Cite this document

(Leasing vs Purchasing computer equipments Term Paper, n.d.)

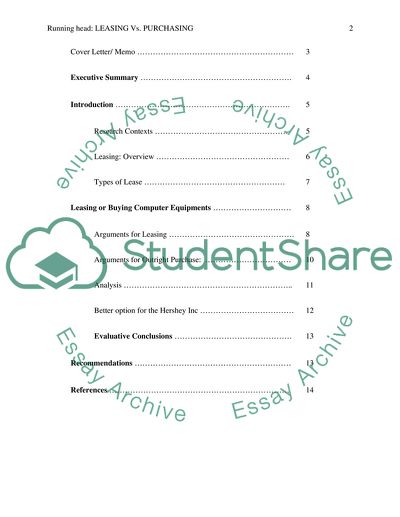

Leasing vs Purchasing computer equipments Term Paper. Retrieved from https://studentshare.org/technology/1741520-leasing-vs-purchasing-computer-equipments

Leasing vs Purchasing computer equipments Term Paper. Retrieved from https://studentshare.org/technology/1741520-leasing-vs-purchasing-computer-equipments

(Leasing Vs Purchasing Computer Equipments Term Paper)

Leasing Vs Purchasing Computer Equipments Term Paper. https://studentshare.org/technology/1741520-leasing-vs-purchasing-computer-equipments.

Leasing Vs Purchasing Computer Equipments Term Paper. https://studentshare.org/technology/1741520-leasing-vs-purchasing-computer-equipments.

“Leasing Vs Purchasing Computer Equipments Term Paper”, n.d. https://studentshare.org/technology/1741520-leasing-vs-purchasing-computer-equipments.