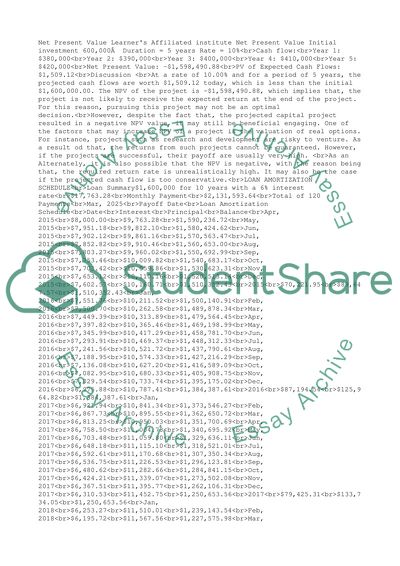

Net Present Value Coursework Example | Topics and Well Written Essays - 250 words. Retrieved from https://studentshare.org/business/1691551-net-present-value

Net Present Value Coursework Example | Topics and Well Written Essays - 250 Words. https://studentshare.org/business/1691551-net-present-value.