, First Lessons in Accounting Standards. Delhi. Snow White Publications Pvt. Ltd. Pg.511-520.

Book Bibliography:

Tulsian. P.C. 2002. Problems and Solutions in Financial Accounting. Delhi. Tata Mc. Graw Hill Co. Pvt. Ltd.

Read

More

CHECK THESE SAMPLES OF Financial Management: Theory and Practice

ABC Financial Business Research

Business planning to expand its sales with a 25% increase requires the management and its shareholders to set their targets and goals through a forecast budget.... As a growing business, the board of management needs to be sensitive to such customer needs and requirements.... ABC financial Business Research Introduction An effective business is vital in a company's long term strategy to success.... In this case, it is critical to form a financial plan to assist the agency's long term objectives....

3 Pages

(750 words)

Research Paper

Cash Flow Statement

The author states that cash flows exclude movements between the items that constitute cash or cash equivalent because these are part of the cash management of an enterprise rather than part of its operating investing and financing activities.... n brief, cash flow serves the following purposes: Helpful in planning and coordinationHelpful in control useful in internal financial managementKnowledge of changes in cash position in direct METHOD: Under this method cash flow from operating activities is calculated on the basis of net profit as reported in the profit and loss account or balance sheet and is especially used when the amount of sales is not given in the question....

1 Pages

(250 words)

Essay

Discussion Question

Financial Management Theory and Practice.... Achieving these goals and objectives is a process that requires enough time and resources, as well as management of all activities that the company engages in.... Achieving these goals and objectives is a process that requires enough time and resources, as well as management of all activities that the company engages in.... In this regard, the financial manager of the company should devote more time in managing working capital in such a way that mainstreams the inventory aspect....

1 Pages

(250 words)

Essay

Financial Management week 5

Financial Management Theory and Practice.... (Brigham & Ehrhardt, 2010)financial management also allows a company to manage its liquidity in effective manner and provides tools which can help maintain financial stability within the company.... By using the resources optimally, financial management can actually help a company to remain financial stable even during hard times when a firm is unable to generate sufficient sales.... financial management....

1 Pages

(250 words)

Essay

Disucssion Question 1 week 2 Investment Information

Financial Management: theory and practice.... Below are financial statements whose elements one would.... Thus an investor should choose to invest his or her financial Investment Information Investment information refers to the data obtained from the comparison of performances of firms inthe same industry by a potential investor regarding their earnings forecasts so as to decide which one to invest in.... Below are financial statements whose elements one would carefully consider before deciding to invest in a particular company:Cash flow statementThis is an accounting breakdown of the inflow and outflow of cash in the business enterprise, and below are the elements which a potential investor should carefully consider:1....

1 Pages

(250 words)

Assignment

Financial and Commodity Markets and Their Role in International Trade and Economic Performance

The paper "financial and Commodity Markets and Their Role in International Trade and Economic Performance" claims financial and commodity markets play many roles in international economic performance.... erivative MarketDerivatives are the hedging instruments that provide the holders the opportunity to mitigate the risk against the undesired movements of financial securities....

1 Pages

(250 words)

Essay

Expediency to Use of Retained Profit rather than an External Loan

Business planning to expand its sales with a 25% increase requires the management and its shareholders to set their targets and goals through a forecast budget.... In this case, it is critical to forming a financial plan to assist the agency's long-term objectives.... The paper also analyses the overall risk profile of the company based on current economic and industrial issues that it may be facing based on the track records of its financial statements....

10 Pages

(2500 words)

Impact of Finances on Financial Statements

2005, financial management theory and

... IMPACT OF FINANCES ON FINANCIAL MENTS The management of a company is highly dependent on the control of finances in order to ensure there is an optimal mix of debt and capital in the company.... While there are huge benefits to a company when it is sufficiently liquid, the volatility the influx of finances will bring forth to the company can be challenging as it requires improvement in the management practices (Brealy, Richard & Stewart, 2003).

...

2 Pages

(500 words)

Essay

sponsored ads

Save Your Time for More Important Things

Let us write or edit the report on your topic

"Financial Management: Theory and Practice"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY