StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Macro & Microeconomics

- The Issue of Money Laundering

Free

The Issue of Money Laundering - Term Paper Example

Summary

The author of the paper examines the issue of money laundering, an illegal transfer of funds obtained through criminal or otherwise illegal activities so that its illegal sources can be disguised so that the cash can be absorbed into the conventional channels. …

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER94.8% of users find it useful

- Subject: Macro & Microeconomics

- Type: Term Paper

- Level: Ph.D.

- Pages: 5 (1250 words)

- Downloads: 0

- Author: longaylord

Extract of sample "The Issue of Money Laundering"

Money laundering Money laundering is the illegal transfer of funds obtained through criminal or otherwise illegal activities so that its illegal sources can be disguised so that the cash can be absorbed in to the conventional channels. According to federal laws, money laundering is considered to have occurred when someone attempts to conceal disguise or location of money; furthermore, attempts to control the proceeds of unlawful activities such is also categorized under money laundering. When dealing with cases of money laundering the nature of the crime or activity through which the money was obtained is not considered and one can have charges pressed upon them simply for being in possession of the money irrespective of whether they were involved in procuring it or not. There are dozens of criminal enterprises such as organized crime, smuggling, drugs, embezzlement insider trading tax evasion and many others which generate phenomenal profits (Beare 2003). However this money is essentially dirty, as such criminals must look for means through which to have the money “washed” hence the term laundering so that it does not attract the attention of the authorities. With time and due to the globalization of criminal activities, there is a lot of dirty money that needs washing and this has created a demand for legitimizing these ill-gotten gains through money laundering.

[Fig 1]

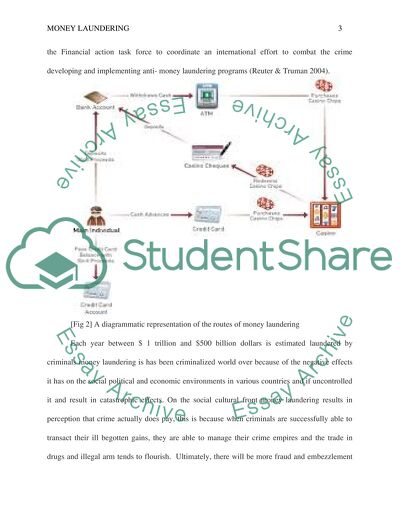

Money laundering can range from complex tasks extending across geopolitical boarders to small-scale local operation involving tens of dollars or pounds. In response to the escalating levels of money laundering on a global scale, in 1987 during the G7 summit in Paris established the Financial action task force to coordinate an international effort to combat the crime developing and implementing anti- money laundering programs (Reuter & Truman 2004).

[Fig 2] A diagrammatic representation of the routes of money laundering

Each year between $ 1 trillion and $500 billion dollars is estimated laundered by criminals money laundering is has been criminalized world over because of the negative effects it has on the social political and economic environments in various countries and if uncontrolled it and result in catastrophic effects. On the social cultural front money laundering results in perception that crime actually does pay, this is because when criminals are successfully able to transact their ill begotten gains, they are able to manage their crime empires and the trade in drugs and illegal arm tends to flourish. Ultimately, there will be more fraud and embezzlement with little or no repercussions, the social economic result is that more companies end up collapsing and people lose their jobs. In addition, when money laundered from the illegal sale of arms, drugs and even human trafficking, the business thrive and as a result the society suffers from the proliferation of drugs, guns and other contraband goods. Many of the social vices today such as drug addition, child prostitution and increased gang violence are indirectly supported by the money laundering infrastructure that sustains the circulation of funds.

