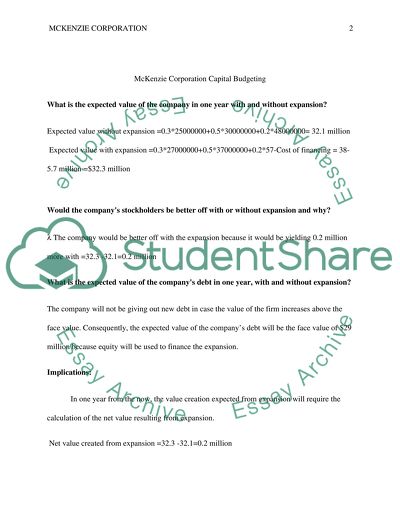

McKenzie Corporation Capital Budgeting Coursework. Retrieved from https://studentshare.org/finance-accounting/1656483-mckenzie-corporation-capital-budgeting

McKenzie Corporation Capital Budgeting Coursework. https://studentshare.org/finance-accounting/1656483-mckenzie-corporation-capital-budgeting.