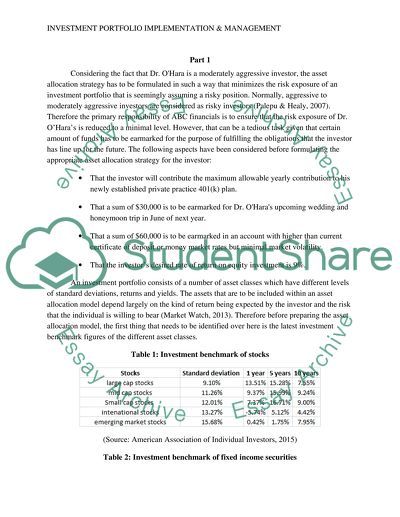

Investment Portfolio Implementation & Management Essay. Retrieved from https://studentshare.org/finance-accounting/1675263-investment-portfolio-implementation-management

Investment Portfolio Implementation & Management Essay. https://studentshare.org/finance-accounting/1675263-investment-portfolio-implementation-management.