StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Basic Business Finance

Free

Basic Business Finance - Assignment Example

Summary

The paper “Basic Business Finance ” is a thrilling example of a finance & accounting assignment. The company made sales up to 3.7% to an estimated over 2.3 billion dollars and had an underlying growth in profit of 9.8% to 400 million dollars…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER91.2% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: Business School

- Pages: 5 (1250 words)

- Downloads: 1

- Author: caterina73

Extract of sample "Basic Business Finance"

Business finance By Task Highlights for the company The company made sales up to 3.7% to an estimated over 2.3 billion dollars and had an underlying growth in profit of 9.8% to 400 million dollars. The company also had a strong cash generation of 271 million dollars before share buybacks of 250 million dollars. The special dividends that were announced for the previous year 2014 were paid in March and the others were paid in May. The strategies that were announced by the business were those that focus on improving the products, increasing the profitability of the company and returning cash to the shareholders.

Payback period

Year

Cash inflow (million dollars)

Cumulative cash inflow( (million dollars)

2014

476

2438

2013

500

1962

2012

543

1462

2011

499

919

2010

420

420

The payback period was in 2013 when the cumulative cash inflow took a positive trend

The last negative cumulative inflow = 543

The cash flow of the next year = 500

The payback in months = 543/500 = 1.086 = 2 months

The other consideration is average rate of return of the company. Average rate of e following returns for the company can be determined through the following steps

Year

Cash inflow (million dollars)

Cumulative cash inflow( (million dollars)

2014

476

2438

2013

500

1962

2012

543

1462

2011

499

919

2010

420

420

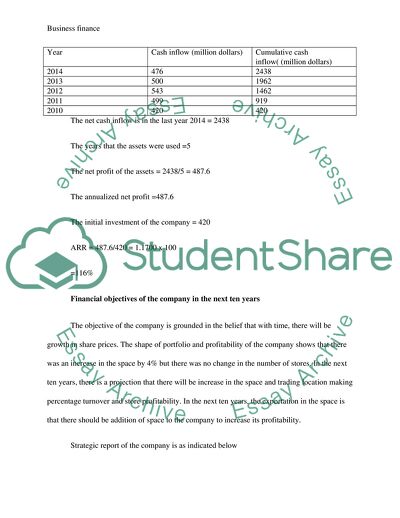

The net cash inflow is in the last year 2014 = 2438

The years that the assets were used =5

The net profit of the assets = 2438/5 = 487.6

The annualized net profit =487.6

The initial investment of the company = 420

ARR = 487.6/420 = 1.1700 x 100

=116%

Financial objectives of the company in the next ten years

The objective of the company is grounded in the belief that with time, there will be growth in share prices. The shape of portfolio and profitability of the company shows that there was an increase in the space by 4% but there was no change in the number of stores. In the next ten years, there is a projection that there will be increase in the space and trading location making percentage turnover and store profitability. In the next ten years, the expectation in the space is that there should be addition of space to the company to increase its profitability.

Strategic report of the company is as indicated below

Net operating margin for the previous year 15.1%

Lower markdown- Retail stock for sale was down with a percentage of 15 0.8%

Reduction in freight fabric and stock loss- this increased utilization of fabric 0.5%

Reduction in store payroll 0.1%

Analysis

From the statistics that were obtained from the company, it shows that the sales of the company, the profitability and inflow of cash increases with time. This implies that when the company is to be sold in the next ten years, there will be increase in the price of the store. The increase will be due to improvement in services that are offered in the company and also the growth in economy.

Task 3

Advantages and disadvantages for relying on retained earnings as a source of funds

Advantages

The main advantage of using retained profits as a source of funds is that they are considered long term payments and no one is able to ask for their payments. This makes the funds convenient as compared to other sources of funds. Returned earnings also are advantageous as they have no additional equity to be issued in using the funds. This makes control of the business to be diluted and also ownership of the business. The other advantage of using the source of funds is that there are no fixed obligations of interest or installment payments. Retained earnings as a source of funds are cost effective as compared to other funds when there is consideration of the fact that there are no issue costs that are attached to it which ranges between 2-3% (Peirson, 2002). The ranges are not much as compared to other sources of internal funds used in businesses. Investing retained earnings in projects with IRR being better than ROI of the business have direct and positive impact on the wealth of shareholders wealth thereby the main objective of management will be served by the stakeholders.

Disadvantages

There are disadvantages that retained earnings as a source of funding for a business may lead. The main advantage of the source of funding is limitation in finance. The amount that can be raised by the source is limited. The finances also take into consideration the stable dividend policy that makes the directors not being able to utilize all the retained earnings (Peirson, 2002). The other disadvantage of the source is high opportunity cost of the source. The retained earnings are nothing but sacrifice of profit that is made by the equity of stakeholders. When the source is used in a business, the sacrifice increases the opportunity cost of retained profits.

Other sources of internal finance

Sale of assets is an alternative for retained earnings. This is done when a business sells its assets and the finance that is obtained in used in the business for financial needs. The source can be used as short term or long term depending on the asset that is sold (Dlabay & Burrow, 2008). Selling an asset such as a car can create short term finance while other assets such as machinery, land and buildings create long term finances. The main disadvantage of using this source of finance is that the source of capital is that the benefits of useful assets that are sold are not accrued to the business.

Reduction or controlling of working capital can also be used as a source of internal finance. In a normal situation, a business always require two types of financial viz. long term finances to be used in capital expenditure and working capital finance for daily needs. Reduction in working capital can be achieved through speeding up the cycle of account payables and stock or through lengthening the cycle of account payables (Cinnamon, Helweg-Larsen & Cinnamon, 2010). Both the strategies will be useful in reducing the working capital requirement therefore the funds that had been invested for working capital can be utilized for the other finances or capital requirements. The source of finance however has little different analytics. The source is generated out of efficiency management or working capital and appropriate usage of working capital management methods.

There are also other sources of internal funds including employee contribution to the financial requirement of the organization and the personal savings of the company owner (Cinnamon, Helweg-Larsen & Cinnamon, 2010). Businesses that use internal sources of funding shows good signs of performance as the business is independently satisfying the requirements with the help of own efficiencies and operational profits.

References

Cinnamon, R., Helweg-Larsen, B., & Cinnamon, P. (2010). How to understand business finance. London: Kogan Page.

Dlabay, L., & Burrow, J. (2008). Business finance. Mason, Ohio: South Western.

Gitman, L. (2006). Principles of managerial finance. New York: Harper & Row.

Hunt, P., Williams, C., & Donaldson, G. (2001). Basic business finance. Homewood, Ill.: R.D. Irwin.

Peirson, G. (2002). Business finance. Roseville, N.S.W.: McGraw-Hill.

Sharma, N. (2010). Business finance. Jaipur, India: ABD Publishers

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Basic Business Finance"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY