StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Macro & Microeconomics

- Microeconomics Homework

Free

Microeconomics Homework - Report Example

Summary

This paper 'Microeconomics Homework' tells that A price ceiling is defined as the maximum price imposed on a product by the government beyond it, which cannot go. Here, the pre-determined price is above the market price, and New York City is controlled at a predetermined price…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER93.6% of users find it useful

- Subject: Macro & Microeconomics

- Type: Report

- Level: Masters

- Pages: 4 (1000 words)

- Downloads: 0

- Author: jacobsmuriel

Extract of sample "Microeconomics Homework"

3a) The policy acts as a price floor, which is defined as the lowest price limit imposed for a product by the government, below which the product’s price cannot be reduced.

Price ceiling is defined as the maximum price imposed on a product by the government beyond it which cannot go. Here, the pre determined price is above the market price and New York City is controlled at pre determined price. Therefore, the situation here is that of price flooring. All the conditions of price flooring are satisfied because for a price flooring to be truly effective, the price of the commodity should be greater than the market equilibrium price. This situation cannot be referred as a price ceiling because in price ceiling the price can be set either above or below the market price.

Demand stands for demand curve and supply stands for supply curve. E is the market equilibrium price. Surplus is the excess over the market price.

Diagram showing the price flooring policy

b) Inefficiencies likely to have risen when the controlled price was above the market price

When the controlled price is above the market price, there will be shortage of produced because there are certain inefficiencies like there are fewer benefits to producers and consumers. Shortages emerge when the quantity of the product supplied exceeds the quantity demanded. The consumers are able to buy the product not at the market rate but at an inflated rate which can be termed as the black market rate. The producer can make large profit if the product is brought at the controlled price instead of an inflated rate. The producers will be suffering from losses when the controlled price is above the market price.

There is a loss to consumers also when the controlled price is above the market price. There is a lot of black market money in the market when the price ceiling is above the market price.

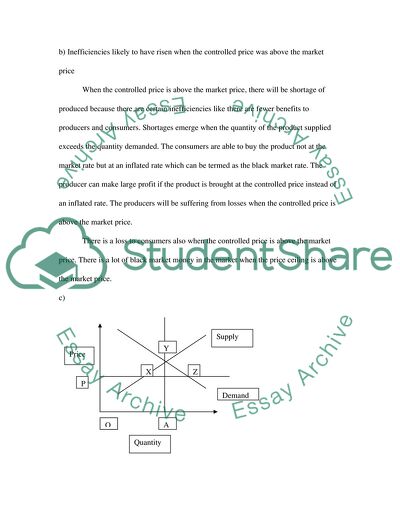

c)

When the controlled price of bread is below the market price it implies a maximum effective price control.

OP is the government controlled price. Demand stands for demand curve and supply stands for supply curve. AY is the equilibrium price set by the market. At the maximum control price, the market remains unclear and the quantity demanded exceeds the quantity supplied by a certain amount called XZ in the diagram, which creates artificial shortage of goods.

When the artificial shortage of products is created, then there is a rush by the consumers to buy the product at available price and this leads to black market. “The chief characteristic of a price maximum is the queue, the endless lining up for goods that are not sufficient to supply the people at the rear of the line.” (Rothbard, 2004, P.893).

When the controlled price is below the market price, it is a case of price ceiling. Price ceiling is usually done when there is a necessity to make consumer goods available at affordable price to the common man.

d) Price ceiling and price floorings are two types of government interventions in order to sustain the economy. Inefficiencies in the economy forces government to either adopt price ceiling or price flooring economic practice for the benefit of the country, especially the farmers who are the producers.

8 a) When the price floor is above the market price, it is a binding price flooring.

When the government sets a price flooring of $5 per bushel then the quantity of corn produced is 1200 while the quantity of corn demanded is 800. 800 bushels of corn are purchased by consumers. The quantity of corn bushels purchased by the government is 1000 at the market equilibrium price of $3 per bushel. There is a surplus of 200 bushels of corn produced.

The revenue that corn farmers receive is 1000 x 3 = $3000.

b) When the government sets a target price of $5 per bushel for any quantity supplied up to 1000 bushels, then the quantity of bushels of corn purchased by consumers is 800 bushels because the target price of $5 per bushel is more than the equilibrium price of $3 per bushel. Therefore, the government will have to pay the farmers the target price. The consumers will buy the 1000 bushels at $3 per bushel. The government will purchase 1000 bushels at $5 per bushel. The situation will cost the government a revenue loss of $2000. The corn farmers will receive a revenue of 1200 x $5 = $6000.

c) The first program of price flooring costs the consumers more while the second programme of target pricing costs the government more. There is a surplus quantity of corn produced in the price flooring system because the government does not allow the price of corn to fall and the price floor is set above the market equilibrium price. Target price is mainly set to reduce the surplus quantity produced during price flooring. With the target price system the consumers pay less but it is expensive for the government.

d) The target policy costs the government more than the price flooring system.

In the price flooring system, there is a surplus of quantity produced and, then fore, the farmers suffer losses. Consumers also have to buy products at an inflated price. The target policy acts as an incentive scheme to farmers to produce more because the government will be bearing the cost even though the produced goods are not sold.

5)

According to the diagram the deadweight loss from the inefficiently low quantity bought and sold is $100.

a) 100 pints will be produced as a surplus due to the price flooring policy.

b) The cost to the government as per this policy is $1 per pint and the quantity supplied is $750.

c) The diary program will cost more to the government because even though the schools increase the amount of milk purchased and it is supplied to them at 0.60 per pint but the reduction in the revenue when parents do not purchase milk is 50 million pints.

10) a) In the absence of government regulations and restrictions the equilibrium price is $10 while the equilibrium quantity is 120 pounds.

b) The demand price at which the consumers wish to purchase 80, 000 pounds of lobsters is $ 14 per pound. 80, 000 x 14 = 11, 20,000 pounds.

c) The supply price at which suppliers are willing to supply 80,000 pounds of lobsters are

80, 000 x 8 = 6, 40,000 pounds.

d) Quota rent is defined as “The economic rent received by the holder of the right (or license) to import under a quota. Equals the domestic price of the imported good, net of any tariff, minus the world price, times the quantity of imports.” (Deardorff, 2010).

The quota rent when 80,000 pounds of lobsters are sold is 80,000 x 10 = $8, 00,000.

e) The situation that benefits both buyer and seller is the equilibrium quantity of 120 pounds of lobsters at $ 10 per pound = $ 12, 00,000. This is called the most beneficial situation because it is the equilibrium point of both demand and supply curve and this is not barred by quota restrictions.

Works Cited

Deardorff, Alan V. Deardorffs’ Glossary of International Economics. Alendear. 2010. Web. 23 Feb. 2011. .

Rothbard, Murray Newton. Man, economy, and state with Power and market: government and economy. Ludwig von Mises Institute. 2004. Print.

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the report on your topic

"Microeconomics Homework"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY