Wiley GAAP Policies and Procedures Assignment Example | Topics and Well Written Essays - 750 words. https://studentshare.org/finance-accounting/1837221-financial-reporting-and-analysis-week-3-assignment-bear-stearns-co

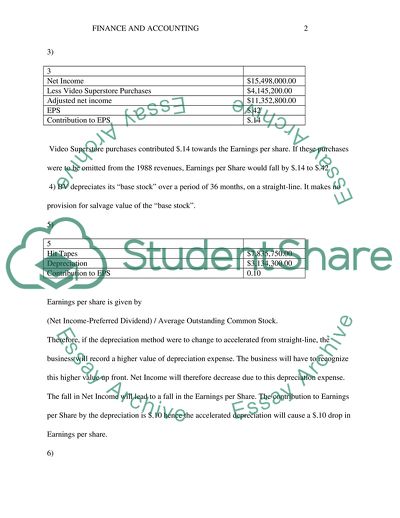

Wiley GAAP Policies and Procedures Assignment Example | Topics and Well Written Essays - 750 Words. https://studentshare.org/finance-accounting/1837221-financial-reporting-and-analysis-week-3-assignment-bear-stearns-co.