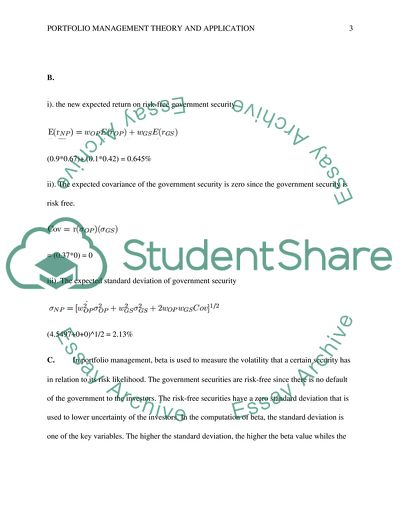

Portfolio Management Theory and Applications Essay. https://studentshare.org/finance-accounting/1878675-portfolio-management-theory-and-applications

Portfolio Management Theory and Applications Essay. https://studentshare.org/finance-accounting/1878675-portfolio-management-theory-and-applications.