Money laundering is often carried out in three steps, the first is placement then layering and finally integration, and in a nutshell the cash obtained illegally is illegally placed into the system with the long-term objective of using it as legal funds. In the placement stage, the money laundering parties introduces the illegal profits into the financial system, and this is done through breaking up large sums into small quantities that are less conspicuous so that they can be deposited into a bank account. It can also be done by purchasing a variety of monetary instruments such as banker’s checks and money orders, which are then collected together and deposited in another bank (Reuter & Truman 2004). After the initial stage, the next one is layering, the funds that have just entered the financial systems, they funds are put through a series of conversions and transactions which are designed to distance the money from its original source. This can be done through wiring the money to various banks across the globe especially those whose jurisdictions are not bound by the anti-money laundering organization. The funds can also be converted into goods or payments for services so as to give them a legitimate appearance. After being disguised and successfully processed, the criminal profits are then put in the third stage which is integration, and this is where they are finally reintroduced in to the economy. In most cases, the launder may opt to invest it in real estate luxury goods and assets such as diamond or a variety of other business ventures, at the end of the day having successfully undergone all this stages, the money is relatively clean and those who acquired it in the first place can enjoy it without fear of legal repercussions since it is almost impossible to trace back its roots.

A study conducted by the United Nations Office on Drugs and Crime (UNODC) to estimate magnitude of funds laundered in 2009 for criminal enterprises such as money drugs weapon and others amounted to over 1.6 trillion which is approximately 3.6% of the global GDP. In the UK specifically, it is estimated that around 48 billion pounds which is approximately 2% of the nation’s GDP. The international Monetary Fund, IMF had carried out a retrospective study in 1998 and determined that the amount of laundered money in the world could account for between anything between 2 to 3 percent of the global economy at the time (Ratha, Mohapatra & Silwal 2004). During that time, this was approximately the size of Spain’s economy, notwithstanding, this figures are not cast in stone and they are prone to understatement, more so the latter because billions of laundered dollars go undetected by the authorities. The FATF takes cognizance the fallibility of mathematical estimates and as result they do not release any figures in regard to how much money has been laundered.

Money laundering is a result nearly all the profit making criminal activities, given that crime does not have geopolitical limitations, money laundering can occur anywhere in the world, however money launderers tend to focus on countries where the risk of detection is lower. This is motivated by the fact that the individuals who launder money often intern to move it around until they can put it back in stable financial system. Depending on the stage the funds have reached, laundering activities can be concentrated in one place especially during the placement stage; in this case the location is where the funds originated in the first place. In the layering stage, the launders often opt to take the money to an offshore center, and in many cases this is a world banking center such as Switzerland or any location with the requires business infrastructures. This is the most geographically dynamic stage where the money may be shuttled around several countries and banks where the transactions can be done without leaving paper trails that can be used to trace it back to its source (Ratha, Mohapatra & Silwal 2004). The Bahamas and some banks in Switzerland are some of the top destinations owing to their lenient banking rules that give a wide allowance for the privacy of the transactions. Finally, the funds may be invested either in the original location where they were acquired or a different place especially if the first is economically unstable of there is a risk of their activities being traced back to them. However at this stage since the money is relatively clean, it can be invested anywhere at the discretion of the launderers.

In most cases, the people who make this money are not the ones that do the laundering; in fact, there are many professional economists and accountants’ world over who lend their services to this business. Conventionally, they are either given a fraction of the money as payment or a prearranged sum, at the end of the day, despite efforts by the various world government to stem it money laundering is unfortunately still prevalent and if current indications are anything to go by, its rater are going up rather than down.

References

Beare, M. E. (Ed.). (2003). Critical reflections on transnational organized crime, money laundering and corruption. Toronto. University of Toronto Press.

Reuter, P., & Truman, E. M. (2004). Chasing dirty money: The fight against money laundering. Peterson Institute.

Ratha, D., Mohapatra, S., & Silwal, A. (2009). Migration and Remittance Trends 2009: A better-than-expected outcome so far, but significant risks ahead. People Move. Retrieved from http://blogs.worldbank.org/peoplemove/migration-and-remittance-trends-2009-a-better-than-expected-outcome-so-far-but-significant-risks

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the term paper on your topic

"The Issue of Money Laundering"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY