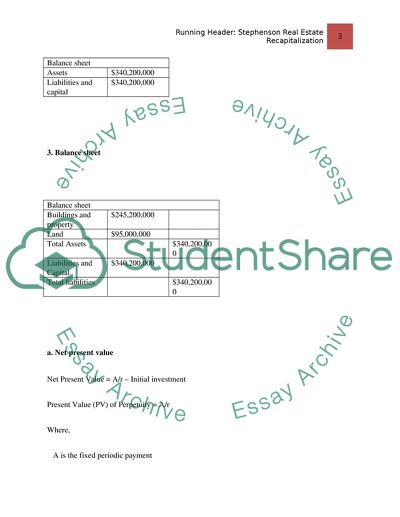

Stephenson Real Estate Recapitalization Case Study - 2. Retrieved from https://studentshare.org/finance-accounting/1701762-stephenson-real-estate-recapitalization

Stephenson Real Estate Recapitalization Case Study - 2. https://studentshare.org/finance-accounting/1701762-stephenson-real-estate-recapitalization.